Beta, a barometer of a stock’s volatility in relation to the broad market, such as the S&P 500 Index, stands at 1.0 for the market by default.

Stocks with a beta exceeding 1.0 indicate higher volatility than the market at large, while those below 1.0 signal the opposite. Embracing low-beta stocks can furnish portfolios with several benefits, including defensive attributes.

When blended with high-beta stocks, low-beta options offer stability, contributing to a well-rounded risk profile.

Three low-beta contenders – Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED – present viable choices for investors seeking a more cautious approach.

All three not only offer reduced volatility but also boast appealing Zacks Ranks, embodying optimism among industry analysts.

Let’s delve deeper into each of these opportunities.

Exceeding Expectations: The Journey of Elevance Health

Elevance Health functions as a provider of health benefits, promoting healthier lives for consumers, families, and communities through the care continuum. The company holds a favorable Zacks Rank #2 (Buy), with earnings outlooks progressively climbing.

Investors found satisfaction in ELV’s most recent quarterly results, propelling the stock upwards post-earnings. Elevance outperformed the Zacks Consensus EPS estimate by 1% and reported sales slightly below projections.

Earnings surged by 12.5% year over year, while sales saw a 1% uptick. The chart below demonstrates the company’s quarterly revenue.

Image Source: Zacks Investment Research

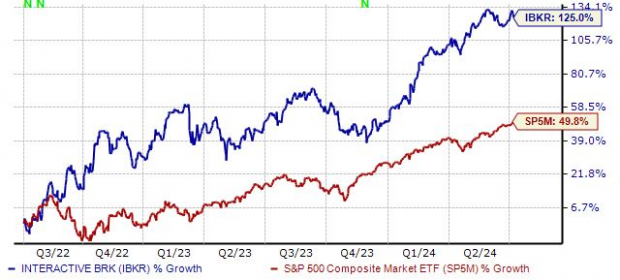

Interactive Brokers: Outshining the S&P 500

Interactive Brokers Group operates as a global automated market maker and broker. Analysts have given positive makeovers to their expectations, positioning the stock in the favorable Zacks Rank #2 (Buy).

Showcasing significant outperformance over the last two years, the stock surged a remarkable 125%, eclipsing the 50% gain in the S&P 500. Amplified trading activity has boded well for the company in recent times.

Image Source: Zacks Investment Research

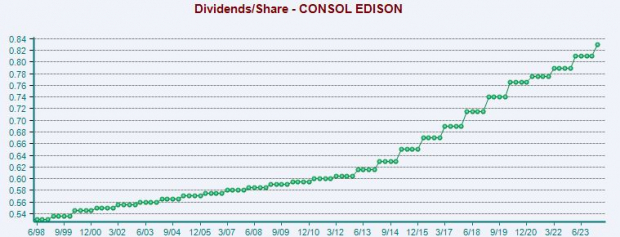

Consolidated Edison: A Beacon for Shareholder Rewards

Consolidated Edison, currently holding a Zacks Rank #2 (Buy), is a diversified utility holding entity with subsidiaries involved in regulated and unregulated ventures. The company has shown stellar earnings performance, consistently surpassing the Zacks Consensus EPS estimate by an average of 6% over its last four releases.

Investors seeking income may find ED shares enticing, offering a sturdy 3.8% annual yield. Notably, the company demonstrates modest 2% annualized dividend growth over the past five years.

The company’s commitment to rewarding shareholders is evident, as displayed below.

Image Source: Zacks Investment Research

In Summary

Low-beta stocks can serve as valuable assets in portfolios, offering defensive attributes and stability.

When juxtaposed with high-beta stocks, they aid in creating a balanced risk spectrum.

For the risk-averse investor, considering the trio of low-beta picks highlighted above – Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED – might prove prudent.

In addition to curbing volatility, all three tout favorable Zacks Ranks, embodying bright prospects as perceived by industry analysts.