The tech stock fray is ripe, with possibilities abounding for shrewd investors eyeing plum prospects among undervalued companies.

One key measure garnering attention is the Relative Strength Index (RSI), a momentum indicator that pits a stock’s strength on upward price swings against downturns. A low RSI figure, particularly below the 30 mark, may hint at an oversold condition, a potential cue for astute market players, as per Benzinga Pro.

Delve into the notable tech contenders showcasing an RSI close to or beneath the 30 threshold.

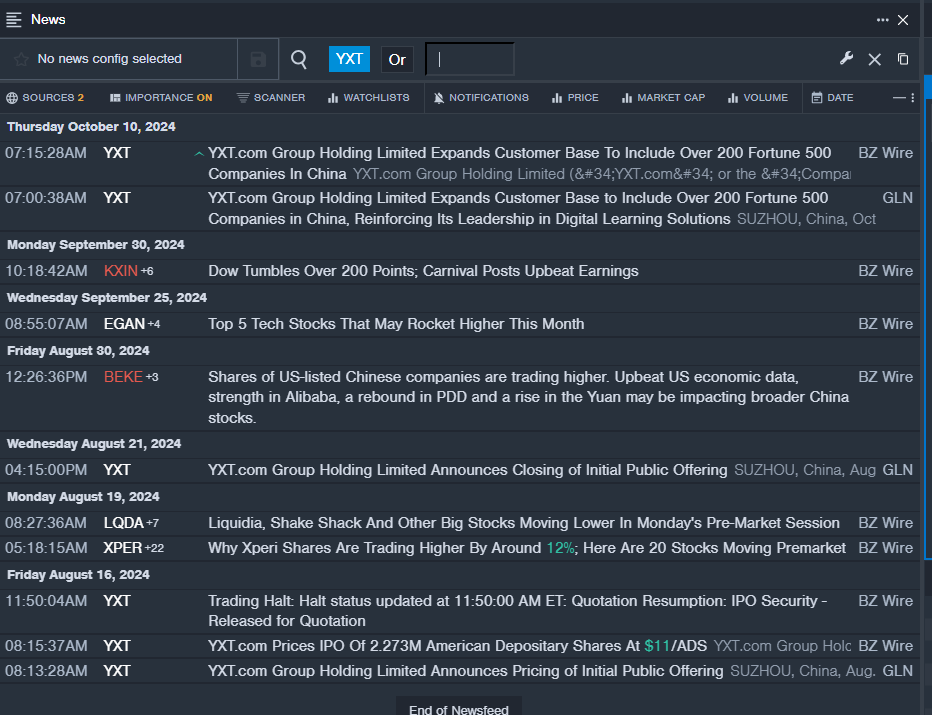

YXT.Com Group Holding Ltd – ADR YXT

- Brushing off stormy market tides, YXT.com Group recently cast its net wider, snagging over 200 Fortune 500 clientele within China. Despite this feat, the company’s shares took a tumble of nearly 42% over the past lunar cycle, dipping to a 52-week nadir of $2.10.

- RSI Value: 29.6347

- YXT Price Action: Noting the swift downward spiral, YXT’s stock contracted by 6.3% to cap at $2.10 during the previous trading session.

- Benzinga Pro’s dynamic market pulse alerted aficionados to the latest YXT disclosures.

Verint Systems Inc. VRNT

- On the 25th of September, the esteemed analyst Joshua Reilly, in a nod of acclaim, upheld Verint with a Buy rating and maintained a bullish $40 price target. Despite this vote of confidence, the firm’s shares lost ground, shedding approximately 6% over the past quintet of trading days, flirting with a 52-week low of $18.41.

- RSI Value: 21.29

- VRNT Price Action: The market bell tolled a somber note for Verint, as shares took a downward glide of 0.6%, closing at $21.89 in the most recent market session.

- Benzinga Pro’s analytical compass discerned fluctuations in the Verint equity landscape for discerning traders.

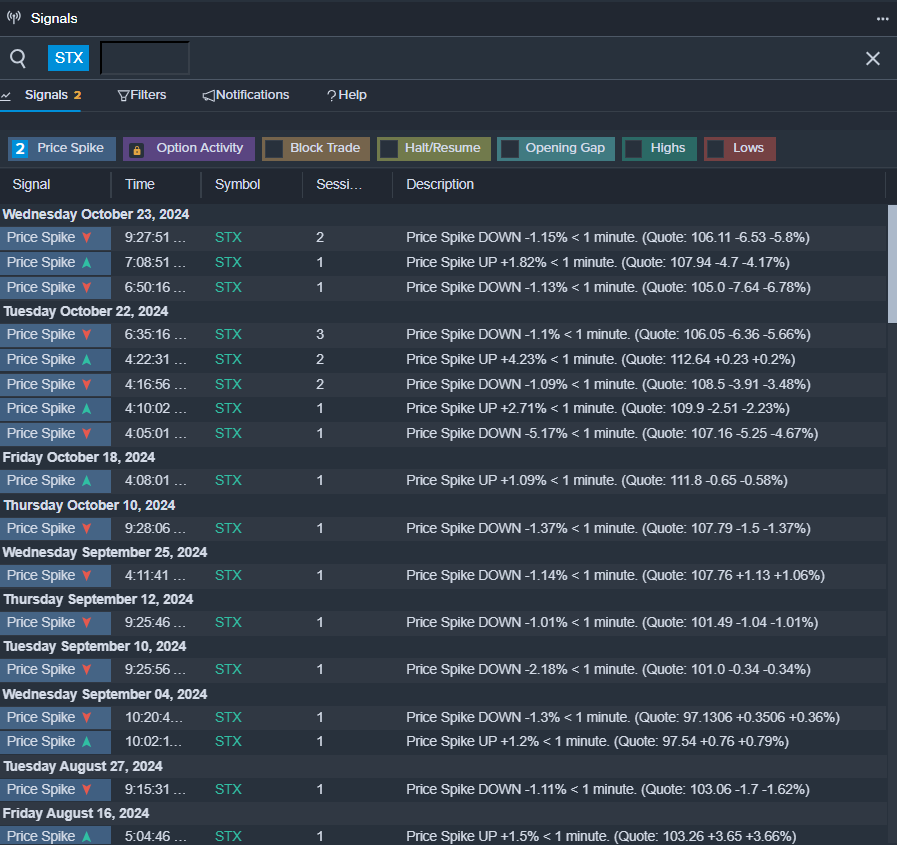

Seagate Technology Holdings PLC STX

- The latest chapter in the Seagate saga unfolded on the 22nd of October, as the company unveiled a robust first-quarter revenue figure of $2.17 billion, besting the consensus estimate of $2.119 billion. The performance metrics painted a vivid tapestry of success, with adjusted gross margin soaring to 33.3% from a modest 19.8% in the year-prior quarter. Adjusted operating margin followed suit, vaulting to an impressive 20.4% from a mere 2.8% in the corresponding period. Clocking in with adjusted earnings per share of $1.58, Seagate handily outpaced the anticipated $1.46 figure. Yet, shareholders appeared unmoved by this show of strength, as the company’s stock endured an 8% slide over the past workweek, kissing a 52-week low of $64.12.

- RSI Value: 27.97

- STX Price Action: The market verdict was cast, as Seagate shares sustained an 8.1% plunge, concluding the trading day at $103.52.

- Benzinga Pro’s predictive signals hinted at a brewing narrative of potential resurgence in Seagate shares.