In a week reminiscent of David and Goliath, tech stocks faced a Goliath-sized stumble as the earnings season kicked off with the Magnificent Seven registering disappointments, leaving investors disheartened.

Alphabet Inc. witnessed a rollercoaster ride, posting earnings and revenue figures that exceeded expectations. However, the stumble came in the form of missed targets on YouTube advertising revenue. This misstep culminated in a turbulent week for the Google parent company, displaying a vulnerability rarely seen. The market’s reaction was swift and unforgiving.

Tesla Inc. missed the mark on quarterly earnings projections due to slimmer profit margins resulting from decreased vehicle prices and restructuring charges. The electric-vehicle behemoth also delayed the unveiling of the much-anticipated Robotaxi until October, further exacerbating investor concerns. The stock plunged by 12.3% in a startling reaction to the earnings report, marking its worst single-day performance since September 2020.

The tech-heavy Nasdaq 100 index endured its second consecutive week in the red, a rare feat since April, painting a somber picture for tech enthusiasts.

Among mega-cap stocks, Ford Motor Company and United Parcel Service Inc. experienced substantial declines buoyed by underwhelming earnings reports, with General Motors following suit. However, amidst the gloom, 3M Company and Bristol-Myers Squibb Company emerged as shining stars, defying expectations and surprising market spectators.

On the flip side, small-cap stocks continued their triumphant march, with the Russell 2000 Index notching its third consecutive week of gains, fueled by optimistic outlooks on imminent interest rate reductions.

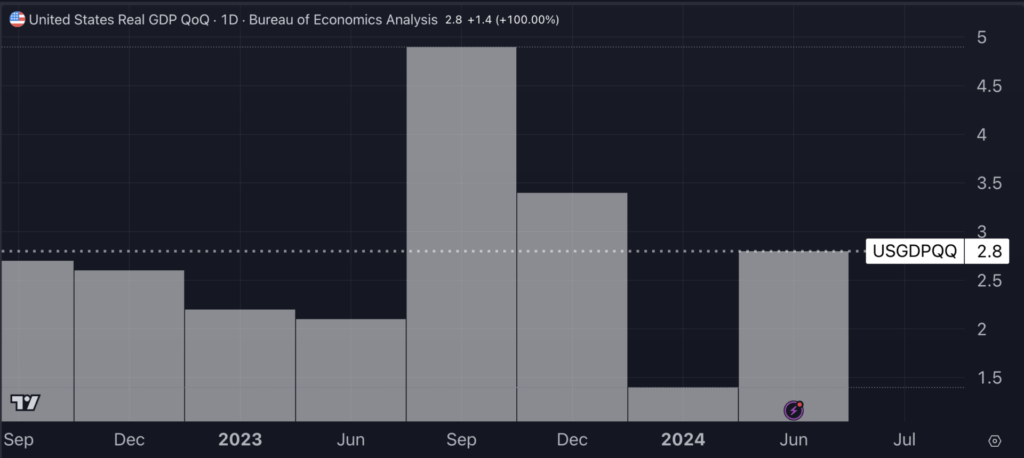

On the macroeconomic front, the U.S. economy showcased its strength, expanding at an annualized rate of 2.8% in the second quarter, a robust acceleration from the preceding quarter and surpassing growth forecasts of 2%.

Chart Of The Week: US GDP Growth Surges in Q2 After Q1 Lull

Don’t Blink: Exciting Updates You Might Have Overlooked

Inflation Gauge Takes a Dive: A key inflation metric tracked by the Federal Reserve retreated to 2.5% in June, hitting lows unseen since February 2021 and solidifying market anticipations of an impending rate cut in September.

However, the Fed remains cautious, awaiting a sustained downward trajectory in inflation before committing to rate adjustments, as per insight from a Comerica Bank economist.

Alphabet Shares Descend: OpenAI’s ambitious venture into launching SearchGPT, a tool aimed at disrupting Google’s search dominance, has initiated a 10,000-person waiting list for testing the innovative product, underscoring the revolution brewing in the tech landscape.

Mortgage Rates Ease Off: With mortgage rates dipping to levels not witnessed since February, the average 30-year fixed interest rate plummeted to 6.62%, fuelled by expectations of forthcoming interest rate cuts. Despite this favorable climate, prospective homebuyers seem lukewarm in their response, casting a shadow over the housing market outlook.

Click now to explore more!

Generated using artificial intelligence through Midjourney.