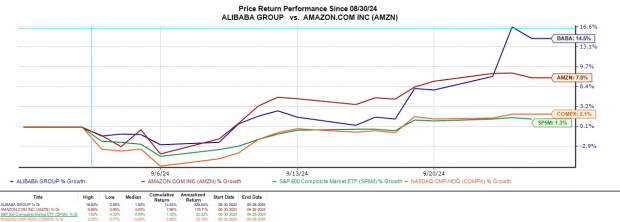

News of China’s economic stimulus has given Chinese equities a spike this week with Alibaba turning heads once again. Alibaba’s stock has soared +14% this month, leading to a +30% gain for the year, edging out American e-commerce giant Amazon by +25%.

Both e-commerce behemoths have shown strong momentum in September, making it a compelling discussion piece on which stock may be the better buy. Noteworthy, the Zacks Internet-Commerce Industry ranks in the top 27% of over 250 Zacks industries.

Image Source: Zacks Investment Research

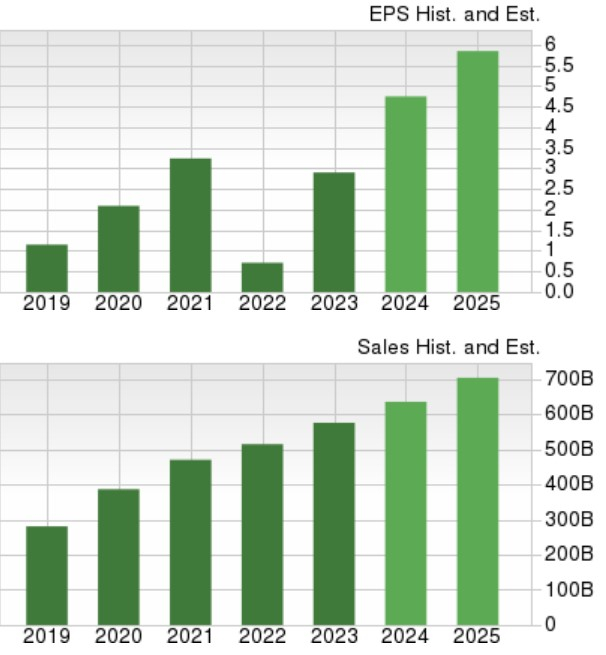

Amazon: The Growth Investors’ Darling

Amazon’s growth trajectory appears impressive, with annual earnings projected to surge by 63% in fiscal 2024 to $4.74 per share, compared to $2.90 in FY23. Additionally, FY25 EPS is forecasted to increase by 23%.

Amazon Web Services (AWS) has been a major driver of the company’s expansion, with total sales estimated to hike by over 10% in both FY24 and FY25, climbing towards the $700 billion mark. As the world’s largest cloud provider, AWS segment sales rose by 18% during Q2, reaching $26.28 billion.

Image Source: Zacks Investment Research

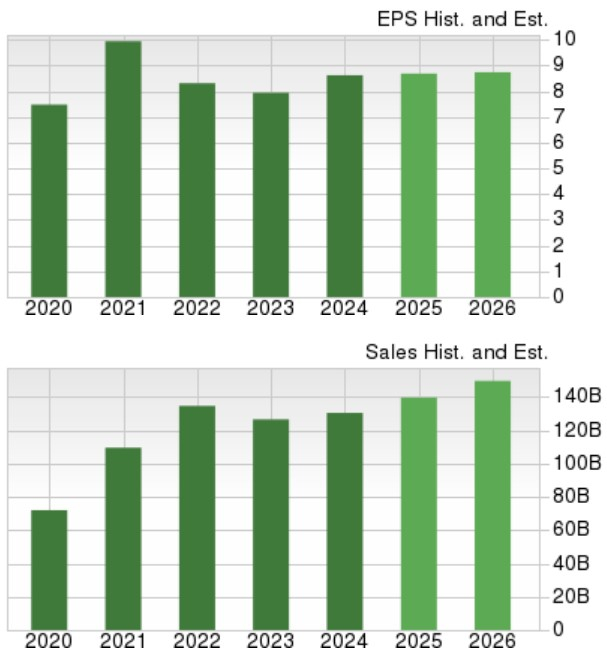

Conversely, Alibaba has diversified operations beyond e-commerce, including cloud computing, but its earnings growth has decelerated in recent years. In FY25, Alibaba’s EPS is projected to rise by around 1% compared to virtually no change in FY26, expected to reach $8.74 per share. However, the company’s top line is forecasted to grow by 7% in both FY25 and FY26, with sales estimates nearing $150 billion annually.

Image Source: Zacks Investment Research

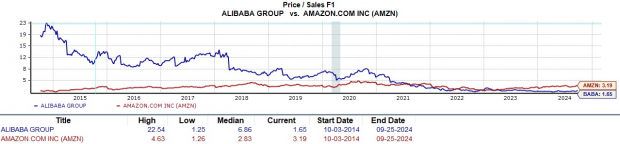

Value Investors Lean Towards Alibaba

Despite Amazon’s promising growth prospects, value investors may find Alibaba’s stock more appealing. Despite the recent rally, Alibaba trades at just 10.9X forward earnings, a significant discount compared to the industry average of 28.7X. Conversely, Amazon sits at a 40.5X forward earnings multiple, showcasing a premium over the S&P 500’s 24.2X.

Image Source: Zacks Investment Research

Moreover, Alibaba’s price-to-sales ratio is less than 2X, while Amazon’s stands at 3.1X.

Image Source: Zacks Investment Research

Balance Sheet Face-Off

Looking at the balance sheet, Amazon boasts $89 billion in cash & equivalents at the end of Q2 2024, while Alibaba holds $68 billion.

Image Source: Zacks Investment Research

In terms of total assets, Amazon records $554.81 billion, with $318.37 billion in total liabilities. On the other hand, Alibaba reports $245.63 billion in total assets, compared to $102.18 billion in total liabilities.

Image Source: Zacks Investment Research

The Verdict

Currently, both Alibaba and Amazon stock carry a Zacks Rank #3 (Hold). Amazon proves attractive to growth investors, while value investors may gravitate towards Alibaba. With recent surges in e-commerce stocks, there might be better buying opportunities on the horizon, although both remain strong long-term investments.

Infrastructure Stock Boom to Sweep America

A colossal effort to revamp the crumbling U.S. infrastructure is on the horizon. It’s a bipartisan, urgent, and inevitable endeavor. Trillions will be invested, leading to substantial wealth creation opportunities.

The crucial question is, “Will you identify the right stocks early, capturing their maximum growth potential?”

Zacks has unveiled a Special Report to aid in this quest, and it’s available for free today. Uncover 5 companies poised to benefit significantly from the massive scale of construction, repair, cargo hauling, and energy transformation.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>