$200 billion. That’s how much revenue Apple (NASDAQ: AAPL) generated last year from iPhone sales.

Most people think that is why Apple is the most valuable company in the world. And they’re not entirely wrong. But it is more complicated than that.

Let’s explore how Apple churns out its revenue, and why the company is funneling vast amounts of resources into a domain that many overlook – a business that lies beyond the glitzy iPhone facade.

Image source: Getty Images.

Products vs. services: A Tug-Of-War

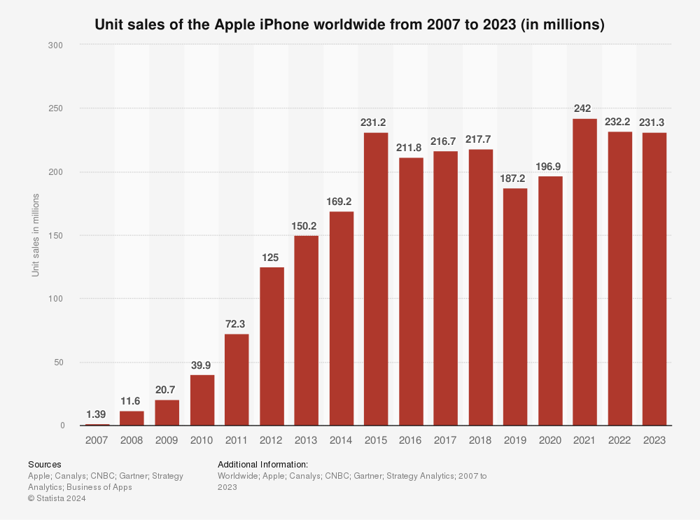

At the mention of Apple, minds reverberate with one word – iPhones. And, as highlighted previously, the company rides on a revenue high with its flagship smartphones. However, here’s the curveball: Apple’s iPhone earnings have stagnated for nearly a decade:

Image source: Getty Images.

In essence, the iPhone is old hat — at least in Apple’s playbook. The narrative extends to its other hardware offspring — the iPad, Macs, even wearables. Certainly, these have bolstered Apple’s revenue over the past decade, but they pale compared to the juggernaut that was the iPhone between 2007 and 2015.

The real catalyst of Apple’s recent growth lies in its services domain. This division revels in proceeds from the App store, iTunes, AppleCare+, advertising, and subscriptions to apps like iCloud+, Apple Fitness, and AppleTV+.

What’s intriguing, much to the delight of Apple and its shareholders, is that the services arm boasts a significantly higher profit margin than its product corollary. In essence, Apple garners around 33% gross profit from its products (iPhones, iPads, and Macs). In stark contrast, its services wing flaunts an overall gross profit margin of 75%.

This divergence signifies that Apple has zeroed in on amplifying its services revenue and profits – recognizing this area as the crux of the company’s value currently.

Hence, the grand conundrum – why has Apple splurged $20 billion on somnolent content?

Apple’s $20 Billion Bet on Apple TV+ Content

Sans a lucid breakdown of the revenue and expenditures within its services realm at a granular level, investors rely on conjectures. Reports from Bloomberg hint that Apple has outpoured over $20 billion on Apple TV+ in a bid to lock horns with Netflix, Amazon, Disney, and their ilk. Evidently, the infamous “streaming wars” have exacted a hefty toll on Apple as well.

What’s graver, however, is that most of that expenditure seems to have been mostly futile. True, Apple snagged a Best Picture laurel in 2022 through Coda, but myriad other high-budget ventures floundered in elevating Apple TV’s viewership. As per one account, Apple TV clocks almost the identical viewership count in a month that Netflix racks up in a day.

Rumors allude to Apple’s top brass tightening the purse strings and slashing budgets for its streaming escapades. And perhaps with valid reasoning. The organization is now pivoting towards fresh artificial intelligence (AI) tools that could catapult its services revenue even further. Investments in AI come at a hefty price, and thus, the days of profligate spending on Apple TV might be numbered.

Apple immersed itself in the maelstrom of the streaming wars, bleeding billions that could have been channeled into AI. Nevertheless, it seems the realization of this misallocation of resources has dawned, prompting the tech giant to rein in its extravagant expenditure on streaming. Consequently, Apple’s leadership team can focus resources on fortifying its services and AI domain – the former driving current growth and the latter shaping its future.

The Bottom Line: Apple’s Strategic Pivot

Before contemplating an investment in Apple, deliberate on this:

The Motley Fool Stock Advisor analysts have pointed out what they consider the next big thing for companies at the forefront of tech innovation.