When pondering the decision to engage in the stock market – whether to buy, sell, or hold – investors often turn to the gospel of analyst recommendations. The surface allure of the gospel of Wall Street analysts might sway many, but does it merit such unbridled faith?

Prior to diving into the veracity of brokerage recommendations and their utility, let’s delve into the musings of the Wall Street sultans regarding the behemoth that is Alibaba (BABA).

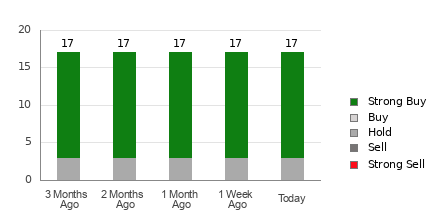

Alibaba currently basks in an Average Brokerage Recommendation (ABR) of 1.35, nestled on a rating scale extending from 1 to 5 – spanning Strong Buy to Strong Sell. Crafted from the venerated musings of 17 brokerage firms, this ABR of 1.35 straddles the realm between Strong Buy and Buy.

Of the numerous feathers weaving the current ABR cap, a striking 14 plumes are dyed in the hue of Strong Buy, constituting a lion’s share of 82.4% of all recommendations.

Brokerage Recommendation Trends for BABA

The siren song of the ABR may whisper sweet nothings of buying Alibaba, yet placing one’s fortunes solely on this edict might be akin to navigating treacherous waters with a blindfold. Evidenced by numerous studies, brokerage recommendations scarcely hold the golden key to unlocking stocks poised for meteoric ascension.

Ever wondered why this is so? The vested entwining of brokerage firms with the stocks they cloak often sows the seeds of buoyant optimism within their analyst ranks. Our investigations unfurl a disquieting revelation – for every “Strong Sell” battle cry, these firms unfurl five “Strong Buy” ensigns.

Alas, the compass of these institutions might not always align with the true North sought by retail adventurers, offering but a hazy glimpse into the tea leaves of a stock’s future trajectory. It would be judicious, then, to employ this counsel as a mere litmus test to corroborate one’s own analysis or to wield a tool wielding a sharp edge in prophesying stock price maneuvers.

We submit for your approval our lauded luminary in the financial firmament – the Zacks Rank – a tool of repute, rigorously examined and ordained with the imprimatur of success. Segmenting stocks into five distinct cohorts from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), it stands as a beacon illuminating a stock’s near-term exaltation or despair. Thus, amalgamating the Zacks Rank with the ABR might spell the difference between prosperous seas and shipwrecked dreams.

ABR: A Resplendent Dalliance, Divergent from Zacks Rank

Bear in mind, the Zacks Rank and ABR, though bedecked in a shroud of 1-5 garb, exude essences antipodal.

Broker recommendations exclusively furnish the scaffold for the ABR edifice, oft bedecked in decimal regalia (cue 1.28). In stark contrast, the Zacks Rank burgeons forth as a quantitative ode to earnings estimate revisions, adorned in whole numbers – a pantheon ranging from 1 to 5.

History echoes and resounds with the refrain of brokerage analysts awash in a sea of optimism, their fountains of favor gushing beyond the banks of due diligence. A tempestuous contrast lies herein – the Zacks Rank, a creation spun from earnings estimate revisions, a divining rod attuned to the nuance of stock price pirouettes, as attested by empirical scrolls.

Moreover, the benison of varied Zacks Rank classifications bedecks all stocks serenaded by brokerage analysts and their offerings of current-year earnings auguries. Herewith lies the crux – this tool, ever judicious and egalitarian, never teeters off balance with its fivefold grades.

An abyss yawns betwixt the ABR and Zacks Rank in the realm of time’s sway. While peering through the ABR lens might unveil the puppet show of yesteryears, the ever-flowing stream of brokerage analysts’ earnings asides adorns the visage of the Zacks Rank with swiftness, rendering it a bulwark of fortunetelling in the realm of stock price soothsaying.

Is BABA a Fabled Gem?

Casting our gaze upon Alibaba’s mantle of earnings estimate revisions, the Zacks Consensus Estimate for the fiscal year has waned by 0.1% o’er the past lunar phase, settling at $8.20.

The mounting shadows of analyst ennui shrouding the company’s earnings trajectory, unfurled by the synchrony in their descent of EPS auguries, might foreshadow a tempest, propelling the stock e’er closer to the abyss in the days to come.

The mantle of change donned by the consensus estimate, coupled with three other omens revolving around earnings forecasts, has armored Alibaba with a Zacks Rank #4 (Sell). Should you seek further solace or guidance in this realm, perchance the list of Zacks Rank #1 (Strong Buy) stocks beckons here >

Thus, it may be sage to hearken to the siren song of the Buy-reminiscent ABR for Alibaba with a grain of salt.

Parse through the riddles of future strung by stock whisperers with caution – for the compass leading to the treasure trove of wealth may not always point true north.