The stock market’s upward trajectory since early 2023 remains resilient despite facing minor setbacks as we step into September. The recent correction, highlighted in the preceding month’s commentary, appears to have stabilized, with the S&P 500 showing a robust rebound.

The chart reflecting the S&P 500’s movements reveals a breakthrough above several resistance levels and crucial moving averages. This notable progress indicates the conclusion of the correction phase and hints at a favorable upward momentum, although the index now encounters a pivotal resistance point at its previous high.

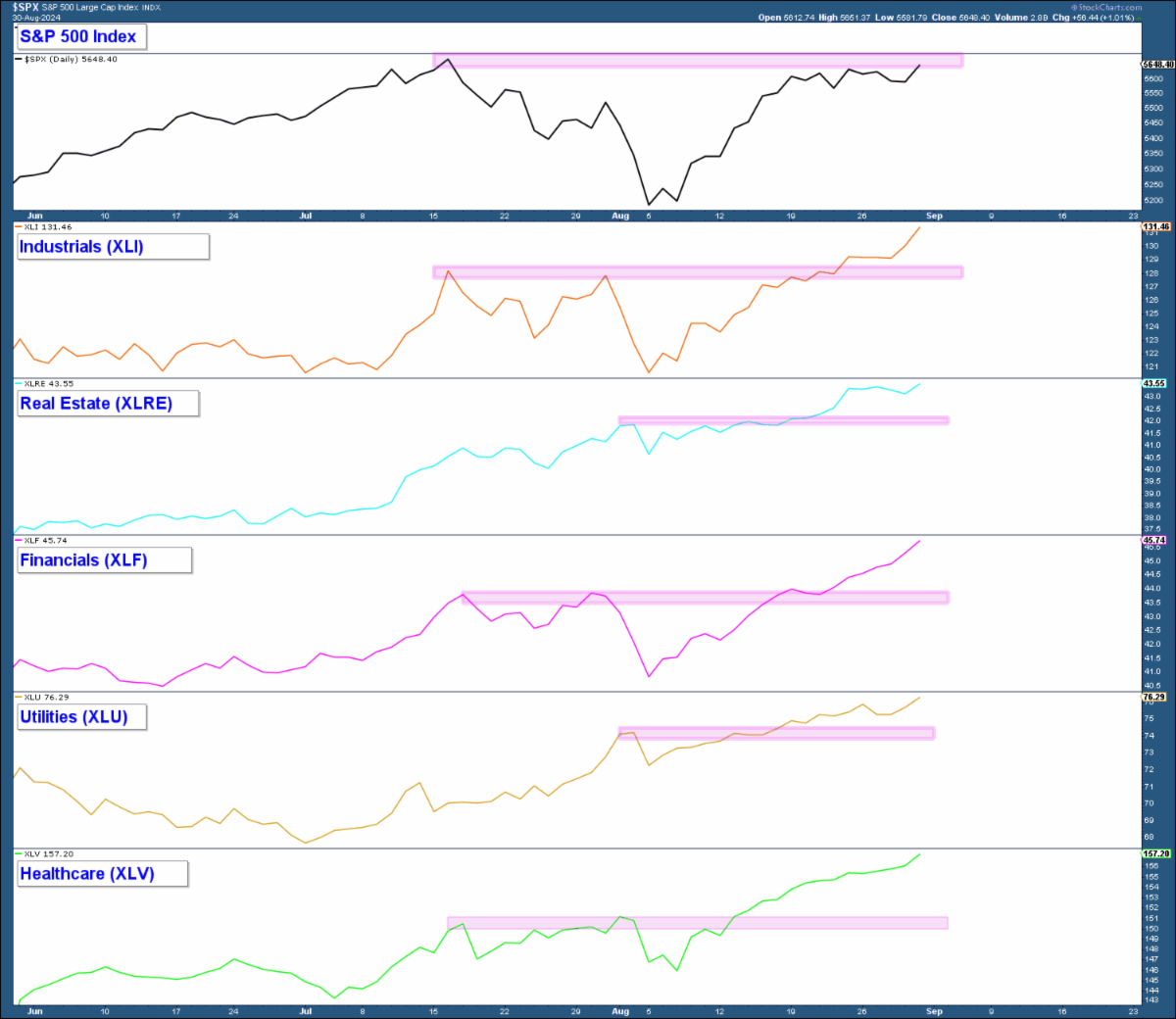

Apart from the S&P 500’s positive performance, other technical indicators point towards a bullish market. Further charts will elucidate these aspects. Notably, the Invesco S&P 500 Equal Weight ETF (NYSE:) has surpassed its pre-correction peak, indicating underlying market strength. Moreover, a healthy shift is observed from technology stocks towards sectors such as industrials, real estate, financials, utilities, and healthcare—a vital signal of a robust bull market.

However, a watchful eye is necessary on the , which exhibits lagging performance. Unlike the S&P 500, this sector remains below its previous high and is yet to breach the downtrend line from the correction period. The tech sector’s trajectory, given its pronounced influence on the S&P 500, demands close monitoring in the forthcoming weeks.

Broad Participation in S&P 500: Overcoming Hurdles

An essential development in the Equal Weighted S&P 500 chart showcases a significant breakthrough: the index has ascended past its pre-correction peak, marking a breakthrough in a critical resistance zone. This advancement underlines market resilience, signifying widespread participation in the rally beyond the cap-weighted giants in the S&P 500.

This breakout instills confidence in the bullish narrative, indicating that the market’s positive momentum is supported by a diverse range of stocks rather than being driven by a few dominant players. Such broad participation signifies a promising outlook for the ongoing upward trend.

Market Health: Sector Shifts Signaled

The upper panel depicting the S&P 500 emphasizes its proximity to a key resistance level. However, what truly stands out is the sectoral strength evident in the subsequent panels.

Industrials, real estate, financials, utilities, and healthcare have all exceeded their respective pre-correction peaks, affirming the bullish sectoral rotation mentioned earlier. This robust sectoral performance reinforces the optimistic market outlook, suggesting a widespread participation in the upward trend and signaling potential for continued growth.

Nasdaq 100: Trailing Momentum

The focus now shifts to the Nasdaq 100 ETF (QQQ), presenting a contrasting picture compared to the broader market and other sectors. Unlike the general market sentiment, Nasdaq 100 struggles to surpass its downtrend line and lags behind its pre-correction peak. Hovering at its 50-day moving average, this level holds critical importance.

The underperformance of this sector underscores a significant concern. While sector rotation and widespread gains bolster overall market strength, Nasdaq 100’s sluggish performance indicates a partial absence of the technology sector, a major contributor to the S&P 500. This discrepancy merits vigilant observation, as sustained weakness in this sector could impede overall market progress.

Final Notes

In conclusion, the upward trajectory of the stock market endures, with the S&P 500 depicting a strong recovery post-correction and approaching critical resistance levels. The breakout of the Equal Weighted S&P 500 above its pre-correction high and the shift towards value sectors through broad-based sector rotation reinforce positive market sentiments. Nonetheless, the underwhelming performance of the Nasdaq 100 underlines a need for cautious monitoring.

Optimal Portfolio Strategy

Previously maintaining a conservative stance in equity allocations amidst market volatility, recent indications of market strength prompted a significant change in strategy, with client accounts currently nearly fully invested. Aggressive equity additions during the market upturn capitalize on the renewed bullish momentum, reflecting confidence in the prevailing market conditions.