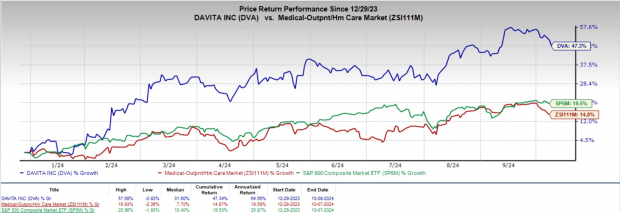

DaVita, Inc. DVA has been on a tear this year, with its shares skyrocketing by a whopping 47.3%. In comparison, the industry grew at a modest pace of 14.8%. Surpassing the S&P 500 composite gain of 19.5%, DaVita has caught the attention of investors with its remarkable performance.

Carrying a Zacks Rank #2 (Buy), DaVita is riding high on a wave of positive momentum, largely fueled by the company’s distinct business model. The enthusiasm surrounding its stock stems from a stellar second-quarter 2024 performance and strategic acquisitions of dialysis centers, setting the stage for continued growth.

DaVita stands as a prominent provider of dialysis services in the United States, catering to patients battling chronic kidney failure. Operating kidney dialysis centers and offering a range of medical services, DaVita’s footprint extends across the country. Its services encompass outpatient and inpatient dialysis, alongside ancillary services like ESRD laboratory services and disease management.

Image Source: Zacks Investment Research

The Driving Forces Behind DaVita’s Growth

The surge in DaVita’s stock value can be credited to the resilience of its dialysis and related lab services. Bolstered by a strong second-quarter 2024 performance and promising business prospects, DaVita’s growth trajectory appears robust.

DaVita’s growth narrative is underscored by its patient-centric care approach, leveraging its kidney care services platform to offer diverse treatment models and modalities. The increasing prevalence of value-based partnerships in kidney health is enhancing collaboration among nephrologists, physicians, and transplant programs, leading to improved care coordination and timely interventions.

A pivotal component of DaVita’s growth strategy lies in the strategic acquisitions of dialysis centers and related enterprises, exemplified by the extension of its pilot phase for a supply and collaboration agreement with Nuwellis. The company’s recent agreements to broaden its operations in Brazil, Colombia, Chile, and Ecuador signify a growing global footprint.

DaVita’s strong performance in the second quarter of 2024, surpassing expectations in revenue streams and patient services, sets a positive tone. The uptick in daily United States dialysis treatments, expansion of new centers, and overseas acquisitions all point towards a promising growth trajectory.

Additionally, the upward revision of DaVita’s earnings guidance for fiscal 2024, now projecting adjusted EPS in the range of $9.25 to $10.05, up from the previous forecast of $9 to $9.80, is poised to attract heightened investor interest.

Examining the Risk Landscape

DaVita faces a potential risk of reduced profitability should patients transition from commercial insurance to government programs, given the notably lower reimbursement rates from the government. This scenario, triggered by rising unemployment rates, could impact DaVita’s revenue streams and profit margins adversely.

Peering into Projections

The Zacks Consensus Estimate for DaVita’s bottom line in 2024 and 2025 anticipates an 18% and 14.4% year-over-year advancement, reaching earnings of $9.99 and $11.42 per share, respectively.

Over the past 30 days, the Zacks Consensus Estimate for DaVita’s 2024 earnings has held steady at $9.99 per share.

Revenue projections for 2024 and 2025 are set to climb by 5.4% and 4%, landing at $12.8 billion and $13.3 billion year-over-year.

Other Standout Picks

Joining DaVita are other top-ranked stocks in the expansive medical sector, including Rockwell Medical RMTI, Quest Diagnostics DGX, and RadNet RDNT. While Rockwell Medical boasts a stellar Zacks Rank #1 (Strong Buy), Quest Diagnostics and RadNet each hold a Zacks Rank #2 currently.

Rockwell Medical has outperformed earnings estimates in the last four quarters, with an average beat of 87.9%.

RMTI’s shares have surged by 79.7% this year, outpacing the industry’s 10.7% growth.

Quest Diagnostics is poised for a long-term growth rate of 6.8%. DGX has exceeded earnings estimates in the past four quarters, averaging at 3.3%.

Quest Diagnostics has seen a rise of 7.9% this year, contrasting with the industry’s growth of 14.9%.

RadNet has surpassed earnings estimates in the last four quarters, with an average surprise of 98.2%.

RDNT’s shares have soared by 93.7% year to date, eclipsing the industry’s 14.8% growth.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.