Spotting Undervalued Potential

Opportunities abound for those willing to delve into the world of consumer stocks showing signs of being oversold. These undervalued gems present chances for discerning investors to capitalize on potential rebounds.

Exploring Oversold Consumer Picks

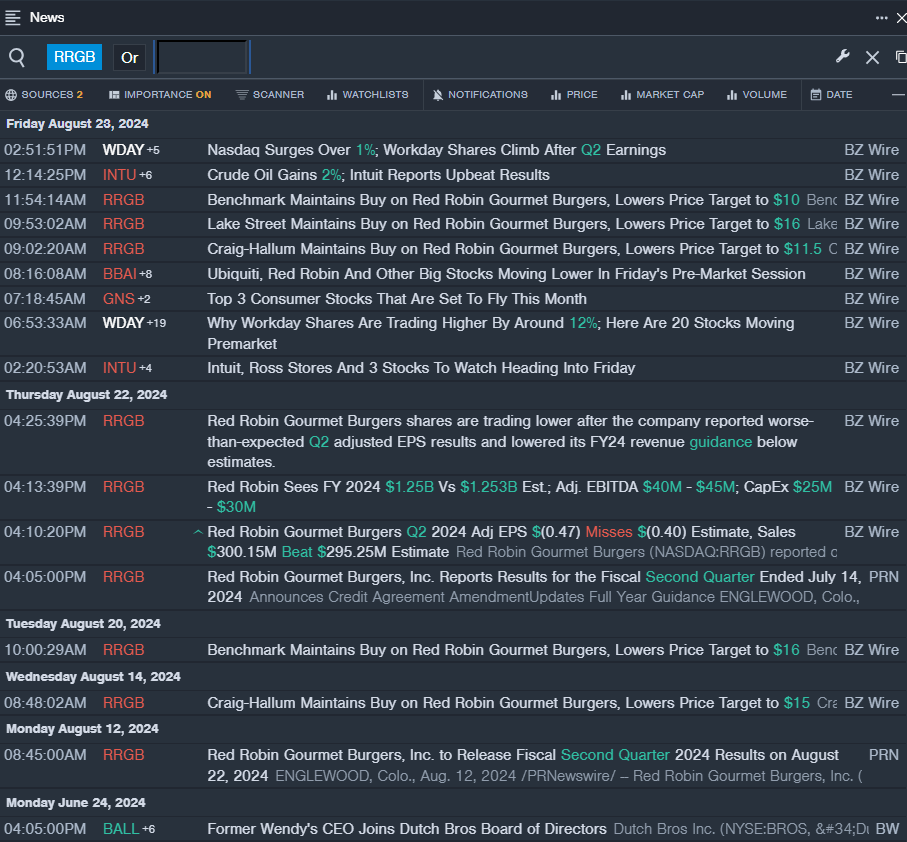

One such standout in the consumer discretionary sector is Red Robin Gourmet Burgers Inc., which has recently grappled with disappointing financial figures. The company’s stock plummeted approximately 38% in the past month, hitting a 52-week low of $3.28.

Red Robin Gourmet Burgers Inc

- On Aug. 22, Red Robin Gourmet Burgers reported underwhelming second-quarter adjusted EPS results and readjusted its FY24 revenue projection below market expectations, resulting in a substantial drop in its stock value. This company, identified by an RSI value of 28.02, witnessed its shares closing at $3.34 on Tuesday.

- Despite the recent setbacks, could this be the moment for Red Robin to reclaim its former glory?

Seeking Potential Turnarounds

Advance Auto Parts, Inc. also finds itself in the mix of oversold consumer stocks, having endured a challenging period highlighted by earnings below analyst expectations. The company’s stock plummeted around 26% in the past month, reaching a 52-week low of $43.70.

Advance Auto Parts, Inc.

- On Aug. 22, the company’s earnings per share fell short of estimates, triggering a revision in its FY24 outlook and causing a shift in market sentiment. With an RSI value of 21.42, Advance Auto Parts closed at $43.72 on Tuesday.

- Is there a silver lining on the horizon for this once high-flying stock?

Assessing Recovery Possibilities

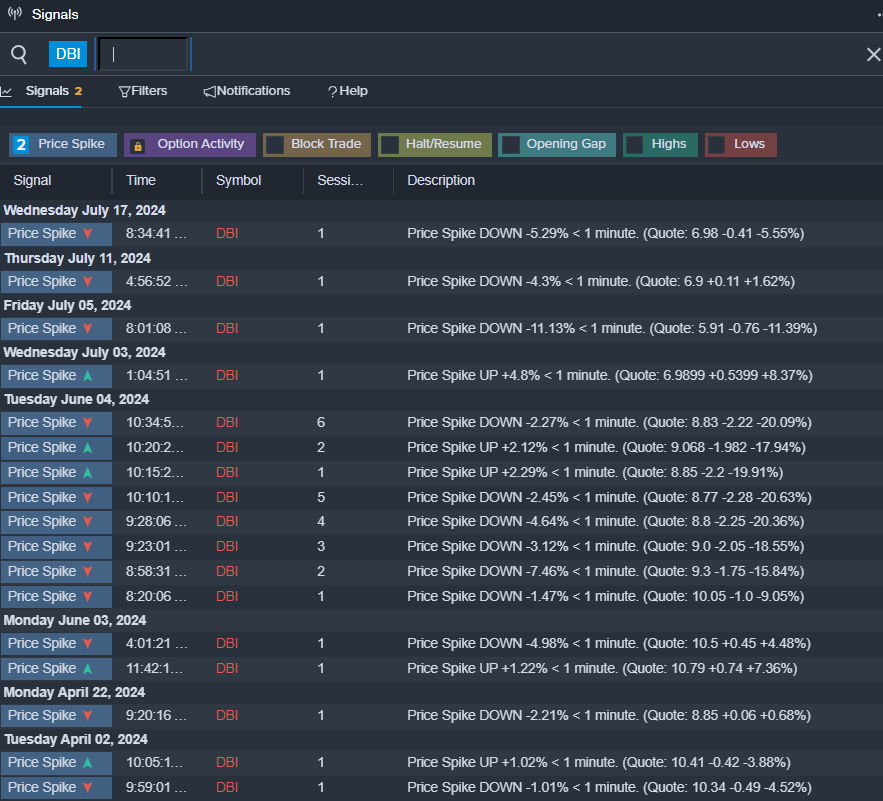

Designer Brands Inc. rounds out the trio of potentially resurgent consumer stocks, recently facing challenges in meeting market expectations. The company’s stock depreciated by approximately 22% in the past five days, touching a 52-week low of $5.99.

Designer Brands Inc.

- Designer Brands disappointed investors with lower-than-anticipated first-quarter earnings, impacting its market standing. With an RSI value of 29.52, Designer Brands closed at $6.13 on Tuesday, leaving room for speculation on its potential comeback.

- Will Designer Brands be able to design a new future despite recent setbacks?

Read Next: