Amidst the tumult of the information technology sector, there glimmers a silver lining: the chance to sow seeds in undervalued enterprises.

One key metric, the Relative Strength Index (RSI), acts as a lodestar for traders navigating the murky waters of market dynamics. A stock’s strength on bullish days versus bearish ones can offer prescient hints about its near-future trajectory. An RSI below 30 traditionally marks the territory of oversold assets, as per industry stalwart Benzinga Pro.

Herein beholds a trio of tech entities, presently teetering at or below the critical RSI threshold:

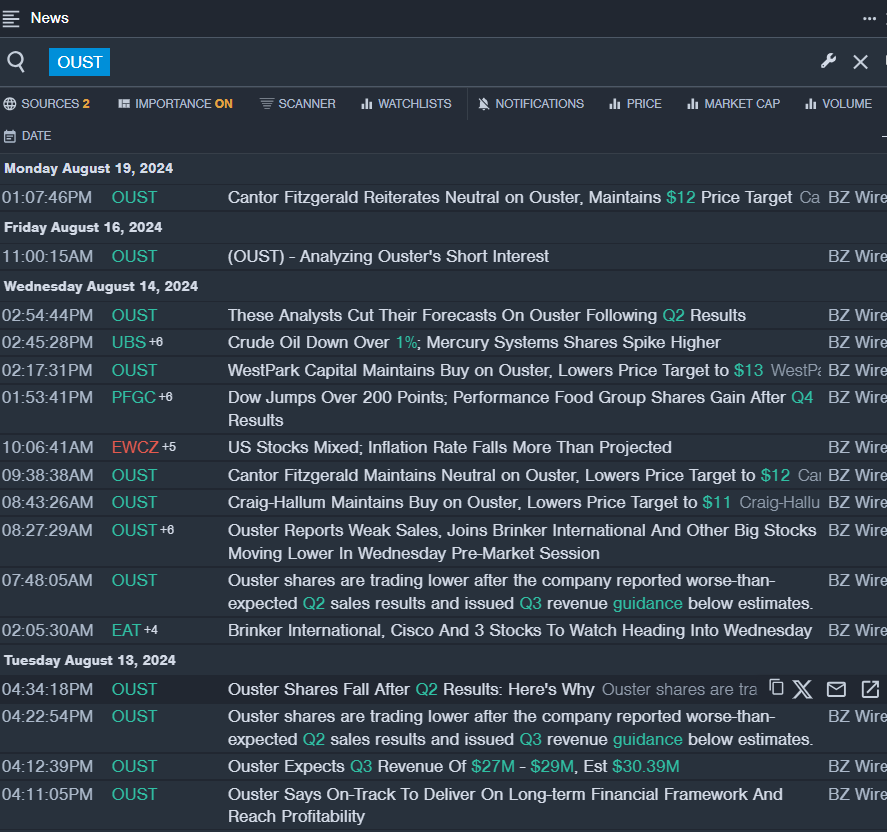

The Tale of Ouster Inc (OUST)

- Recently, Ouster disclosed subpar second-quarter revenue figures alongside a tepid third-quarter forecast, inciting a stock nosedive. Angus Pacala, CEO of Ouster, extolled the company’s software expansion endeavors. Despite the market turbulence, Ouster’s innate robustness shines through, as echoed by a 45% dip over the past month and a 52-week low of $3.67.

- RSI Value: 28.96

- OUST Price Action: The day concluded with Ouster’s shares falling by 2%, resting at $7.85.

