The anticipation for the Q3 earnings season looms large, with major banks set to reveal their results next Friday. However, stealing the thunder before them is consumer staple juggernaut, PepsiCo (PEP), scheduled to report on Tuesday, October 8th, before the opening bell.

Let’s delve deeper into the prospects of the consumer staples giant.

Performance Expectations for PepsiCo

In the year 2024, PEP shares have left much to be desired, eking out a mere 1.2% uptick and mostly moving laterally throughout the year. Notably, investors have been shying away from Consumer Staples stocks in 2024, favoring the riskier Technology sector.

Below is a visual representation of PEP shares’ performance so far this year compared to the Zacks Consumer Staples sector and the S&P 500.

Image Source: Zacks Investment Research

Analysts have tempered their earnings projections for the upcoming quarter in recent months. The Zacks Consensus EPS estimate sits at $2.30, down 2% since mid-July but signaling a 2.2% growth from the same period last year.

Image Source: Zacks Investment Research

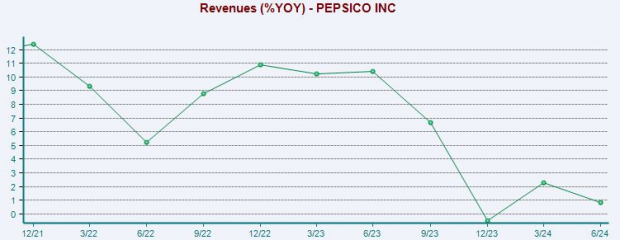

Revenue forecasts have mirrored this trend, with a modest 1% decrease in the expected $23.9 billion, though still reflecting a 1.9% year-over-year increase. Notably, PepsiCo’s revenue growth rate has witnessed a considerable slowdown in recent times.

It is crucial to understand that the chart below depicts the year-over-year percentage change, not the actual sales figures.

Image Source: Zacks Investment Research

PEP shares are not exorbitant from a historical perspective, with the current forward 12-month earnings multiple of 19.6X below the five-year median of 23.6X and far from the five-year high of 27.8X. This decreased multiple reflects the waning growth expectations highlighted earlier.

Is Investing in PepsiCo Recommended?

The prelude to PepsiCo’s imminent quarterly announcement paints a somewhat gloomy picture, as analysts have slightly revised their earnings and revenue forecasts downward. While PEP shares have not been the stars of 2024, a positive guidance could inject vitality into their performance.

This seems to be a ‘wait-and-see’ scenario, especially given the recent downward revisions. Yet, being a defensive stock, PEP shares are unlikely to witness a significant downward spiral if the results fall short of expectations.