Tesla TSLA released its highly anticipated third-quarter 2024 results yesterday after the closing bell, delivering a mixed bag of surprises. While revenues fell short of expectations, the electric vehicle (EV) giant managed to pull off an earnings beat in the September quarter, breaking its streak of missing earnings estimates in the previous four quarters.

Tesla, Inc. Price, Consensus and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

This unexpected earnings win sent TSLA stock soaring roughly 12% in after-hours trading. The better-than-expected earnings performance came on the heels of Tesla’s much-hyped Robotaxi event, which failed to impress investors due to the lack of clear details on its ridesharing platform. As such, the stock has lost around 10% since the disappointing Robotaxi Day held on Oct. 10.

Now, if yesterday’s after-market gains hold, Tesla could achieve its highest close since the underwhelming Robotaxi event and break its five-day losing streak. While we wait for that, let’s dive into the key takeaways from the latest earnings report and CEO Elon Musk’s commentary to evaluate if Tesla stock is worth betting on now.

Tesla Q3 Report Snapshot

EPS & Revenues: Tesla reported earnings per share of 72 cents, which beat the Zacks Consensus Estimate of 58 cents and rose from the year-ago figure of 66 cents. Total revenues of $25.18 billion lagged the consensus mark of $25.57 billion but rose 7.2% year over year.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

Vehicle Deliveries: Tesla delivered 462,890 cars (439,975 Model 3/Y and 22,915 other models) worldwide in the third quarter. The deliveries rose on a year-over-year basis for the first time this year. Third-quarter deliveries also rose 4.3% sequentially.

Image Source: Tesla

Image Source: Tesla

Sales Break-Up: Total automotive revenues of $20 billion were up 2% year over year but missed our estimate of $22.2 billion. The reported figure also included $739 million from the sale of regulatory credits for EVs, which surged 33.3% year over year. Automotive sales, excluding revenues from leasing and regulatory credits, totaled $18.8 billion, up from $18.5 billion in the year-ago quarter.

Energy Generation and Storage revenues came in at $2.37 billion, higher than the year-ago quarter’s figure of $1.55 billion and topped our estimate of $2.16 billion. Energy storage deployments came in at 6.9 GWh, up from 4 GWh in the year-ago quarter. TSLA forecasts a sequential increase in deployments for the fourth quarter, aiming to finish the year with more than twice the number from last year. Services and Other revenues were $2.79 billion, which increased 29% year over year.

Margin Improvement: Automotive gross profit reached $4 billion, with a margin of 20.3%, up from 18.7% recorded in the year-ago quarter, exceeding the 18.3% forecast. This was largely driven by high regulatory credit revenue, as other automakers lag in emissions compliance. It was Tesla’s second-highest quarter of regulatory credit revenues. Gross margins from automotive sales (excluding leasing and regulatory credits) also rose 40 basis points to 18.6% due to lower vehicle costs, including raw materials, freight, duties and one-time charges.

The Energy Generation and Storage business (being the most lucrative unit of Tesla in terms of margins) achieved a record gross margin of 30.5% in the quarter under review. Gross margin from Services and Other unit was 8.8%, higher than 6% generated in the third quarter of 2023. Tesla’s total operating margin increased 323 basis points year over year to 10.8% in the quarter.

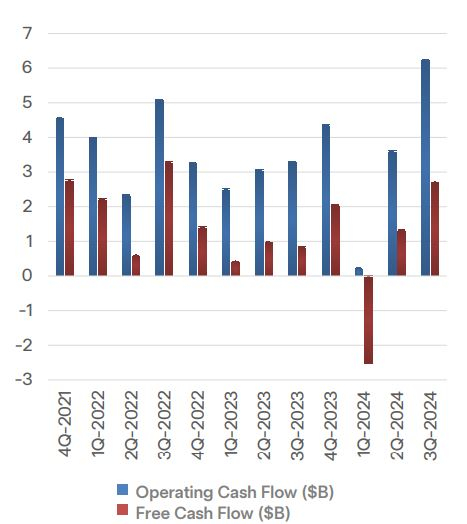

Balance Sheet & Cash Flow: Tesla exited third-quarter 2024 with $33.6 billion of cash/cash equivalents/investments of $33.6 billion, up $2.9 billion from the second-quarter level, thanks to the FCF boost. Long-term debt and finance leases, net of the current portion, totaled $5.4 billion.

