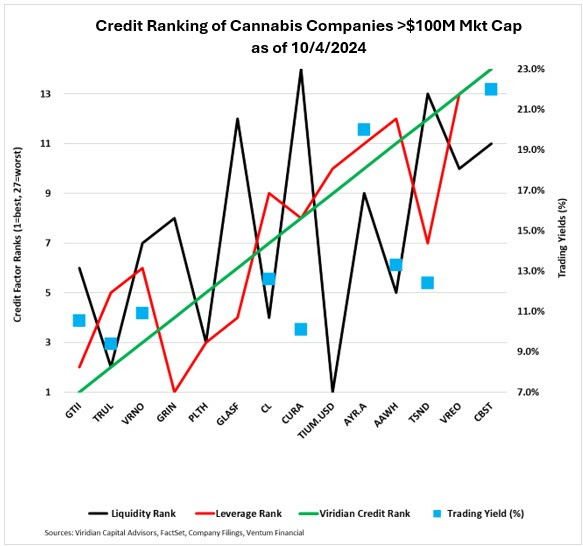

As investors brace for Florida’s crucial vote on recreational cannabis, a wave of tantalizing opportunities floods the market. The renowned Viridian Credit Tracker heralds AYR Wellness (OTC:AYRWF) as a robust stronghold, boasting a captivating 20% yield fueled by its expansive footprint in Florida’s cannabis realm. With Florida poised on the brink of endorsing recreational usage, AYR emerges as a veritable El Dorado for investors, beckoning them with promises of bountiful profits.

AYR Wellness Offers 20% Yield: Capitalize on Florida’s Potential Vote

Viridian Capital Advisors’ Viridian Credit Tracker underlines AYR’s strategic advantage over its peers owing to its firm footing in Florida’s flourishing market. Sporting a 20% trading yield, AYR outshines its competitors by a landslide. Should Florida give the green light to recreational cannabis, AYR’s market value stands poised for a meteoric rise, making it a judicious buy for investors eyeing the impending vote.

Cresco Labs vs. Curaleaf: A 250 Basis Point Difference

A tantalizing pair trade recommendation from the report proposes purchasing Cresco Labs (OTC:CRLBF) with a lucrative 12.6% yield while simultaneously offloading Curaleaf (OTC:CURLF) at a humbler 10.1% yield. This strategic maneuver presents investors with a 250 basis point yield upswing, championed by Cresco’s robust financials and soaring credit profile. For those hungering for superior returns and credit stability, this proposition demands earnest consideration.

TerrAscend: Why 12% Yield Might Not Be Enough

In stark contrast, TerraAscend (OTC:TRSSF) flaunts a modest 12% yield and is advised as a sell. Despite its noteworthy presence in the cannabis domain, TerraAscend’s relatively lower yield and pallid exposure to Florida’s growth narrative render it a less attractive prospect when juxtaposed with AYR’s tantalizing promise.

Cannabist Faces Liquidity Challenges

Amidst the allure of premium stocks, Cannabist (OTC:CCHWF) languishes as the weakest link in the credit chain, chiefly due to liquidity apprehensions following recent asset divestitures. Investors should tread cautiously recognizing that Cannabist’s feeble credit rating may fetter its near-term ascension, notwithstanding prospective ameliorations down the road.

Seize the Day: Florida’s Vote Could Herald a New Era

With Florida’s cannabis panorama ripe for expansion, discerning investors eyeing maximal gains should contemplate a strategic pair trade: acquiring AYR at the lavish 20% yield, divesting TerraAscend at its meager 12%, and examining Cresco Labs at 12.6% versus Curaleaf at 10.1%. The impending vote could orchestrate a seismic shift in the cannabis stock tableau, and seizing the moment before this epochal event unfurls promises a windfall of substantial returns.

Peruse More: SEC Levels Charges at ‘Magic Mushroom’ Co., Minerco, in an $8M Pump-and-Dump Deception

Market News and Data brought to you by Benzinga APIs