Following a remarkable display of strength in its Q1 earnings report, Cava Group CAVA is now riding the expansion wave that has propelled other renowned retail restaurant chains like Chipotle Mexican Grill CMG and Starbucks SBUX to investor stardom.

Since going public in June 2023, this Mediterranean fast-casual food chain has witnessed its stock surge nearly +100%, outpacing the performances of Starbucks (-19%) and the Zacks Retail-Restaurant Market (-6%), while also outshining broader indexes and even inching past Chipotle’s +56% rise in the same period.

Despite being one of the hottest IPOs in recent memory, the question lingers – is now the opportune moment to invest in CAVA for further gains?

Image Source: Zacks Investment Research

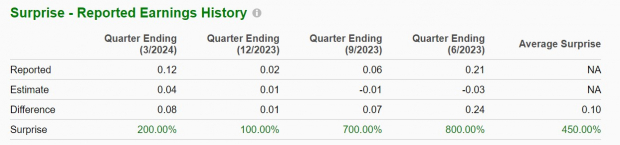

Analyzing Q1 Performance

Reporting Q1 sales of $259.01 million, Cava Group witnessed a robust 46% growth in revenue over the last quarter, surpassing Q4 sales of $177.17 million. Impressively, these figures exceeded Q1 sales estimates of $246.65 million by 5%. Of particular interest is Cava Group’s profitability, with Q1 EPS of $0.12 exceeding expectations by an impressive 200% and skyrocketing from $0.02 per share in Q4.

Image Source: Zacks Investment Research

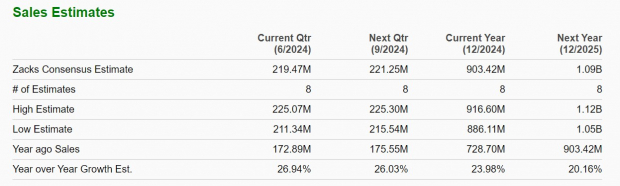

Evaluating Growth Trajectory & Prospects

Established in 2006, Cava Group launched its IPO last year and has a nationwide presence across the United States. The company’s growth is propelled by a distinct dining experience, akin to Chipotle, allowing customers to customize their bowls from a selection of premium fresh ingredients.

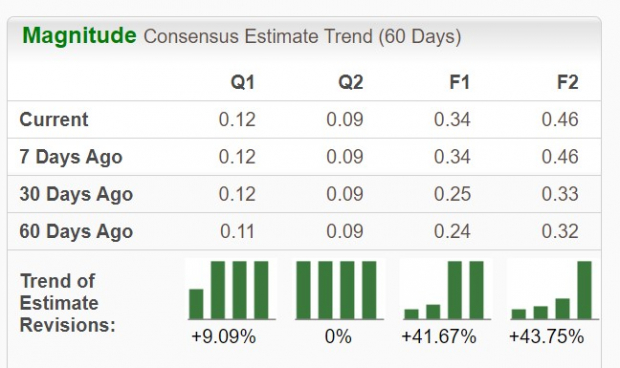

Cava Group is projected to achieve a 24% sales increase in FY24 and anticipates a further 20% surge in FY25, edging over $1 billion in total sales. Earnings are forecasted to escalate by 62% this year to $0.34 per share compared to $0.21 in 2023, with an additional 33% growth expected in FY25, amounting to $0.46 per share.

Image Source: Zacks Investment Research

Further enhancing the potential for continued growth in CAVA’s stock is the notable upward revisions in earnings estimates for FY24 and FY25, surging by over 40% in the last 30 days and 2 months, respectively.

Image Source: Zacks Investment Research

In Conclusion

With a Zacks Rank #2 (Buy), Cava Group’s stock is poised for potential upward movement, given the company’s promising growth trajectory and the favorable trend in earnings estimate revisions.