Netflix (NASDAQ: NFLX) has outdone itself once more. The video-streaming behemoth has just unveiled robust Q3 earnings that catapulted its stock price by over 10% to record-breaking highs. As the company attracts more subscribers and diversifies its offerings with ventures into gaming, advertising, and live events, it continues to be in the pole position of the streaming war.

While earnings are indeed critical, investors are now fixated on more than the financial numbers as Netflix prepares for a momentous change in disclosure set for 2025, which could significantly reshape investor sentiment towards the stock.

Impressive Revenue Surge and Widening Margins

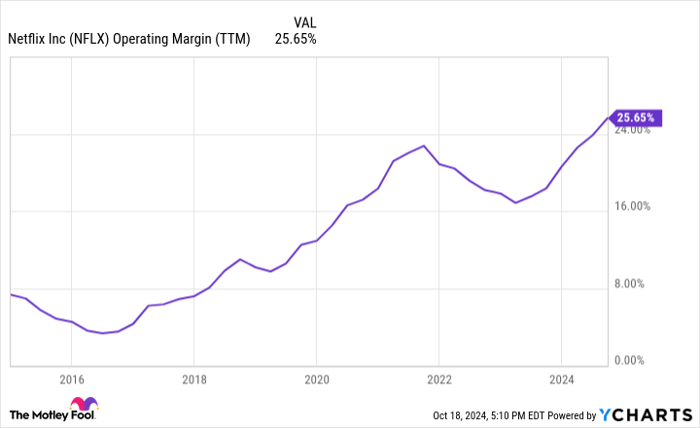

To kick-off, let’s dissect Netflix’s Q3 earnings. Revenue surged by 15% year-over-year to hit $9.8 billion in the quarter, with the operating margin expanding to 30%, notably up from 22.4% a year prior. This indicates that Netflix is boosting revenue without a proportionate rise in content expenditures. The period also saw a robust free cash flow exceeding $2 billion.

Additionally, other performance metrics painted a rosy picture. The company welcomed over 5 million new subscribers during the quarter, with subscriber numbers swelling in all regions except Latin America, which experienced minimal movement due to price adjustments. Notably, average revenue per subscriber in North America saw a 5% uptick, showcasing Netflix’s pricing power with its subscription service.

Embracing Watching Hours Over Subscriptions

The earth-shattering announcement from Netflix, one that may rattle some investors, is the decision to cease reporting its subscriber count. Commencing in 2025, the company has opted to withhold disclosing the number of subscribers globally and in different regions. This particular metric, closely monitored by Wall Street, has traditionally been a significant factor influencing stock market reactions post each earnings report.

Given the company’s maturation, management posits that revenue, operating margin, and time spent on the Netflix platform are now the pivotal key performance indicators (KPIs) to gauge its success. Rather than chasing subscriber growth, the business aims to channel its focus towards enhancing hours spent viewing its content.

While I personally value subscriber count disclosure and view the impending change critically, investors can still track the progress of revenue and operating margin on a quarterly basis.

NFLX Operating Margin (TTM) data by YCharts

The Future Trajectory of Netflix

Despite potential displeasure stemming from this announcement, it is by no means a catastrophe. Instead, Netflix investors should hone in on the strategies the company is adopting to bolster revenue over the next five to ten years. Luckily, it seems to have a few aces up its sleeve in this regard.

Firstly, Netflix is marching into the realm of advertising-supported subscriptions and ramping up its advertising revenue generation. The advertising earnings are on a doubling trajectory year-over-year, poised to inject significance into the revenue stream within the next couple of years as per the management’s projection.

Secondly, Netflix is delving into live events like boxing matches, National Football League games on Christmas Day, and offerings from World Wrestling Entertainment. Thirdly, the company is exploring opportunities in mobile games and other gaming formats to enhance user engagement across its platform.

The lure of diverse content offerings is anticipated to attract more subscribers and foster extended time spent on the platform, ultimately translating to increased revenue and profits for Netflix. This indicates that the company’s growth trajectory remains intact, even with the discontinuation of detailed subscriber figures each quarter.

Optimal Investment in Netflix

Prior to diving into Netflix stock, it’s imperative to take heed of the following:

The Motley Fool Stock Advisor analysts have pinpointed what they believe to be the 10 top stocks for investors to consider right now, and surprisingly, Netflix wasn’t among them. The identified stocks present the potential for substantial returns in the forthcoming years.

Think back to when Nvidia made this list on April 15, 2005, and if you had invested $1,000 at our recommendation, you’d have had $845,679!*

Stock Advisor offers investors a straightforward roadmap to success, offering guidance on portfolio building, regular updates from analysts, and two fresh stock picks monthly. The Stock Advisor service has multipled more than quadrupled the returns of the S&P 500 since 2002*.

*Stock Advisor returns as of October 21, 2024

Brett Schafer holds no position in any of the stocks mentioned. The Motley Fool has a stake in and endorses Netflix. The Motley Fool abides by a disclosure policy.