Industry Shifts: A New Age in Automotive Evolution

The automotive industry, a longstanding pillar of the economy, is currently undergoing a period of significant transformation. Technological advancements, changes in vehicle design, and evolving consumer behaviors are reshaping the landscape of the auto sector.

Electric Vehicles vs. High-Tech Subscription Services

The focus on electric vehicles as a cleaner alternative has garnered widespread attention, fueled by environmental concerns and government initiatives. However, the emergence of high-tech subscription services at the intersection of software, connectivity, and automobiles may herald a more profound impact on the industry in the long run.

Seeking Value in Auto Stocks Amidst Innovation

Despite these transformative trends, the fundamental investment principle of identifying stocks with solid value remains critical in the automotive sector. Investors are advised to adhere to time-tested strategies in navigating the evolving market landscape.

Breaking Down Tesla

Tesla, spearheaded by Elon Musk, stands out as a trailblazer in the electric vehicle realm and currently holds the distinction of being the sole profitable US-based EV manufacturer. With a market capitalization exceeding $560 billion, Tesla has rapidly ascended in the industry since its inception, showcasing unparalleled growth and innovation.

Tesla’s Performance and Prospects

In recent years, Tesla has consistently delivered strong financial performance, marked by sustained revenues exceeding $20 billion for seven consecutive quarters. The company’s strategic focus on infrastructure development, efficient production processes, and technologically advanced vehicles has propelled its success in meeting consumer demands.

Challenges and Opportunities for Tesla

Despite its achievements, Tesla faced setbacks in the first quarter of 2024, with production and delivery figures falling below expectations. External factors such as supply chain disruptions and factory incidents contributed to these challenges. However, Tesla’s continuous innovation, including its foray into subscription-based services and strategic partnerships, presents opportunities for future growth.

Fording Ahead: The Legacy of Ford Motor

Transitioning to Ford Motor Company, a stalwart in the automotive sector, the company’s heritage is deeply rooted in iconic offerings such as the F-series trucks and the legendary Mustang. Ford’s historical dominance in the pickup truck market and muscle car segment underscores its enduring legacy in American automobile culture.

Ford’s Electric Vehicle Endeavors

While Ford has ventured into the electric vehicle space with models like the Mustang Mach-E and electric variants of its popular F-series trucks, achieving profitability in the EV segment remains a challenge. Despite notable sales growth, Ford’s EV operations have yet to translate into sustained profitability, necessitating strategic adjustments to drive long-term success.

Bernstein’s Analysis and Recommendations

Assessing the contrasting trajectories of Tesla and Ford, Bernstein analysts offer insights into the investment potential of both auto stocks. While Tesla’s market leadership and innovation garner acclaim, Ford’s established presence and brand heritage evoke investor confidence. Evaluating the evolving dynamics of the automotive market, investors are advised to weigh the opportunities and risks associated with each company’s strategic direction.

Unlocking the Hood: Exploring Ford’s Rocky Q1 Ride

Amidst the cacophony of the first quarterly financial reports, Ford shared a bumpy ride, recording a staggering loss of $1.3 billion. However, this setback did not cast a shadow over its overall Q1 earnings performance, which left many tongues wagging with awe.

Driving through the Financial Landscapes

Zooming into the Q1 earnings spectacle, Ford paraded its $42.8 billion at the top line, outshining expectations by a dazzling $1.3 billion. The non-GAAP earnings per share stood at a commendable 49 cents, comfortably perched 5 cents above the initial estimates. While the electric vehicle domain faced a rough terrain, Ford’s commercial segment, the Ford Pro, experienced a robust 36% year-over-year growth. The surge owed much to the demand for the Super Duty trucks and Transit delivery vans. Not to be overshadowed, the R&D-focused Ford Blue segment showcased vigorous hybrid sales, with a promise of 40% sales growth within the year. Among the lineup, the Maverick emerged as the reigning champion, claiming the throne of the best-selling hybrid truck in the US market.

