The Battle of Apple Stock: A Tale of Resistance and Potential

Apple Inc.AAPL shares have encountered a familiar adversary – resistance at a price level reminiscent of a past peak. The probability of Apple maintaining its stance at this level for an extended duration seems bleak. The prevailing sentiment among experts suggests that Apple is at a crossroads, with a looming possibility of either a breakout to ascend further or a reversal to descend.

This pivotal juncture has led our team of trading aficionados to designate Apple as our Stock of the Day.

Market dynamics are orchestrated by a delicate dance of supply, demand, and the capricious nature of human emotions. It is the intricate psychology of investors and traders that etches patterns on the canvas of price action.

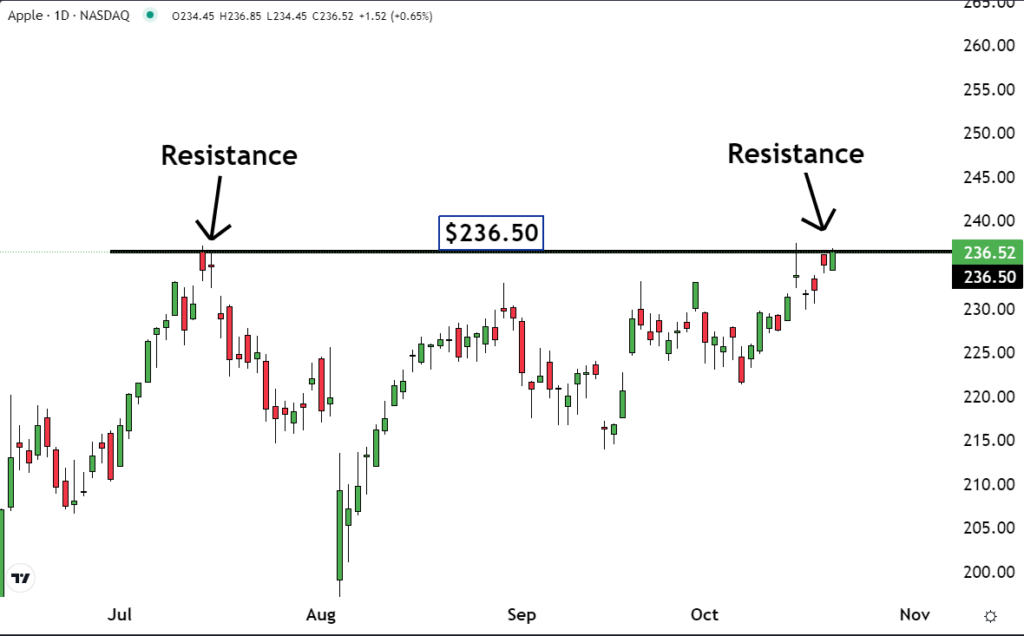

Consider this – when a stock surges to a level that had once played the role of a peak or resistance, there is a predisposition for history to repeat itself. Examination of Apple’s chart unveils a familiar narrative. The $236.50 threshold served as a barrier in July, and now, it stands as a formidable obstacle once more.

But make no mistake, this is no mere coincidence. The reemergence of resistance stems from traders and investors who previously entered the market during the formation of this peak in July. Subsequently, as the price trajectory dipped, doubts plagued many regarding the prudence of their investments.

Read Also: Goldman Sachs Predicts Bleak Long-Term S&P 500 Returns As Market Concentration Hits ‘Highest Level In 100 Years’

This harbinger of distress among buyers sowed the seeds of an impending exodus. Reluctant to incur losses, a cohort of investors resolved that if Apple’s shares reverberated to their acquisition price, they would tender their holdings, ensuring a breakeven scenario.

Consequently, as Apple retraced to the neighborhood of $236.50, a surge of sell orders inundated the market. This deluge of sell mandates instigated a resurgence of resistance at a familiar price point.

If Apple can vault over this barrier of resistance, it would signify the exit of the sellers who had fortressed the market with their orders. With their departure, prospective buyers would be compelled to negotiate increasingly higher prices to secure shares, catalyzing an upward trajectory for Apple.

Conversely, failure to breach this resistance portends a downturn for the stock. Triggered by apprehensions about offloading their positions, some investors might resort to undercutting each other. The fear of missing out on a trade compels sellers to adopt a preemptive stance, potentially fostering a snowball effect that propels prices downward.

When a stock arrives at a pivotal juncture, akin to Apple’s current saga, the odds of stagnancy are scarce. Instead, the narrative leans towards an imminent breakout into an ascension or a reversal into a downtrend.

Read Next:

• Tesla Q3 Earnings Preview: Analyst Says 1.8 Million Unit Estimate ‘Hittable’ For 2024, ‘2 Million+ Number The Focus For 2025’

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs