Legacy automaker Ford (F) has been unveiling a plethora of new patents, sparking curiosity among investors. Despite the speculative nature of patents, each filing hints at a potential breakthrough. Ford’s latest patent revolves around electric vehicles and their batteries, heralding a new era of innovation in sustainable transportation. This news buoyed Ford’s shares, propelling them nearly 2% higher during Wednesday’s trading session.

The most recent patent, filed back in November 2021 and published on October 15 under US 12115880 B2, addresses “battery electric vehicle monitoring systems and methods for track usage and off-roading.” This revelation has attracted significant attention within the automotive industry.

The utilization of electric vehicles for specialized activities like off-roading has posed challenges in the past, primarily due to inadequate charging infrastructure. However, with Ford’s groundbreaking patent, users will now have enhanced visibility into their battery usage during activities such as racetrack driving or off-road adventures, ensuring a seamless journey without the anxiety of running out of charge.

Exploring Performance at the Nurburgring

Furthermore, Ford’s conventional gas-powered vehicles have garnered attention with the unveiling of the Mustang GTD, a high-performance V8 vehicle boasting an impressive 815 horsepower. The latest teaser video showcased the vehicle’s capabilities, hinting at a racing car-like performance standard. Ford decided to put this powerhouse to the test at the legendary Nurburgring racetrack in Germany to ascertain its lap time. While the official results are pending, Ford’s pursuit of a sub-seven-minute lap time hints at a considerable achievement. The teaser release alludes to an impressive feat in the making, underscoring Ford’s confidence in its product.

Analyzing Ford’s Investment Appeal

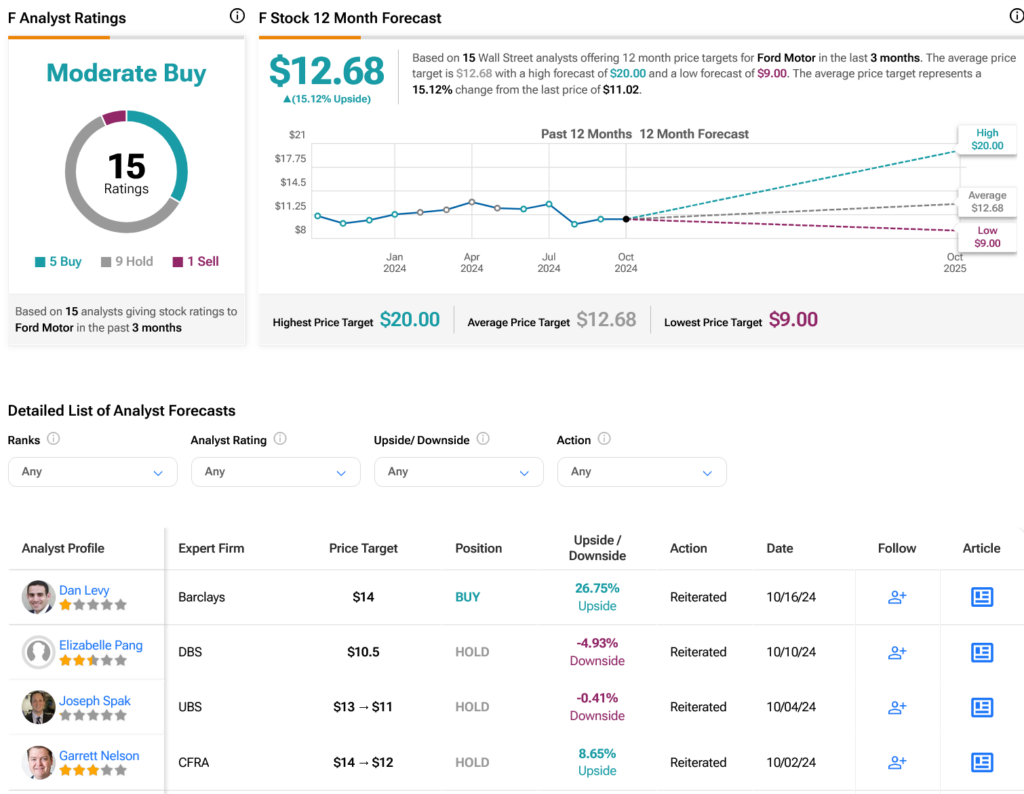

In the realm of Wall Street analysis, Ford’s stock carries a Moderate Buy consensus rating, with analysts providing five Buy ratings, nine Holds, and one Sell over the past three months. Despite a 1.65% decline in share price over the last year, the average price target of $12.68 per share suggests a potential upside of 15.12%. This forecast indicates a favorable outlook for Ford, showcasing its resilience and growth potential in the market.

Explore additional analyst insights regarding Ford stock here.