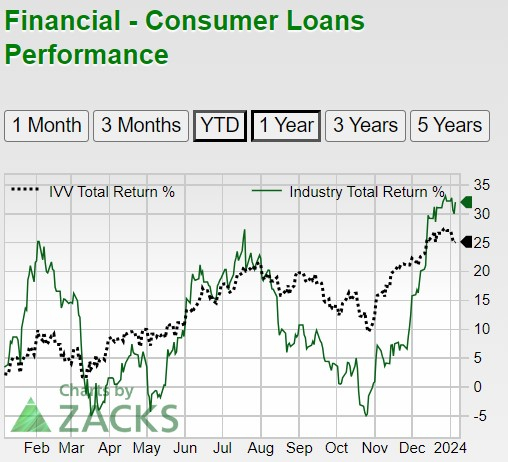

The Zacks Financial-Consumer Loans Industry has produced a total return of +32% over the last year when including dividends, making many consumer loan stocks more attractive amidst easing inflation.

Two prominent names in this space, Capital One Financial COF and Discover Financial Services DFS, are now being considered for investment potential.

Image Source: Zacks Investment Research

Undervalued Stocks with Dominant Presence

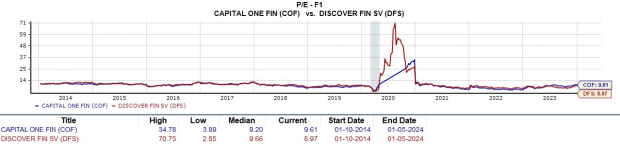

Capital One and Discover stocks appeared to be vastly undervalued for most of 2023 after the collapse of Silicon Valley Bank and fear-induced panic selling across the financial sector. Yet, they maintain a dominant presence in consumer lending through personal loans and credit offerings, each with unique focuses.

Although Capital One and Discover shares have rebounded, they still trade at just 9.6X and 8.9X forward earnings, respectively, well below the S&P 500’s 19.6X and closer to the Zacks Financial-Consumer Loans Industry average of 7.5X.

Image Source: Zacks Investment Research

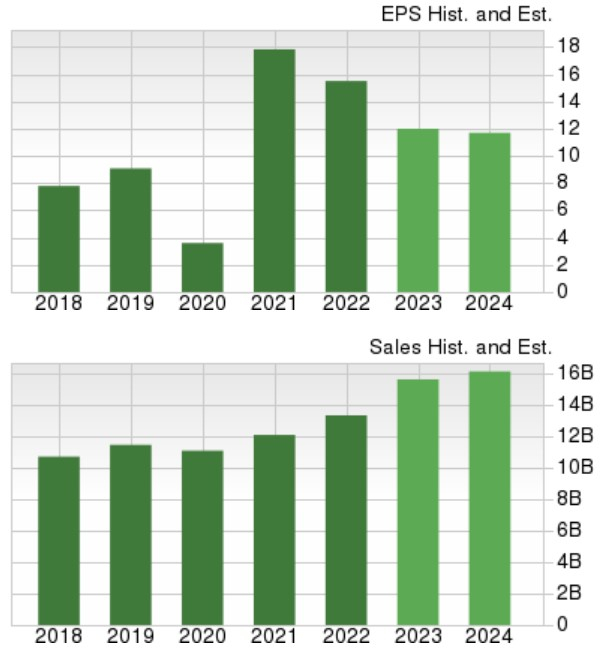

Strategic Sales Projections

Despite headwinds from high inflation, both Capital One and Discover have posted attractive sales growth. Capital One is forecasted to close fiscal 2023 with earnings of $12.79 a share versus $17.71 per share in 2022, with FY24 EPS projected to rebound and rise 8% to $13.78 per share. Total sales are estimated to have risen 7% in FY23 and expected to climb 4% this year to $38.36 billion.

Image Source: Zacks Investment Research

Discover’s total sales are projected to have surged 18% in FY23 and are forecasted to rise another 6% in FY24 to $16.66 billion, with annual earnings for FY23 anticipated at $12.27 a share compared to $15.50 per share in 2022. Fiscal 2024 earnings are expected to stabilize and rise over 1% to $12.47 per share.

Image Source: Zacks Investment Research

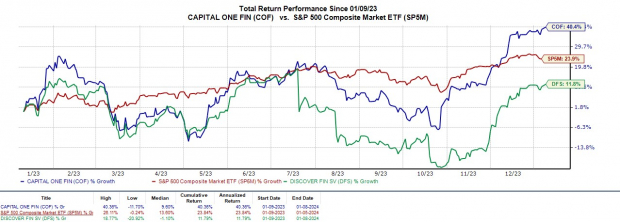

Analysis of Total Return Performance

Capital One’s +40% total return has outperformed its Zacks Subindustry’s +32% and the benchmark’s +24% over the last year, with Discover’s +12% trailing.

Image Source: Zacks Investment Research

Despite Discover’s price performance trailing the broader market, its 2.5% annual dividend yield exceeds the S&P 500’s 1.4% and its industry average of 2.2%, with Capital One’s yield at a respectable 1.81%.

Image Source: Zacks Investment Research

Conclusion: Should You Invest?

Currently, Capital One Financial and Discover Financial Services stocks both hold a Zacks Rank #3 (Hold). While their attractive valuations suggest further upside, this may depend on the ability to provide favorable fourth quarter results later in the month, with Discover set to report on January 17 and Capital One reporting on January 25.