Key Takeaways

- Stocks like NVDA, IBKR, BLK, ACN and CME are set to rise as cryptocurrencies are on a rally.

- Bitcoin hit an all-time trading high of more than $75,000 after Donald Trump’s presidential election victory.

- Register now to see our 7 Best Stocks for the Next 30 Days report – free today!

Cryptocurrencies are on a rally, with Bitcoin (BTC) hitting an all-time high on Wednesday morning, amid reports of Donald Trump making major gains in the U.S. Presidential election. Bitcoin crossed the $75,000 mark hours after the nation went to polls to elect the 47th president.

The Bitcoin rally has been gaining pace over the past month after the Federal Reserve announced its first interest rate cut in four years. Investors are optimistic about another rate cut at the end of the Federal Reserve’s November policy meeting on Thursday, which is likely to give the crypto market a further boost.

Given this situation, investing in Bitcoin related stocks like NVIDIA Corporation NVDA, Interactive Brokers Group, Inc. IBKR, BlackRock, Inc. BLK, Accenture plc ACN and CME Group Inc. CME, which have strong growth potential for the near term, would be a prudent choice.

Bitcoin Hits All-Time High

Bitcoin hit an all-time high of $75,011.06 on Wednesday, surpassing its previous high of $73,770 recorded in March. The cryptocurrency was last trading at 74,802, up 8.2% in the past 24 hours. The high came as millions of Americans came out to cast their votes to elect the nation’s next president.

Other major cryptocurrencies like Ethereum (ETH), Cardano (ADA) and Dogecoin (DOGE) also surged on Tuesday. Ethereum, Cardano and Dogecoin jumped 6.6%, 8.8% and 18.8%, respectively. The cryptocurrency market cap surged to nearly $1.5 trillion hours after polling opened.

Bitcoin Rally to Continue

Bitcoin has performed well lately, driven by institutional investments and increasing mainstream acceptance. Bitcoin ETFs have attracted more than $50 billion in inflows, which has helped create a solid base for Bitcoin’s recent price changes.

Bitcoin is often linked to Trump’s campaign because of his strong advocacy for digital assets. He has even pledged to turn the United States into the global hub for cryptocurrency.

The Federal Reserve cut interest rates by 50 basis points in September, giving a major boost to cryptocurrencies. Since then, Bitcoin has been on a strong rally. Market participants are now confident that the Federal Reserve will announce another 25 basis-point interest rate cut at the end of its November policy meeting this week, which could further fuel the ongoing rally.

Also, market analysts predict that Bitcoin could exceed $80,000 by the end of November, regardless of the election results.

Bitcoin Related Stocks With Upside

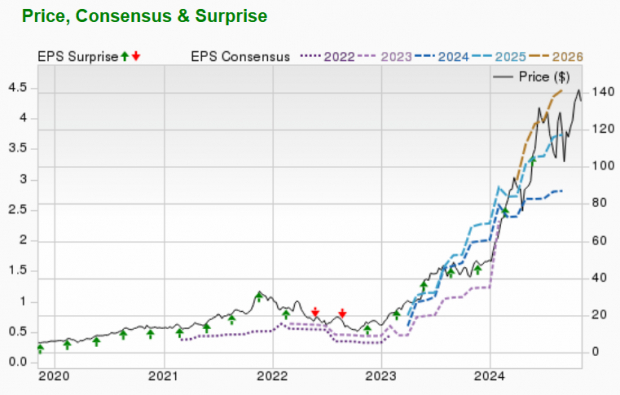

NVIDIA Corporation

NVIDIA Corporation is a major player in the semiconductor industry and has been one of the standout success stories of 2023. As a leading designer of graphic processing units (GPUs), the value of the NVDA stock tends to surge in a thriving crypto market. This is primarily due to the crucial role that GPUs play in data centers, artificial intelligence, and the mining or production of cryptocurrencies.

NVIDIA’s expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 60 days. Currently, NVIDIA has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

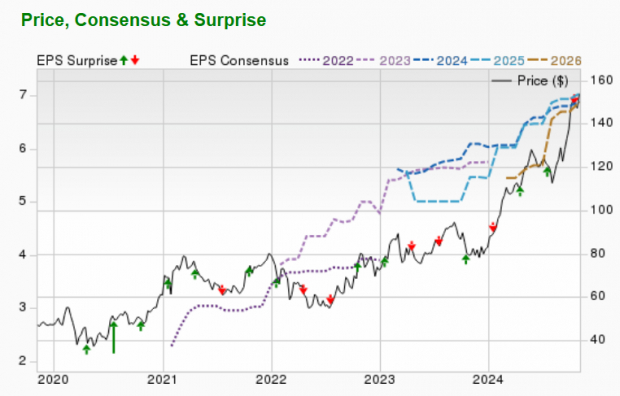

Interactive Brokers Group, Inc.

Interactive Brokers Group, Inc. is a global automated electronic broker. IBKR executes, processes and trades in cryptocurrencies. IBKR’s commodities futures trading desk also offers customers a chance to trade cryptocurrency futures. IBKR has a Zacks Rank #2.

Interactive Brokers Group has an expected earnings growth rate of 20% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% over the last 60 days. IBKR currently has a Zacks Rank #2.

Image Source: Zacks Investment Research

BlackRock

BlackRock is one of the world’s largest investment managers and is publicly owned. BLK was among the first companies from the traditional market to join the Bitcoin ETF race back in June 2023.

BlackRock’s expected earnings growth rate for the current year is 13.7%. The Zacks Consensus Estimate for current-year earnings has improved 3.6% over the past 60 days. BLK currently sports a Zacks Rank #1.

Image Source: Zacks Investment Research

Accenture plc

Accenture plc is a worldwide system integrator that offers consulting, technology and various other services. The company promotes Ethereum-based blockchain solutions to businesses, aiming to simplify payment processing.

Accenture’s expected earnings growth rate for the current year is 6.9%. The Zacks Consensus Estimate for current-year earnings has improved 1.5% over the last 60 days. ACN currently carries a Zacks Rank #2.

Image Source: Zacks Investment Research

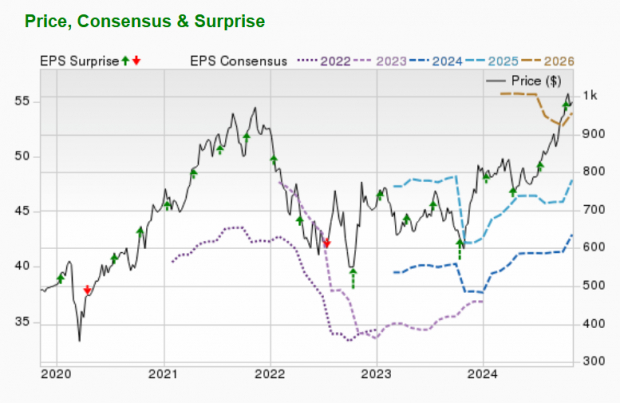

CME Group

CME Group Inc.’s options give the buyer of the call/put the right to buy/sell cryptocurrency futures contracts at a specific price at some future date. CME offers Bitcoin and ether options based on the exchange’s cash-settled standard and micro-Bitcoin and Ethereum futures contracts.

CME Group’s expected earnings growth rate for the current year is 9.5%. The Zacks Consensus Estimate for current-year earnings has improved 3.1% over the last 60 days. CME presently has a Zacks Rank #2.

Image Source: Zacks Investment Research

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

CME Group Inc. (CME) : Free Stock Analysis Report

Accenture PLC (ACN) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report