The Rise of Sofi Technologies

Within the dynamic arena of business services, a glaring phenomenon is emerging as the Zacks Rank #1 list illuminates 19 stocks in this sector with robust buy ratings. Noteworthy among these is the Zacks Technology Services Industry, confidently perched in the top 30% of Zacks industries with two significant players paving their way into the limelight post recent IPOs.

One such luminary is Sofi Technologies (SOFI). Nestling under the $10 umbrella, Sofi Technologies beckons investors with its metamorphosis into a consumer-centric financial hub. Having unfurled its IPO banner in 2021, Sofi stands tall as one of the U.S.’s most varied fintech champions, offering a buffet of services spanning loans, credit cards, investments, insurance, and banking.

An inviting prospect indeed, with its trajectory firmly pointed towards profitability. Projections for fiscal 2024 unveil earnings at $0.09 per share – a significant leap from the disheartening loss of -$0.36 per share from the previous year. Looking further ahead, FY25 EPS is anticipated to skyrocket by a staggering 182% to $0.26.

Qifu Technology Making Waves in China

Enter the IPO debutant, Qifu Technology (QFIN) – a dominant force in China’s fintech ecosystem. Standing tall as a credit tech virtuoso, Qifu extends a comprehensive bouquet of tech services, acting as a guiding light for financial institutions, consumers, and enterprises navigating the intricate loan lifecycle.

Demonstrating sheer gallantry, Qifu’s stock has surged nearly +60% since the year’s inception, overshadowing industry magnates Alibaba and Baidu, whose stocks are languishing at -8% and -35%, respectively.

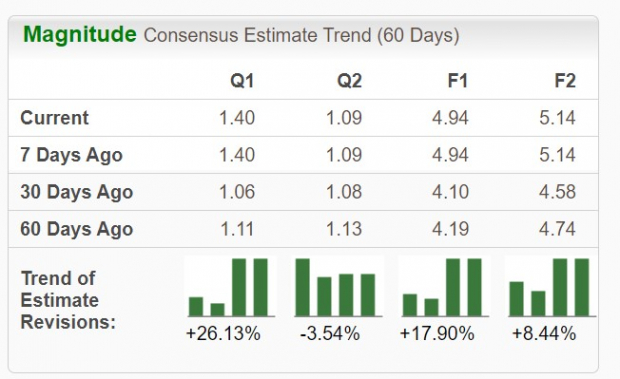

Investor allure towards Qifu is palpable, underpinned by its profitability status with annual earnings expected to vault by 34% in FY24 to a remarkable $4.94 per share, as against $3.68 in 2023. Furthermore, FY25 EPS eyes a 4% increment – a tangible testament to the growth trajectory.

Timing the Market

As the dust settles, the era of Sofi and Qifu shines brightly. With earnings estimates soaring for both entities, the currency of peak investment time whispers in the wind. The chimes of opportunity ring loud and clear for astute investors looking to hitch a ride on the promising trajectories poised for not just 2024 but the years beyond.

Image Source: Zacks Investment Research