Steering Towards the Future: Tech Talk and Beyond

Intriguing the tech-savvy investors, Ford unfurled its Connected Services offering, a subscription-based model bedecked with features like connected navigation, theft recovery, hands-free driving, and access to electric charging networks. These services promise an elevated driving experience for patrons of any Ford vehicle, accompanied by seamless software updates.

An Analyst’s Eye View: The Ford Landscape

Debuting coverage for Ford, analyst Daniel Roeska painted a vivid portrait of a legacy giant steadily acclimatizing to the winds of change. Roeska lauded the automaker’s robust profits stemming from a sheltered auto market, notably the US large SUV and large pickup trucks domain. The company demonstrated ample cash reserves to fuel its electric vehicle metamorphosis while ensuring its shareholders bask in the cash dividends. Over the years, Ford swiftly ditched its lower-margin ventures, shuffling towards a higher-margin B2B stage with its commercial vehicles, majorly the Ford Pro. While the electrification odyssey beckons, Roeska gleamed with optimism, envisioning Ford’s trajectory veering towards a landscape blooming with hybrid cars and trimming the losses in the EV business.

Tantalizing with future prospects, Roeska projected a luminous 2024, hovering at the zenith of the consensus EBIT. Foreseeing a remarkable +18% EBIT in 2025 against the prevailing consensus, Roeska beckoned investors to grab the Ford reins, quoting, “If you haven’t owned Ford lately – now is the time.”

The Bifurcated Road: Projections and Forecasts

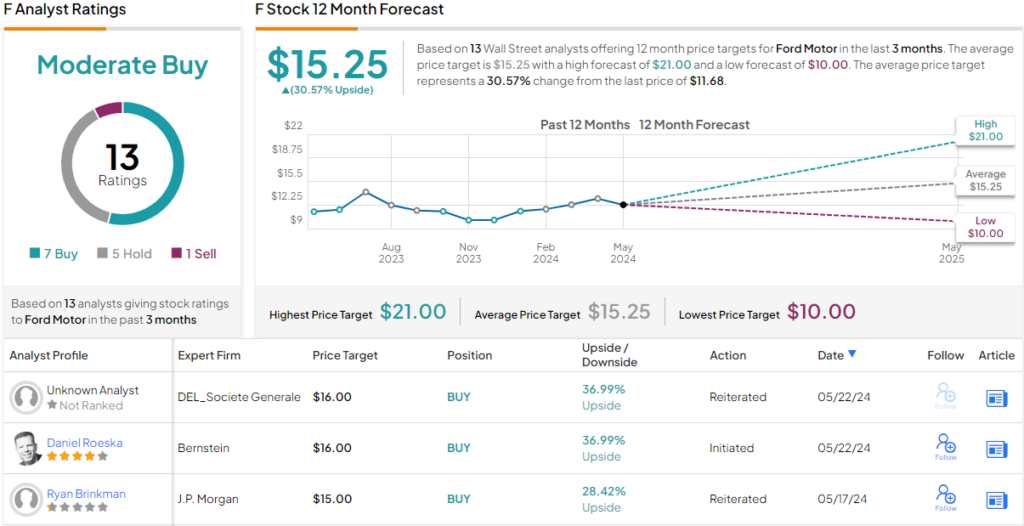

Peering into the crystal ball of Street projections for Ford unveils a tale of divided camps. The Moderate Buy consensus rating wears a cloak stitched together with 7 Buys, 5 Holds, and a critic chanting Sell. Graced by the $15.25 average price target, Ford’s shares promise to dance to a 30.5% premium tune a year hence.

Glued together, Bernstein’s candlelight flickers vibrantly towards Ford as the shining star in the motor firmament. The company stands robustly endowed, ready to navigate the electrification labyrinth while balancing the scales amidst the evolving EV backdrop.

Dive Into the Stock Market Waters

To unearth pearls of wisdom on stocks residing in the lap of attractive valuations, set sail towards TipRanks’ Best Stocks to Buy. This treasure trove houses a melange of equity insights waiting to be unraveled.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.