Unveiling Potential Gems in Consumer Sector

The consumer discretionary sector can be likened to a goldmine, ripe with oversold stocks that may hold the key to unlocking substantial returns for savvy investors. These undervalued gems provide a unique opportunity to capitalize on market fluctuations and potentially rescue portfolios in need of a boost.

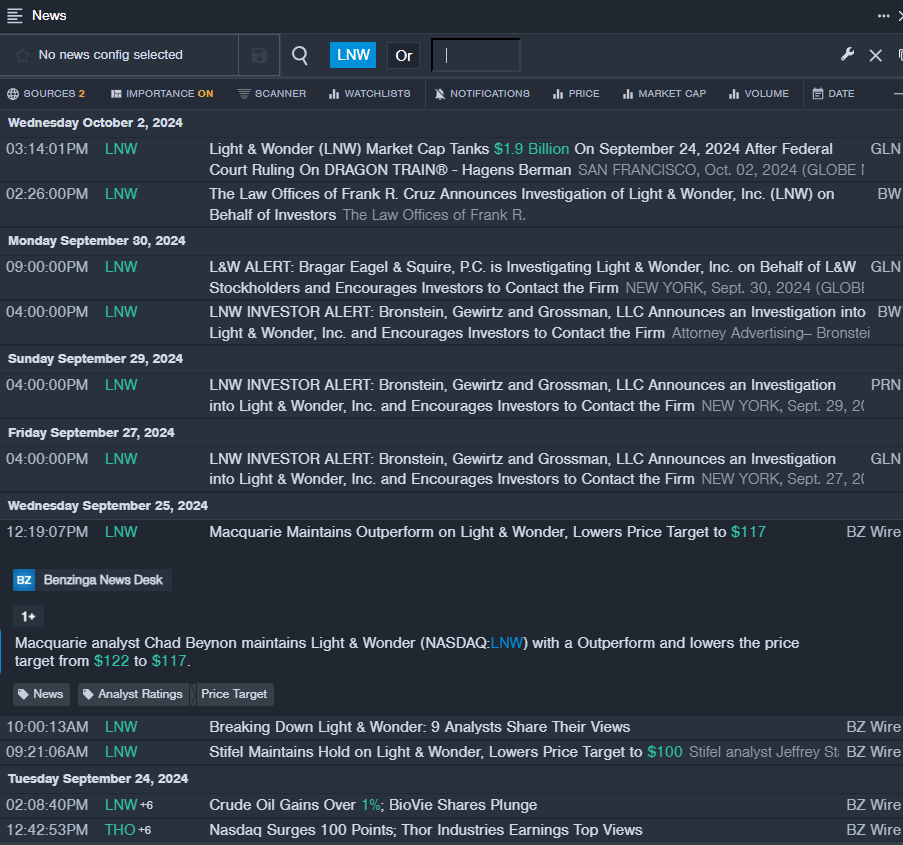

The Resilience of Light & Wonder (NASDAQ: LNW)

- Analyzing the stock market is akin to unraveling a cryptic puzzle. Light & Wonder Inc, symbolized by the ticker LNW, has recently caught the attention of investors with an RSI value of 26.57, signaling a potential buying opportunity.

- The fluctuations in LNW’s stock price, coupled with expert analysis from Macquarie analyst Chad Beynon, reveal a company poised for resurgence despite a recent 19% dip in stock value.

- While Thursday’s closing price of $87.74 may seem underwhelming at first glance, those with a keen eye recognize the latent potential waiting to be harnessed within Light & Wonder.

The Journey of Makemytrip Ltd (NASDAQ: MMYT)

- Exploring the tumultuous seas of the stock market, we encounter Makemytrip Ltd (MMYT) with an RSI value of 29.31, beckoning forth a potential buying opportunity amidst recent price fluctuations.

- The recent performance of MMYT has garnered attention, with B of A Securities analyst Sachin Salgaonkar adjusting the price target to $112 – a strategic move considering the 18% dip in stock value over the past five days.

- Despite Wednesday’s closing price of $86.91, the stormy waters of the market may soon subside, revealing the hidden treasures within Makemytrip Ltd for investors daring enough to take the plunge.

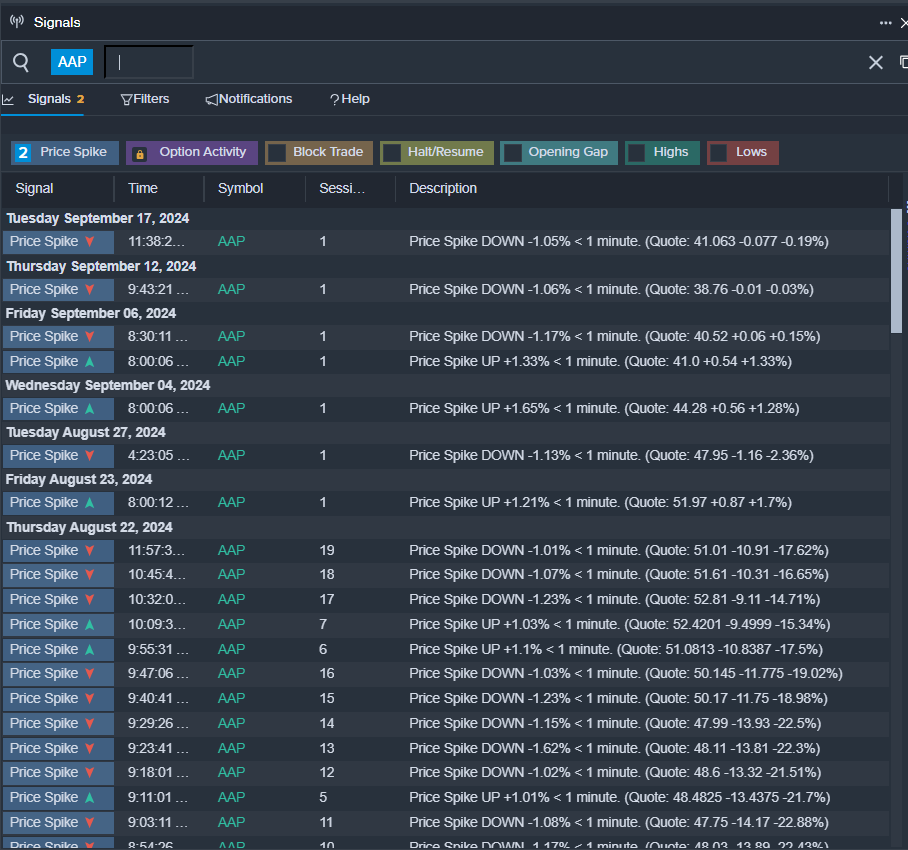

Exploring the Terrain of Advance Auto Parts, Inc. (NYSE: AAP)

- Embarking on an expedition through the stock market wilderness, we encounter Advance Auto Parts, Inc. (AAP) with an RSI value of 27.47, signaling a potential glimmer of hope amidst the recent price turbulence.

- The guidance from Mizuho analyst David Bellinger, while maintaining a Neutral stance on AAP, has provided valuable insights for investors looking to navigate the 15% dip in stock value over the past month.

- Despite Wednesday’s closing price of $37.17, seasoned investors understand that beneath the surface lies untapped potential within Advance Auto Parts, Inc., waiting to be unearthed.

Read Next: