Investors navigating the turbulent waters of the stock market are often drawn to the sirens’ call of analyst recommendations. These Wall Street maestros wield significant influence, yet the question remains: should their heralded predictions guide your investment journey?

Embark on a voyage with us as we delve into the symphonic tunes playing for CrowdStrike Holdings CRWD. Let us unravel the tapestry of brokerage recommendations and unveil the illuminated path for discerning investors.

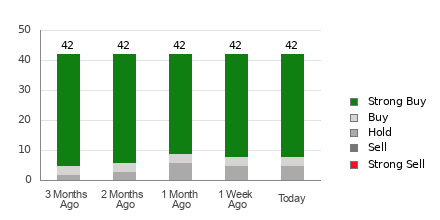

CrowdStrike currently dances to the melody of an average brokerage recommendation of 1.31, on a scale ranging from 1 to 5 (from Strong Buy to Strong Sell). Crafted from the harmonies of 42 brokerage firms, this ABR serenades an approximation between the realms of Strong Buy and Buy.

Among the 42 notes crafting this ABR symphony, 34 resound with the resolute timbre of Strong Buy, while three echo the sonorous call of Buy. Within this chorus, Strong Buy and Buy voices chime, comprising 81% and 7.1% of all recommendations, respectively.

Revealing Trends in Brokerage Recommendations for CRWD

While the ABR melody beckons towards investing in CrowdStrike, caution must be exercised in composing an investment opus solely based on this ballad. Numerous studies have sung the song of limited success in brokerage recommendations guiding investors towards stocks with the highest crescendo in price.

Ever pondered why? The entrenched interests of brokerage firms in stocks they cover often paint their recommendations with emphatic strokes. Our findings reveal that for every solitary “Strong Sell” note, brokerage firms harmonize with five resounding “Strong Buy” voices.

Thus, the melodies of these institutions do not always strike a chord with retail investors, offering but a faint echo of a stock’s future price minuet. It would be wise to employ this melody to harmonize with your own analysis or a tool that has demonstrated a penchant for presaging stock price movements.

Cue the Zacks Rank, our heralded stock rating instrument with a portfolio painted in the colors of a legacy inspected by external reviewers. Dividing stocks into five troupes, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this instrument heralds a prosperous expedition towards understanding a stock’s tempo in the near future. Using the ABR as a validator for the Zacks Rank could orchestrate a harmonious investment overture.

Resonance between ABR and Zacks Rank

While both ABR and Zacks Rank share a canvas from 1 to 5, their strokes paint vastly different portraits.

Broker recommendations alone fashion the ABR tapestry, often donning the guise of decimals (such as 1.28). In stark contrast, the Zacks Rank waltzes as a quantitative masterpiece, weaving the colors of earnings estimate revisions into a tableau. It emerges in whole numbers, from 1 to 5.

Brokerage analysts, enchanted by their employers’ vested interests, have long fostered a utopian landscape with their recommendations. These analysts, bedecked in garb more favorable than warranted, often lead investors astray rather than guiding them towards serenity.

In stark contrast, the Zacks Rank thrives on the crucible of earnings estimate revisions. Studies have evoked a strong concord between near-term stock whims and the cadence of earnings estimate revision trends.

The Zacks Rank grades cascade proportionately across all stocks embraced by brokerage analysts with current-year earnings predictions. In this overture, equilibrium is maintained amongst its five ranks.

A chasm yawns between ABR and Zacks Rank when considering their freshness. Admiring the ABR’s aging portrait, aware that it often languishes in stagnation, evokes a tenuous stance. Yet, the Zacks Rank, a nimble dancer, quicksteps to the rhythm of brokerage analysts’ revisions, adorning itself with timely feathers to predict the apogee of future stock prices.

Evaluating CRWD’s Investment Potential

An introspective gaze at CrowdStrike’s earnings estimate revisions reveals a chilling narrative. The Zacks Consensus Estimate for the ongoing year has plummeted by 34.2% in the moon’s cycle to $3.70.

An augury of analysts’ burgeoning pessimism towards the company’s financial aura is sketched by unanimous accord in downward EPS revisions. This maudlin tale has etched a Zacks Rank #4 (Sell) for CrowdStrike.

Hence, it might be prudent to regard the siren song of the Buy-equivalent ABR for CrowdStrike with tempered spirits.

© 2024 Benzinga.com. Benzinga coyly disclaims any dalliance in the realm of investment sagacity. All privileges reserved.