Interpreting the Latest Consumer Price Index Data

Wall Street greeted the release of the latest Consumer Price Index (CPI) figures with a mix of apprehension and eagerness. Eyes were fixed on the month-over-month CPI increase of 0.2%, matching expectations. The year-over-year rate of 2.5% marked a decline from the previous month, which saw a 2.9% rise.

While the core inflation figure rose by 0.3% on the month, slightly higher than forecasted, the year-over-year number held steady at 3.2%. The housing-related costs, particularly the shelter component, played a significant part in the overall data, increasing by 0.5% monthly and 5.2% annually.

The reaction was swift as stocks plummeted initially, only to rebound later in the day. Notably, the tech-heavy Nasdaq managed to turn positive amidst the market turmoil.

The ‘Silly’ Wall Street Tantrum

Discontent brewed on the street as investors grappled with the prospect of rate cuts following the CPI report. Speculation was rife regarding the magnitude of the anticipated cut and the future trajectory of interest rates. The desire for a hefty 50-basis-point reduction prevailed, hinting at a hunger for rapid market relief.

Frowning upon this impulsive reaction, historical data beckons contemplation. The undertakings by analysts reveal a strong case for a measured 25-basis-point reduction. Insight from market experts points to underwhelming outcomes following vividly executed, larger cuts compared to gradual, smaller interventions.

An illustrative depiction of the S&P’s performance further strengthens this argument, highlighting the preference for subtle rate adjustments and a steady pace moving forward.

Reflections on the narrative of rate cuts highlight an essential distinction – acting in response to market needs versus fueling economic resuscitation. The resounding call for prudence underlines the enduring benefits of a conservative rate strategy.

Prioritizing Investment Strategies Amid Uncertainty

Amid the flux, a shift in focus is warranted. The prevailing hypothesis in investment circles, rooted in deterministic principles, demands a fresh perspective. The age-old ‘if…then…’ paradigm, while ingrained, requires scrutiny.

The innate human tendency to align specific investment strategies with fixed outcomes often leads to disillusionment. Instances of low-PE ratio stocks faltering, AI megatrends losing momentum, or cash flow-reliant businesses facing disruptions expose the fragility of assumed correlations.

Emerging from this introspection is a singular truth – the upshot of investing hinges solely on stock price trajectory during ownership. In light of this, the assertion that investing revolves around price movements acquires newfound relevance, affirming the dictum that ‘price is truth’.

An Embrace of Price Momentum

In times of ambiguity, embracing bullish price momentum emerges as a beacon of clarity in market navigation. Shifting the focus from rigid formulas to dynamic price evaluation offers a paradigm shift with the potential to navigate the uncertain waters of investing.

Unlocking Investment Wisdom Through Price Analysis

The Power of Price in Investment

Investment dilemmas, at times, can appear as complex as solving a Rubik’s Cube blindfolded. However, in a world where financial forecasts and projections clutter the landscape, one truth remains steadfast – the immutable power of price.

Price dictates the fate of retirement funds, the destiny of college savings, and even the reverie of a waterside retreat. It stands as the unequivocal arbiter of financial success or failure, indifferent to all else.

Embracing Price Action

To navigate the labyrinth of investing, one must shed the shackles of speculation and embrace the pure essence of price action. A revelation that our expert, Luke Lango, unfurls through his Breakout Trader service.

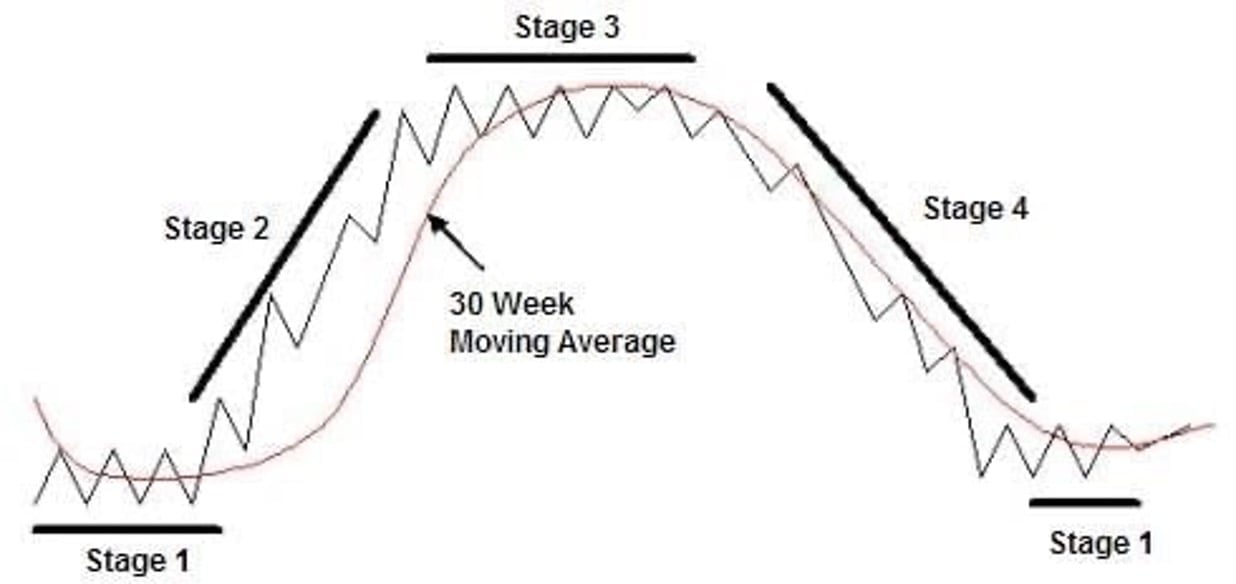

Luke’s approach, grounded in a method known as “Stage Analysis,” simplifies the investment realm into comprehensible categories:

- Sideways at a bottom

- Ascending

- Sideways at a peak

- Descending

Stage Analysis, the bedrock of Luke’s strategy, discerns a stock’s current stage and advocates for investment solely during the exuberant ascent of Stage 2.

By honing in on price, the linchpin of prosperity, Luke accentuates the primacy of wealth preservation and accumulation through judicious market moves.

Shedding Predictive Burdens for Price Certainty

This focus on price emancipates investors from the burdens of prophecy, liberating them from the quagmire of cause-effect reasoning. It prompts an appraisal of a stock or market’s “truth” solely through the prism of price dynamics.

Tonight, in the luminous backdrop of the “Great Tech Reversal of 2024,” Luke delves deeper into this economic tectonic shift foreseen to birth a cornucopia of opportunities. His beacon in navigating this upheaval? Stage Analysis.

The event promises a cornucopia of market insights and portfolio strategies, unveiling the enigmatic allure of stage analysis amidst a thrilling narrative of financial foresight.

Rise above the din of uncertainty, secure your votive seat for tonight’s 8 PM EST event, and immerse yourself in a mélange of market sagacity and astute investment deliberations.

May your evening be as rewarding as your investment acumen,

Jeff Remsburg