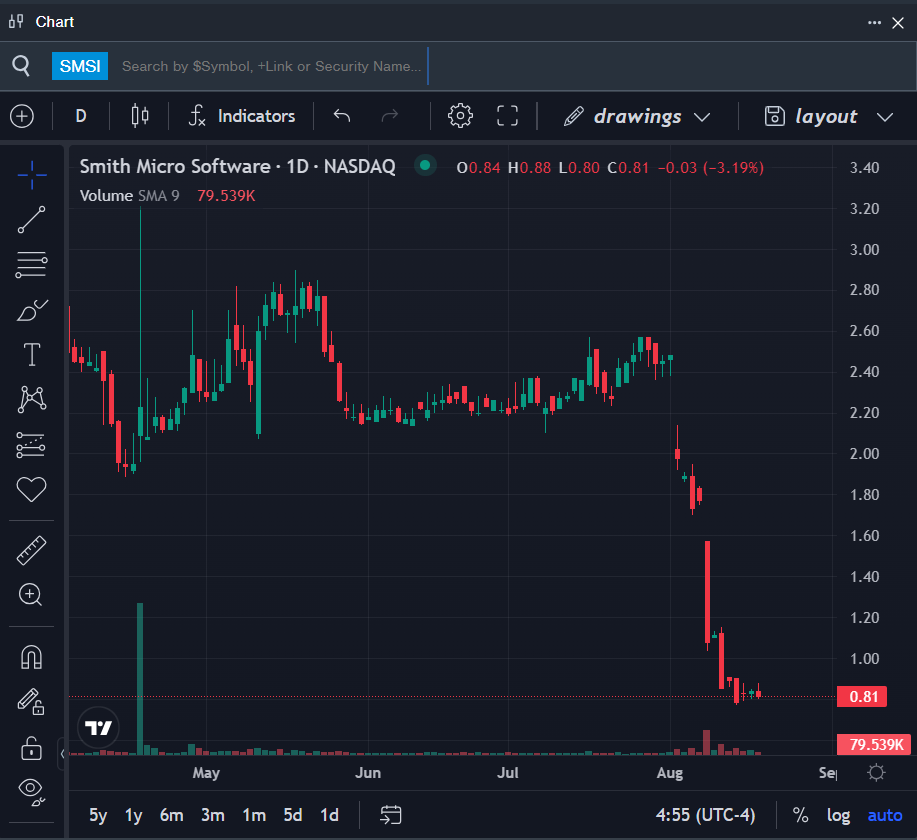

A Fable of Smith Micro Software Inc (SMSI)

- In a parallel saga, Smith Micro Software lamented underwhelming second-quarter financial statistics. William W. Smith Jr., the captain at the helm, painted a hopeful picture, betting on forthcoming growth, profitability, and free cash flow. A grim 64% descent in the last month and a 52-week low of $0.77 signal a period of trial for the company.

- RSI Value: 19.79

- SMSI Price Action: The closing bell tolled with Smith Micro Software’s shares dipping by 3.2%, landing at $0.81.

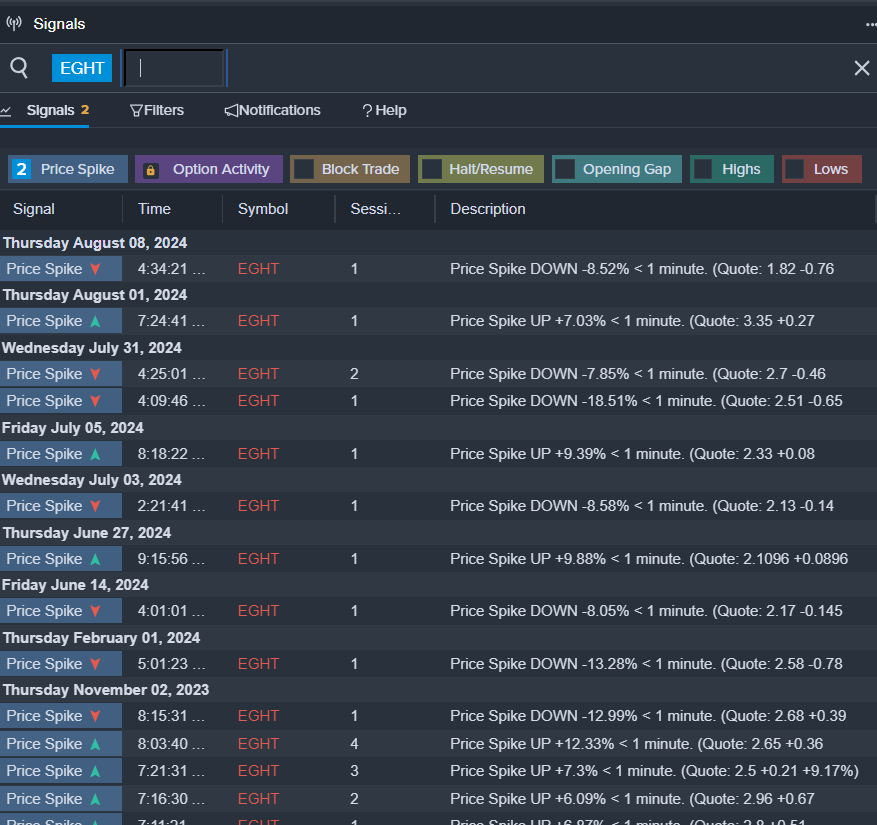

The Chronicle of 8×8 Inc (EGHT)

- Adding to the epic, 8×8 bemoaned lackluster first-quarter financial results and dampened its FY25 revenue outlook. The market punished the company with a 44% plunge over the last lunar cycle, mirroring a 52-week low of $1.52.

- RSI Value: 29.48

- EGHT Price Action: In a glimmer of hope, 8×8’s shares surged by 2.4% at the day’s curtain call, settling at $1.73.

Read More: