Glimpse into Stock Market Trends

Recent months have seen a dramatic shift in stock market dynamics, with Tech and AI sectors taking a backseat to more reliable industries such as Utilities, Healthcare, Real Estate, and Bonds. Notably, Real Estate ETF XLRE, Treasury ETF TLT, Utilities ETF XLU, and Healthcare XLV have outperformed both SPY and QQQ by a noteworthy margin since June.

As the Federal Reserve hints at a series of interest rate cuts and economic indicators signal a slowdown—rather than a recession—it’s no wonder investors are gravitating towards safer investments.

Revival of Tech Stocks

Despite the recent dip in tech stock favorability, leading names in the industry, including the Magnificent Seven stocks, have reached appealing price levels. In this discussion, we’ll spotlight three top choices moving forward: Apple (AAPL), Meta Platforms (META), and Nvidia (NVDA), along with essential trading milestones to monitor.

Image Source: TradingView

Apple’s Innovation and Market Dominance

Apple recently unveiled an array of new products, featuring the iPhone 16 and iPhone 16 Pro, Apple Watch Series 10, and AirPods 4, showcasing enhanced camera capabilities, superior battery life, an intuitive Action button, and the innovative Apple Intelligence AI system. The Apple Watch Series 10 and AirPods 4 introduce advanced health tracking and audio features, making significant strides in health monitoring and AI integration.

Despite criticisms about incremental upgrades, Apple’s performance has surpassed all Magnificent Seven stocks since May—a remarkable feat amidst ongoing market volatility.

Image Source: TradingView

With a potential bull flag emerging and the integration of AI into the iPhone, Apple could catapult to AI leadership. If the AI narrative gains momentum, Apple is poised to lead the charge.

Image Source: TradingView

Meta Platforms: Stability Amidst Storms

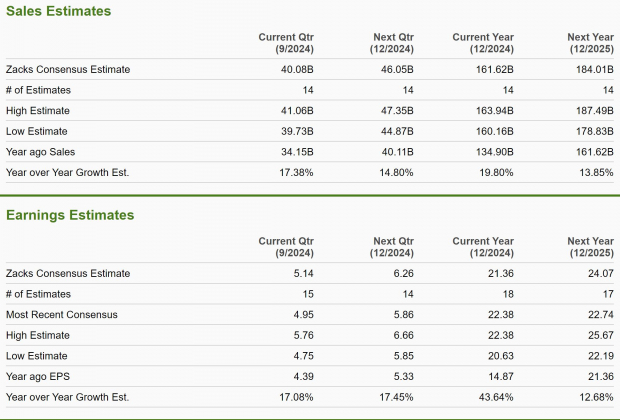

Despite periodic controversies, Meta Platforms continues to exhibit robust growth and profitability, offering attractive buying opportunities for savvy investors. With anticipated sales growth and impressive earnings projections, Meta Platforms remains a promising investment with a relatively low valuation compared to its peers.

Image Source: Zacks Investment Research

Insights into Stock Market Trends Amidst Recent Volatility

Amidst the tumultuous waves of the stock market, Meta Platforms’ and Nvidia’s stock behavior has captured the attention of many keen observers. Offering a glimmer of hope to investors, these tech giants present intriguing prospects for those looking to navigate the choppy waters of the financial world.

Meta Platforms: Navigating Bullish Waters

The movements in Meta Platforms stock paint a picture of optimism. Sporting relative strength and positioned within a bullish flag formation, META seems poised for an upward trajectory. Should the stock breach the $515 level, a path to even greater heights seems likely. Conversely, a breach of the lower support near $465 could signal broader market turmoil, prompting a cautious approach while waiting for a more opportune moment.

Nvidia: The Phoenix Rising

Nvidia, once the darling of the market, faced its share of challenges over the past quarter. With a steep 35% decline from mid-June to early August, the graphics card giant weathered a storm of corrections. However, recent movements suggest a resurgence, with shares bouncing back after testing upper bounds.

Hovering around $100, Nvidia presents a compelling entry point for investors eyeing the bottom of the range. Notably, the semiconductor manufacturer’s valuation has also seen a retreat to more attractive levels, offering a tantalizing opportunity for those with a keen eye.

Valuation Metrics in Play

Currently, Nvidia exhibits a one-year forward earnings multiple of 38x, registering below its 10-year average of 42.8x and nearing five-year lows. Projections of a robust 41.7% annual EPS growth over the next few years yield a PEG ratio of 0.9, indicating a discounted valuation measure.

Looking further ahead, Nvidia’s trading at just 28x FY26 earnings offers a glimpse into a potentially lucrative future. With estimated growth on a high trajectory, Nvidia appears primed for continued appreciation in the coming years.

Investment Considerations

Amid the prevailing market conditions, a shift towards defensive sectors has unearthed enticing prospects among tech stalwarts, notably the “Magnificent Seven”. Equities such as Apple, Meta Platforms, and Nvidia have undergone pullbacks recently, presenting investors with attractive entry points at more rational valuations.

Apple’s innovation prowess, Meta Platforms’ growth surge, and Nvidia’s technological dominance establish a compelling narrative for long-term investors seeking stability, innovation, and growth. Seizing the moment amidst recent retracements may prove prudent before the tech landscape reshapes in their favor.