I reckon most passionate basketball fans can vividly recall the glory days when “AI” was synonymous with the legendary Allen Iverson of the NBA. Fast forward to today, and the mere mention of AI conjures images of artificial intelligence, occupying the center stage in the realm of technology. The AI landscape has witnessed a remarkable surge in attention over recent years.

Although AI has been part of the technological fabric for a considerable duration, the recent breakthroughs and the triumphant exploits of generative AI tools such as ChatGPT have elevated AI to primetime status in numerous industries. Consequently, the stock market has witnessed a meteoric rise in the valuation of companies involved in AI-related endeavors.

Uncovering Gems: An Insight into Two Artificial Intelligence Stocks

Given the transformative influence of AI across various sectors, investors on the prowl for lucrative opportunities would be wise to consider the allure of the following two AI-centric stocks. Doubling down with $1,500 into each promises an exciting growth trajectory, coupled with a stream of dividend income — truly a tantalizing two-for-one proposition.

1. Taiwan Semiconductor Manufacturing Company

At first glance, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) might not immediately strike one as a quintessential AI stock, yet its pivotal role within the AI ecosystem rivals that of nearly any other entity in the current landscape.

While many have lauded Nvidia for its towering presence in the stock market limelight, courtesy of the criticality of its graphic processing units (GPUs) in training AI within data centers, there lies a lesser-known hero in the shadows — TSMC. The semiconductors meticulously crafted by TSMC form the bedrock on which Nvidia’s GPUs heavily rely. Arguably wielding the mantle of the preeminent semiconductor foundry globally, TSMC boasts a stellar track record in luring a plethora of top-tier tech clients. Devoid of TSMC’s semiconductor prowess, the quality and performance of Nvidia’s GPUs, along with a myriad of other electronics, may well plunge, heralding a cascading effect on product quality.

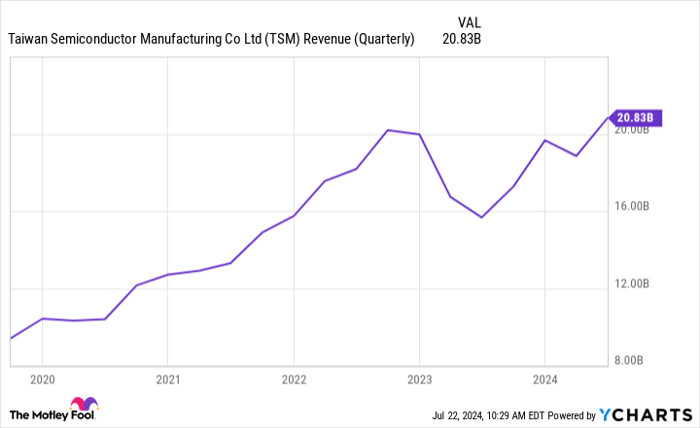

The appetite for TSMC’s semiconductors is projected to swell in the foreseeable future, thereby perpetuating the positive momentum the company has harnessed following a slump induced by declining smartphone sales. Its revenue in the second quarter (Q2) surged by a staggering 33% year over year and 10% quarter-on-quarter.

TSM Revenue (Quarterly) data by YCharts.

Formerly reliant on semiconductor sales linked to smartphones for the bulk of its revenue, TSMC recently witnessed high-power computing, inclusive of AI-oriented chips, contribute a staggering 52% to its revenue — a monumental leap from the 24% witnessed in Q1.

Despite potential geopolitical headwinds, such as export restrictions, looming on the horizon, TSMC’s long-term prospects remain robust. With a dividend yield hovering around 1.2%, on par with the S&P 500, investors are induced to exhibit patience as the company gingerly navigates these impending hurdles.

2. Microsoft

Manifesting a compelling narrative within the AI domain, Microsoft (NASDAQ: MSFT) garners attention owing to its strategic partnership with the brainchild behind ChatGPT, OpenAI.

Microsoft’s substantial investments in OpenAI, aimed at expediting the pace of AI research and development, have fostered a symbiotic relationship that reaps mutual benefits. OpenAI, reliant on Microsoft’s Azure cloud platform for its supercomputing capabilities and infrastructure to orchestrate the training and operation of its AI models, reciprocally empowers Microsoft to embed OpenAI’s models across its suite of consumer and enterprise solutions.

Microsoft’s extensive array of products, anchored by the venerable Office suite including Excel, Word, PowerPoint, and Teams, enjoys global reverence, with the OpenAI integration embellishing user experience and functionalities. Noteworthy is the 15% year-over-year revenue uptick observed in Office 365, a phenomenon partly attributed to this collaboration.

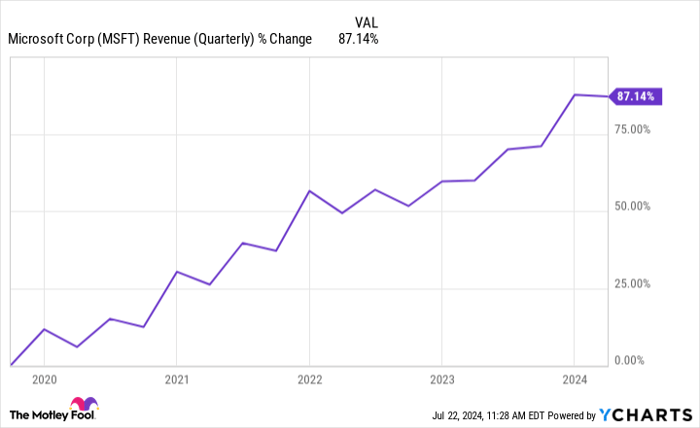

In the third quarter of its fiscal year 2024 (concluding on March 31), Microsoft witnessed a remarkable 17% year-over-year revenue surge to the tune of $61.9 billion. This burst was spearheaded by the “Intelligent Cloud” segment, encompassing Azure’s ecosystem.

MSFT Revenue (Quarterly) data by YCharts.

Microsoft’s intelligent cloud division amassed a staggering $26.7 billion in revenue, marking a robust 21% upsurge year over year, with Azure and other cloud services witnessing a meteoric 31% revenue escalation. Although Azure trails behind Amazon Web Service (AWS) in market share by a slender margin (25% compared to AWS’s 31%), Microsoft has made substantial strides poised to continue with novel AI amalgamations.

Under the aegis of its partnership with OpenAI, Microsoft rolled out Azure OpenAI, endowing customers with Azure’s computational prowess and security features while concurrently hosting all of OpenAI’s models. In the fiercely competitive cloud computing arena, the provision of a comprehensive one-stop-shop constitutes a formidable advantage, positioning Microsoft on a trajectory geared towards futuristic prosperity.

Revolutionizing The Market: Taiwan Semiconductor Manufacturing

When it comes to technological prowess, one company stands at the pinnacle – Taiwan Semiconductor Manufacturing. Not just a manufacturer, they are the architects of digital metamorphosis, reshaping the terrain for contenders like Microsoft and AMD. In the capricious world of silicon, Taiwan Semiconductor Manufacturing remains the astute pioneer.

The Rise and Rise of Taiwan Semiconductor Manufacturing

In an era where innovation is currency, Taiwan Semiconductor Manufacturing forges ahead like a lone wolf in a forest of sheep. Their chipsets are not mere components; they are the vital organs sustaining the heartbeat of modern technology. Like a phoenix from the ashes, Taiwan Semiconductor Manufacturing has soared to unprecedented heights, leaving even the tech giants awe-struck.

Emerging Victorious Against Competitors

Competitors like Microsoft and Nvidia may have formidable arsenals, but Taiwan Semiconductor Manufacturing’s prowess is a force to be reckoned with. Their strategic maneuvering and unyielding dedication have catapulted them into a league of their own, where victory is not just an option but an expectation.

With a dividend yield shy of 1%, some investors may turn a skeptical eye. However, the real allure lies beyond the immediate gratification of dividends – it’s in Taiwan Semiconductor Manufacturing’s meteoric stock price surge of over 50% in the past year. A testament to their unwavering dominance.

Invest Wisely: A Glimpse into the Future

Contemplating an investment in Taiwan Semiconductor Manufacturing begs the question: what does the future hold? While it may not have made the latest list of “10 best stocks” according to the Motley Fool Stock Advisor, history provides the most resounding answer. Recall Nvidia’s feat back in 2005; a $1,000 investment then would have ballooned to a jaw-dropping $751,180*. A tale that speaks volumes about the potential nestled within the corridors of Taiwan Semiconductor Manufacturing.

The Stock Advisor service, with its impeccable success rate since 2002, acts as a compass for investors navigating the tempestuous waters of the stock market. It’s not just about returns – it’s about charting a course towards a future where financial dreams materialize against all odds.

As the realm of technology evolves and giants like Amazon and Microsoft loom large, Taiwan Semiconductor Manufacturing emerges not as a contender but as the harbinger of a new epoch. An epoch where every chip they manufacture is a step towards rewriting the future.

*Stock Advisor returns as of July 22, 2024