Volatility and sentiment shifts characterized Q3 in the crypto market.

Bitcoin, a market barometer, faced notable price swings, with monthly declines surpassing 12% in July and August.

Ethereum’s Q3 run hinted at waning engagement, evident in reduced daily active addresses compared to prior periods. In contrast, rival blockchains like Solana witnessed increased user traction, potentially indicating a shift in user preferences away from Ethereum.

Explore pivotal events shaping the Q3 crypto landscape.

July: Market Dynamics and Political Impacts

July saw a dynamic phase for crypto, marked by trend shifts and price fluctuations. Crypto took a center stage as a pivotal political catalyst after President Joe Biden’s withdrawal from the Democratic nomination, influencing Bitcoin’s upward trajectory. However, the month’s price oscillations underscored Bitcoin’s sensitivity to external factors, highlighting the enduring impact of news and events on the coin’s supply and demand dynamics.

Bearing Witness to Market Trends

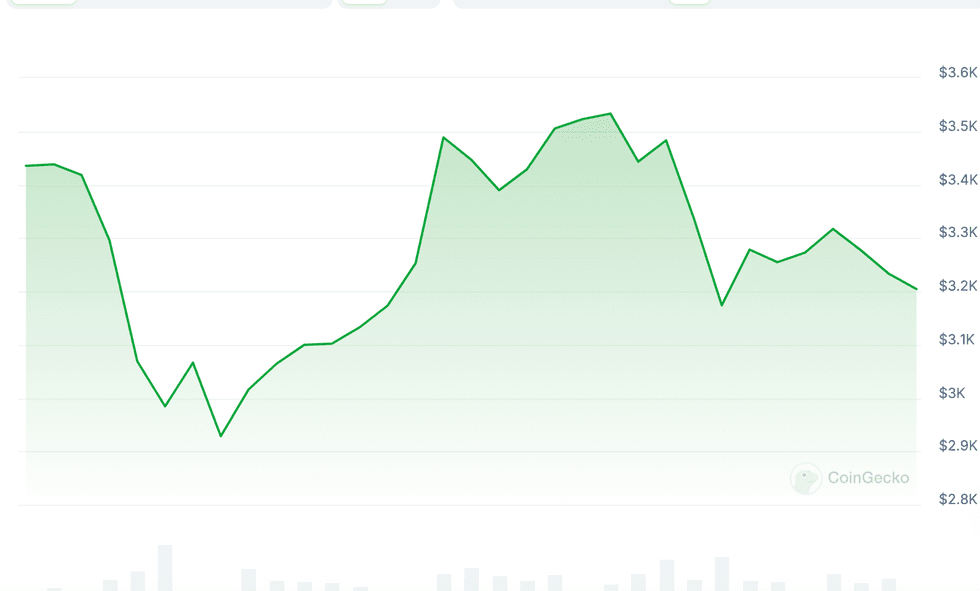

Chart via CoinGecko.

Bitcoin’s July 2024 Price.

Ether experienced an 8% dip immediately following the launch of highly anticipated Ethereum exchange-traded funds (ETFs) on July 23. While this seemed concerning, the ETFs themselves performed well, showcasing robust growth rates throughout the month.

The Rise of Solana in July

Chart via CoinGecko.

Ether’s July 2024 Price.

Solana’s stellar performance in July, fueled by the rising popularity of liquid staking protocols, outshone Bitcoin and Ether in the crypto surge from July 11 to 21. Solana even surpassed Ethereum in on-chain volume, pointing towards a potential shift in the market.

August: Market Decline and Recovery Lag

The commencement of August brought turmoil as macroeconomic challenges led to widespread sell-offs following the Bank of Japan’s surprise interest rate hike on July 31.

Concerns over a possible recession in the US triggered a significant stock market downturn, with the entire crypto industry losing $510 billion by August 5. Both Bitcoin and Ether struggled to regain momentum, with Bitcoin even forming a “death cross” pattern, a signal historically associated with potential further declines.

Market Cap Movement in August

Chart via CoinGecko.

Crypto Sector Market Cap in August 2024.

The market downturn was exacerbated by increased short-selling activity. Although institutional investors initially provided some support, the momentum soon shifted towards sellers, amplifying the downward pressure.

The Thrilling Saga of Cryptocurrency Markets in Q4 2024

September: Bitcoin and Ether break through resistance

September, a month historically bearish for the crypto industry, showcased remarkable resilience. The US Federal Reserve’s long-awaited interest rate cut on September 18 propelled Bitcoin and Ether prices through resistance levels. Market watchers also noted a surge in stablecoin valuations, particularly for XRP, following the launch of Grayscale’s XRP Token Trust on September 12.

Rekt Capital hinted that the end of September could signify the culmination of Bitcoin’s post-halving “reaccumulation range”, possibly indicating a transition to a bull cycle heading into Q4. However, further consolidation before a surge in October could not be ruled out. By the end of the month, Bitcoin had edged up by 7.39 percent, closing just above US$64,540.

BlackRock’s spot Ethereum ETF also reached a milestone, surpassing US$1 billion in value for the first time at the close of Q3.

Watch these crypto market factors in Q4

In a report on Q4 crypto market dynamics, Canadian fintech company WonderFi noted the growing maturity of Bitcoin as an asset class. Global liquidity and political developments were cited as key influencers likely to shape the crypto market in the final quarter of 2024.

Experts like Matt Hougan and Ric Edelman forecasted success for Solana and Ethereum in Q4, aligning with sentiments expressed by Michaël van de Poppe for CoinTelegraph. The upcoming election was highlighted as a pivotal event that could heavily impact the industry based on future regulatory decisions.

Investor takeaway

As the crypto industry matures, the final quarter of 2024 holds the promise of significant growth and innovation. With increasing institutional adoption, evolving regulations, and a rising interest in altcoins, this period could define the future path of the industry.