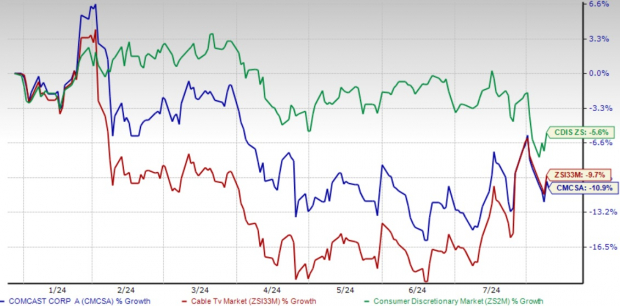

Comcast Corporation CMCSA, a dominant force in the world of media and technology, has seen its stock price plummet by 10.9% year-to-date (YTD) against a 5.3% industry-wide slump in the Zacks Consumer Discretionary sector. This decline, amidst turbulent market conditions and industry-specific challenges, has left investors pondering whether to hold their position or cut their losses. The company finds itself at a crossroads, grappling with a metamorphic media landscape and the need for substantial investments to stay ahead in content and infrastructure.

The Unfolding Performance in 2021

Image Source: Zacks Investment Research

Exploring Comcast’s Investment Potential

In Comcast’s Connectivity & Platforms sector, the Xfinity brand reigns supreme in the realm of broadband Internet services. With a substantial growth in revenue and an investment in broadband infrastructure, Comcast is strategically positioned for future success. The introduction of Xfinity Mobile and the growth in wireless customer lines further bolster its connectivity offerings.

Within the Content & Experiences segment, Comcast presents promising opportunities. Ventures like Peacock and Universal theme parks signify growth potential. Peacock’s rising subscriber numbers and revenue from streaming services underscore Comcast’s prospects in the digital realm. The integration of Comcast’s segments offers a competitive edge, blending connectivity and content seamlessly.

The Zacks Consensus Estimate underscores positive growth projections, with revenue and earnings expected to rise in the coming years.

Image Source: Zacks Investment Research

Challenges in a Cord-Cutting Era

The pervasive trend of cord-cutting poses a significant challenge to Comcast’s traditional cable business. Competition from streaming giants like Netflix and Disney+ exerts pressure on Comcast’s market share. Expanding into streaming with Peacock is vital but demands substantial investments which could impact profitability and ROI.

The deceleration in broadband subscriptions and the costs of network upkeep present additional hurdles for Comcast, raising doubts about its growth trajectory.

Despite Comcast’s best efforts to adapt, these challenges cast a shadow on investor confidence.

Wrapping Up the Comcast Conundrum

Comcast’s recent decline offers a nuanced investment landscape. While its market dominance, diversified business model, and appealing valuation metrics hint at potential gains, the industry headwinds loom large. Investors must meticulously weigh these factors against their risk appetite and long-term objectives before taking action. For existing shareholders, a wait-and-see approach may be prudent, while new entrants should tread carefully and analyze the evolving Comcast story before diving in.

Unveiling the Potential of the Semiconductor Stock Market

The Rise of Semiconductor Stocks

A subtle force in the stock markets, semiconductor stocks have a power that belies their compact size. Take NVIDIA, for instance, which has ascended meteorically, soaring by over 800% since receiving a glowing recommendation. While NVIDIA basks in its strength, a newer contender in the chip realm, only 1/9,000th of NVIDIA’s stature, is emerging as a top player with untapped potential for monumental growth.

The Potential for Growth

Fueled by robust earnings growth and an ever-expanding customer base, this semiconductor stock is strategically positioned to cater to the insatiable demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Projections indicate that the global semiconductor manufacturing industry is on the brink of an explosion, estimated to surge from $452 billion in 2021 to a staggering $803 billion by 2028.