Netflix, the streaming giant, has astounded investors by skyrocketing 40.5% year to date, outpacing the broader Zacks Consumer Discretionary sector and industry peers. This dramatic surge arrives as concerns loom over decelerating user growth, a vital metric for shareholders in recent times.

In the third quarter of 2024, Netflix anticipates a decline in paid net additions compared to the previous year, mainly due to the initial full-quarter impact from paid sharing. The company’s resilience against these headwinds has sparked skepticism among market watchers regarding the sustainability of this remarkable rally.

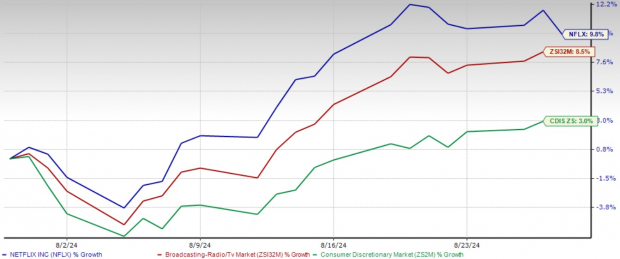

The Ascending Trajectory of 2024

Image Source: Zacks Investment Research

Netflix’s Strategy to Overcome Growth Challenges in the Streaming Space

Netflix has deployed a multi-faceted approach to uphold its market dominance despite concerns of a growth slowdown. By heavily investing in original content, the company has delivered hit shows and movies that resonate with audiences, setting it apart in a saturated market and justifying subscription fee hikes. This emphasis on quality programming has not only attracted viewer loyalty but also boosted subscriber numbers.

The introduction of advertising-supported tiers has created fresh revenue streams, enticing cost-conscious consumers. This initiative has not only expanded the subscriber base but also diversified revenue sources, potentially ensuring stable earnings in the future.

Furthermore, Netflix’s aggressive expansion into international markets, particularly in countries like India, South Korea, and across Europe, where substantial growth opportunities exist, has paid off handsomely. International subscribers now comprise the majority of Netflix’s user base and are driving much of its recent growth.

Financing a plethora of captivating new content offerings, Netflix is set to present Danish series, movies like Mango, and various other international productions, expanding its global footprint. With the entertainment landscape evolving rapidly, the streaming service giant continues to push boundaries and experiment with new formats.

The Zacks Consensus Estimate projects a robust 29.8 million paid total streaming net membership additions in 2024 and foresees reaching 290.4 million total paid subscribers by the year-end, reflecting an impressive 11.6% year-over-year growth.

Image Source: Zacks Investment Research

Netflix has also been exploring non-subscription revenue streams such as mobile gaming, merchandise licensing, and limited theatrical releases for select films, presenting potential avenues for future growth and revenue diversification. The company’s 2024 revenue outlook remains robust, with healthy growth projections of 14-15%, underpinned by strong membership trends and business momentum.

Uncertainties and Challenges Ahead for Netflix

However, Netflix faces stiff competition from industry heavyweights like Disney’s Disney+, Warner Bros. Discovery-owned HBO Max, along with platforms like Peacock, Paramount+, Apple TV+, and Amazon, intensifying pressure on the streaming giant’s growth and profitability. Moreover, contending for consumer attention against traditional TV, YouTube, TikTok, and the booming gaming sector adds to Netflix’s challenges in a fiercely competitive market.

The recent surge in Netflix’s stock price has resulted in expanded valuation multiples, potentially capping future upside for investors. Netflix’s forward 12-month sales multiple exceeds historical levels, hinting at a premium valuation compared to its five-year median and even its industry peers within the Broadcast Radio and Television sector.

Evaluating Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

In Conclusion

Despite Netflix’s impressive stock surge, the company’s ability to sustain this momentum will heavily rely on effectively maneuvering through the hurdles of slowing user growth by innovating content, expanding globally, and diversifying revenue streams. With a resilient position in the streaming realm, it might be premature for investors to abandon ship just yet. Those eyeing entry into the Netflix investment landscape should proceed prudently, keeping a close watch on the company’s evolving strategies and industry dynamics.

Insightful Analysis on Netflix’s Performance and Future Prospects

The Streaming Giant’s Flight Amidst the Flock

Netflix, Inc. (NFLX) has shown remarkable tenacity in the market, soaring by a staggering 40.5% year-to-date. Yet, as seasoned investors know, even the mightiest wings can be clipped.

Swimming Against the Current

Despite its stellar rise, concerns loom on the horizon. The specter of slowing user growth threatens to anchor the stock, pulling it away from its lofty heights. In an ever-evolving landscape, can Netflix continue to defy gravity?

A Silver Lining Among the Clouds

While some analysts sound the alarm, investors scour for a silver lining. With a Zacks Rank #3 (Hold), Netflix presents itself as a tantalizing opportunity for those seeking a strategic entry point.