Investors often turn to Wall Street analysts’ recommendations to gauge the investment viability of a stock. But do these recommendations truly hold merit and influence?

Before delving into the reliability of brokerage advice and how investors can leverage it to their benefit, let’s explore the sentiments of Wall Street giants towards Canoo Inc. – stock ticker symbol GOEV.

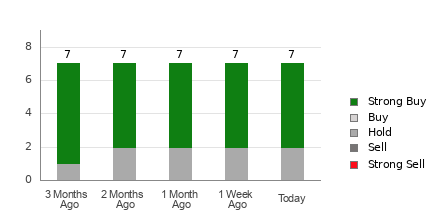

Canoo boasts an average brokerage recommendation (ABR) of 1.57 on a scale of 1 to 5 (ranging from Strong Buy to Strong Sell), derived from the opinions of seven brokerage firms. A rating of 1.57 hovers around the Strong Buy territory.

Out of the seven recommendations contributing to this ABR, an impressive 71.4% are Strong Buy ratings.

Unraveling the Trends in Brokerage Recommendations for GOEV

While the ABR leans in favor of investing in Canoo, relying solely on this indicator may not be prudent. Research indicates that brokerage recommendations often fall short in pinpointing stocks poised for maximum price appreciation.

Curious as to why? Analysts at brokerage firms, with their vested interests in the stocks they cover, exhibit a notable bias towards rating them positively. Our investigations have revealed that for every “Strong Sell” recommendation, these firms tend to assign five “Strong Buy” recommendations.

This disparity hints at a misalignment between institutional interests and those of individual investors, offering limited insights into a stock’s future price trajectory. Thus, it’s advisable to utilize this data to validate personal analyses or rely on tools proven to forecast stock price movements accurately.

Zacks Rank, a reputable stock rating tool with a robust audited track record, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering valuable clues about a stock’s forthcoming price performance. Hence, cross-referencing the ABR with the Zacks Rank can guide investors in making prudent investment decisions.

Understanding the Nuances Between Zacks Rank and ABR

Although both Zacks Rank and ABR employ a 1-5 range, they serve distinct purposes.

ABR is derived solely from brokerage recommendations, often depicted with decimal points (e.g., 1.28). Conversely, Zacks Rank operates as a quantitative model enabling investors to leverage earnings estimate revisions, indicated by whole numbers from 1 to 5.

Historically, brokerage analysts tend to be overly optimistic in their ratings due to institutional influences, issuing more favorable recommendations than warranted by their research.

Conversely, Zacks Rank hinges on earnings estimate trends, where short-term stock price movements correlate closely with these revisions, supported by empirical studies.

Furthermore, Zacks Rank’s gradations are uniformly applied across all stocks with current-year earnings estimates, ensuring fairness in its evaluation.

Another crucial contrast lies in the timeliness of ABR and Zacks Rank. While ABR may lag in providing updated information, Zacks Rank swiftly reflects analysts’ adjustments to earnings estimates, thus offering prompt insights into future stock valuations.

The Investment Outlook for GOEV

Reviewing Canoo’s earnings estimate revisions, the Zacks Consensus Estimate for the ongoing year remains steady at -$4.10 over the past month.

Stable consensus estimates often indicate analysts’ consistent outlook on a company’s earnings, potentially aligning Canoo’s performance with the broader market in the short term.

Considering the recent consensus estimate alongside other relevant factors, Canoo currently holds a Zacks Rank #3 (Hold) designation.

Given the Hold-equivalent ABR for Canoo, exercising caution in the decision-making process is advisable.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.