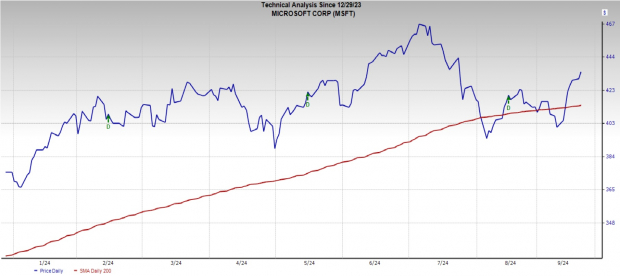

One of the magnificent 7 stocks, Microsoft Corporation MSFT, has stood tall among the giants in the market, boasting a place in the prestigious $3 trillion club. While its shares have surged in recent years, Microsoft faced a dip after reaching a record high on July 5, lagging behind the S&P 500 this year (+15.9% vs. +18.1%).

Image Source: Zacks Investment Research

But how will Microsoft’s recent stock repurchase program impact its stock performance and present an attractive opportunity for investors? Let’s delve deeper –

The Significance of Microsoft’s Stock Repurchase Plan

Microsoft recently greenlit a stock-buyback initiative, signaling its commitment to rewarding shareholders. The tech giant unveiled a hefty $60 billion stock repurchase program, marking the third-largest authorization this year, trailing only Apple Inc. (AAPL) and Amazon.com, Inc. (AMZN) with buybacks of $100 billion and $70 billion, respectively.

NVIDIA Corporation (NVDA) and Meta Platforms, Inc. (META) had also previously approved $50 billion share repurchase programs. Microsoft’s latest move aligns with its largest-ever buyback program, a strategic effort aimed at boosting shareholder value and enhancing earnings per share.

The Upside of Stock Buybacks for Microsoft

Microsoft’s decision to repurchase shares reflects optimistic sentiments from its board of directors regarding future prospects. By reducing the number of outstanding shares in the market, Microsoft aims to drive up the value of the remaining shares, generating favorable returns for its investors. Trading above the 200-day moving average, Microsoft’s stock signals a sustained uptrend.

Image Source: Zacks Investment Research

Microsoft’s Strong Tailwinds: Azure Growth, Robust ROE, Dividend Expansion

Microsoft’s highly sought-after Azure and cloud services division displayed a remarkable 29% year-over-year revenue surge in the fiscal fourth quarter of 2024. This growth trajectory fortifies Microsoft’s position in the fiercely competitive cloud-computing arena, largely dominated by Amazon Web Services (AWS).

The tech giant had already invested a substantial $55.7 billion in fiscal 2024 in its cloud operations and intends to ramp up capital expenditures to capitalize on Azure’s momentum. With Azure outpacing AWS in growth rate – evolving from half the size to nearly three-quarters in comparison – Microsoft’s EPS estimates are on a steady 5% annual increase.

Image Source: Zacks Investment Research

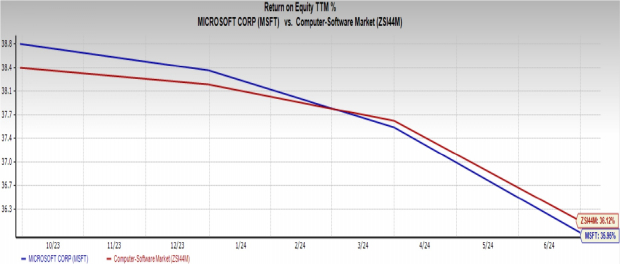

Microsoft prudently manages profits, showcasing a robust return on equity (ROE) at 36%, nearly on par with the Computer – Software industry’s 36.1%. An ROE exceeding 20% is typically considered exceptional.

Image Source: Zacks Investment Research

With a robust cash reserve of $75.54 billion (as of June 30, 2024), Microsoft is well-equipped to clear debts and enhance shareholder wealth through amplified dividends. The recent 10% increase in quarterly dividend to 83 cents per share reaffirms Microsoft’s sound business model, with dividend payouts growing by around 10.3% over the last five years.

Image Source: Zacks Investment Research

To Buy, Hold, or Sell MSFT Stock?

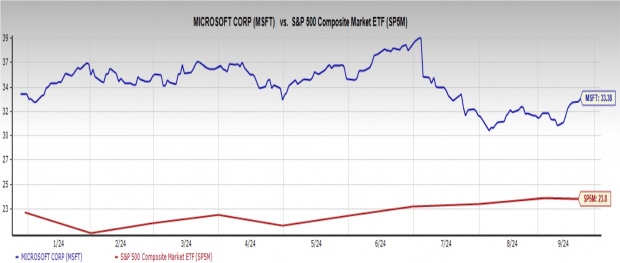

With a strategic stock repurchase plan, Azure’s potential to rival AWS, and a consistent dividend stream, owning MSFT shares appears enticing. However, Microsoft’s stock comes at a premium, sporting a price/earnings ratio of 33.3X forward earnings compared to the broader S&P 500’s 23.8X.

Therefore, savvy investors may consider biding their time for an opportune entry point in MSFT stock rather than making hasty decisions. For existing MSFT shareholders, holding onto the stock could prove prudent given Microsoft’s status as a blue-chip entity with a consistent track record of profitability. Presently, Microsoft holds a Zacks Rank #3 (Hold).

Zacks Highlights #1 Semiconductor Stock

While Microsoft MSFT remains a pillar of financial markets, a fresh opportunity may arise elsewhere. As global semiconductor manufacturing undergoes explosive growth, identifying the next top chip stock becomes imperative. Positioned to cater to the surging demands for Artificial Intelligence, Machine Learning, and the Internet of Things, this semiconductor gem offers substantial growth potential amid evolving industry landscapes.