Net cash provided by operating activities amounted to $6.25 billion in third-quarter 2024. Capital expenditure totaled $3.5 billion. Full-year capex is expected to exceed $11 billion. Free cash flow of $2.74 billion was up from $848 million and $1.34 billion generated in the corresponding year-ago quarter and the previous quarter, respectively.

Image Source: Tesla

TSLA Cybertruck, Delivery Expectations & Affordable Model

Musk notified that Cybertruck became the third best-selling EV in the United States in the September quarter, behind Model Y and Model 3. Moreover, the vehicle achieved positive gross margins for the first time, marking a significant milestone for Tesla’s product lineup expansion.

Despite uncertain macroeconomic conditions, the company expects to achieve slight growth in vehicle deliveries this year. Musk projects 20% to 30% vehicle sales growth in 2025.

Musk also confirmed plans to roll out a more affordable model by the first half of next year. The affordable EV market has been a key battleground. But Musk scrapped earlier plans for a $25,000 non-robotaxi regular car model. Now, the new goal of introducing lower-priced autonomous vehicles seems to be a priority.

Musk’s Big Promises in the AV Domain

Musk’s vision of full autonomy remains a core pillar of Tesla’s strategy, with the CEO stating that the majority of Tesla’s 7 million vehicles produced are “capable of autonomy.” He emphasized that the company is currently producing 35,000 autonomous-capable vehicles per week and promised ride-hailing robotaxis in Texas and California, and a few other states by next year, pending regulatory approval.

Tesla’s ride-hailing app is already being tested by employees in California. Musk also stated that there’s no need to wait for the release of the robotaxi or Cybercab to experience full autonomy and expects to achieve the same with its current vehicle lineup as early as next year.

Notably, the current Full Self-Driving (FSD) system is still classified as a Level 2 driver assist, requiring human supervision, but Musk has promised an “unsupervised” FSD system next year. Time will tell if he can deliver on his promise.

Meanwhile, Cybercab, a two-seat autonomous vehicle, is expected to hit volume production in 2026, with a starting price of $30,000. This ambitious project could revolutionize the ride-hailing industry if it succeeds. Musk said that the company targets to produce 2 million Cybercabs a year eventually.

TSLA Faces Intense Competition

On its latestearnings call Musk notified that the company had produced its 7 millionth vehicle on Oct. 22, a testament to its industry-leading production capabilities. But Tesla’s dominance is increasingly being challenged, especially in China, where local EV giants like BYD Co Ltd BYDDY, Geely, and newer players like Li Auto and Nio are rapidly expanding. In the United States, legacy automakers like Ford F and General Motors GM have ramped up their EV efforts, though they’ve scaled back some electrification commitments amid economic pressure. However, despite competition, Tesla remains one of the few consistently profitable EV makers with strong liquidity, giving it the financial muscle to execute on its ambitious roadmap.

Having said that, the company has been grappling with shrinking automotive margins over the past several quarters amid generous incentives and slower-than-expected demand. While margins showed improvement in the latest reported quarter, Musk has already cautioned that achieving similar margin levels will be challenging in the December quarter amid economic uncertainty.

Should Investors Buy TSLA Stock?

While Tesla faces significant competitive pressures and economic uncertainties, the company’s growth story remains strong. Its key strengths include profitable EV operations, high liquidity and thriving energy business. Musk’s bold promises—though sometimes delayed—continue to drive innovation, keeping Tesla at the forefront of the industry.

The ongoing testing of Tesla’s ride-hailing feature with employees demonstrates the company’s commitment to eventually launch the long-awaited Tesla Network. While Musk’s past autonomy predictions have not materialized, Tesla’s steady progress in this field keeps investors optimistic.

For long-term investors, Tesla’s cutting-edge technology, ability to innovate and expand production, and big bets on artificial intelligence and autonomous vehicle development make the stock worth buying.

TSLA has a Zacks Rank #2 (Buy) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report