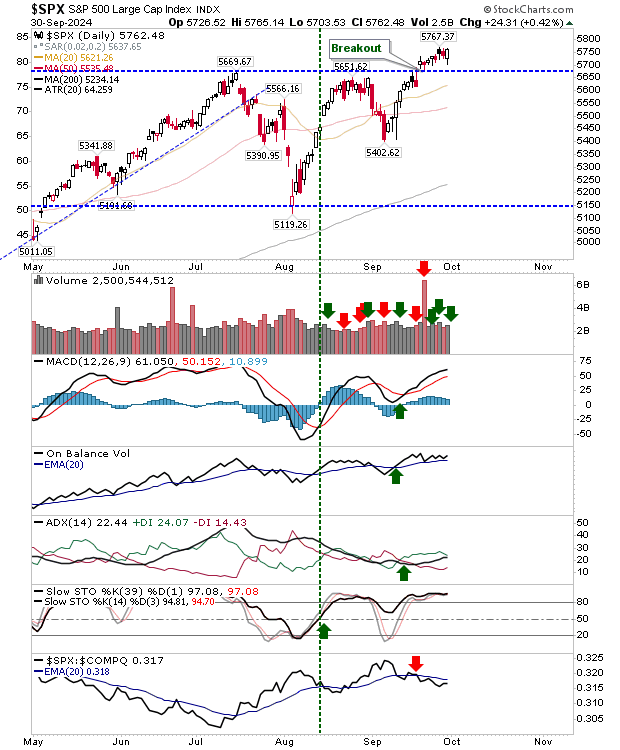

Small Caps are typically the frontrunners in market movements, but currently, the S&P 500 is taking the lead. In recent activity, the index has been edging towards testing breakout support without fully committing.

The surge in trading volume indicates significant demand, reflecting accumulation of assets, with buyers ready to defend the crucial support level at 5,670. The technical indicators are leaning towards a bullish stance, further reinforcing the resolve to maintain the breakout.

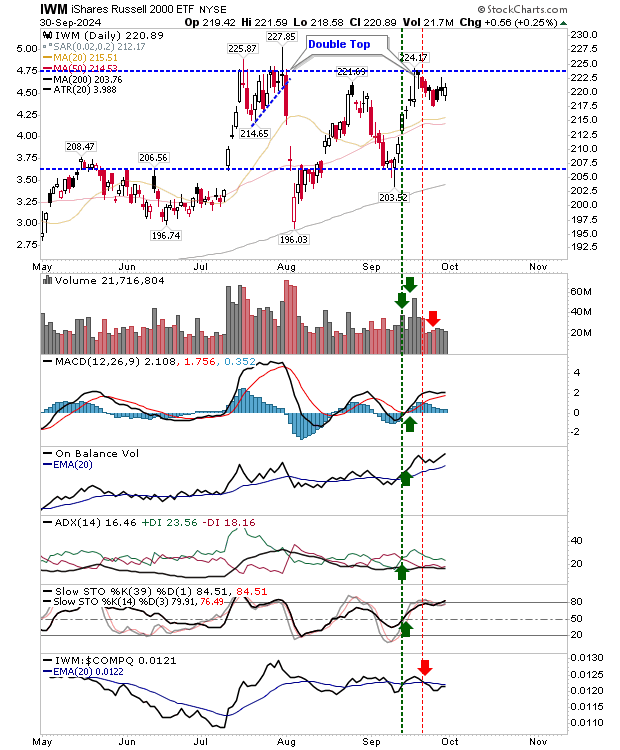

The recent rally in the S&P 500 has set the stage for the Russell 2000 to potentially challenge the $225 resistance level.

Previous discussions highlighted the possibility of a double-top formation in this index. However, the anticipated test of the 20-day/50-day Moving Averages, which could confirm such a pattern, has not materialized.

Instead, buyers have shown resilience by attempting to breach the resistance without clear prior support. A successful move beyond $225 would not only signal optimism but could also pave the way for further price appreciation.

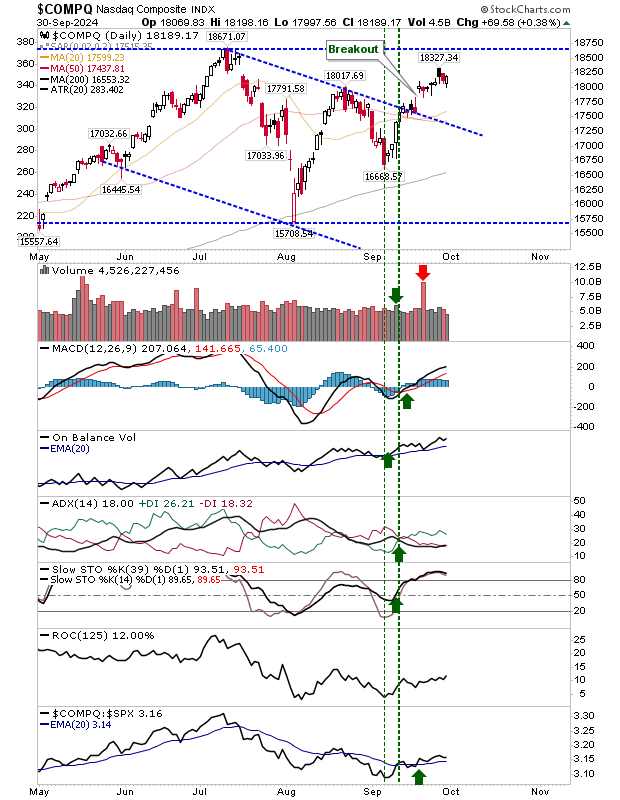

Nasdaq Holds Strong Amidst Market Movement

While the Nasdaq Composite has yet to challenge its July peak, it continues to move steadily towards 18,670, in line with the breakout resistance observed in September. The technical signals remain positive, and even the bearish black candlestick from Thursday holds hope of being invalidated.

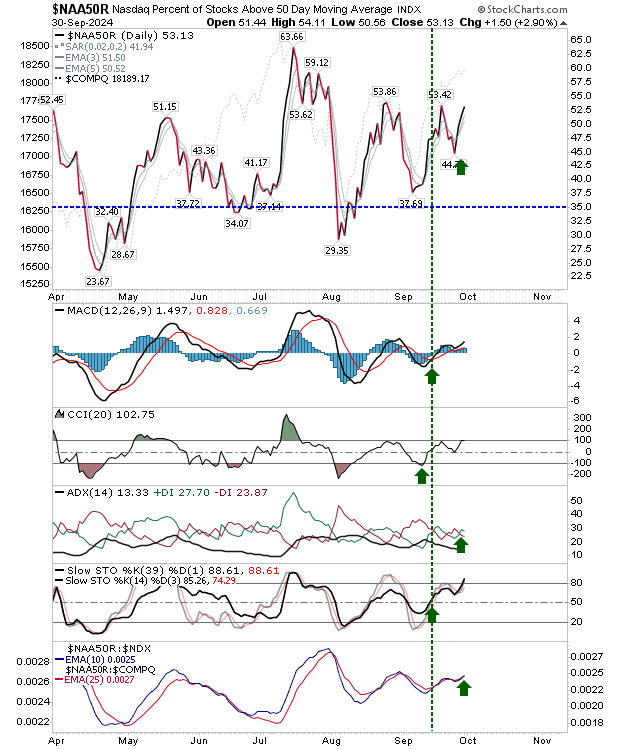

Positive market metrics are also aligning in favor of the bulls; for instance, the Percentage of Nasdaq stocks reaching new 50-day Moving Average highs is on the verge of a significant breakthrough, potentially surpassing the 54% mark. This favorable setup could lead the Nasdaq to further gains.

As the trading day unfolds, investors will keep a close watch on the S&P 500, hoping for the continuation of its breakout momentum, which could, in turn, bolster the Russell 2000 ($IWM) in overcoming the looming double-top pattern. On the other hand, the Nasdaq appears to be charting its unique course, and although a new all-time high may take some time, the breakout from its established channel seems robust and promising.