As the AI revolution continues to gain momentum, several software companies are uniquely positioned to benefit from the surge in enterprise spending on AI infrastructure. Among these companies, Palantir, Palo Alto Networks, and CrowdStrike stand out due to their innovative advancements in AI and sound financial health. Let’s dive deeper into why these three companies are set to capitalize the most on the AI craze.

The Quest for the Next AI Stock Gem

Amidst a bustling market, ProPicks emerges as a valuable tool to uncover hidden gems before they skyrocket. Using advanced AI algorithms, ProPicks identifies over 90 high-potential stocks monthly, offering a strategy that outshines the S&P 500’s performance this year. Ready to witness your portfolio flourish? Subscribe now and seize the opportunity as part of the summer sale!

Palantir: Pioneering AI Innovations

- 2024 Year-To-Date: +50.5%

- Market Cap: $57.5 Billion

Palantir’s stock, currently trading at $25.85, has surged by 50.5% this year, drawing attention for its leading role in artificial intelligence. The Colorado-based firm excels in AI innovation, with Palantir Foundry and Palantir Gotham leading the charge in advanced data analytics. Through these platforms, Palantir caters to industries like defense, healthcare, and finance, empowering organizations to make informed decisions based on extensive data analysis.

With a Financial Health Score of 4.0, Palantir signifies strong growth potential, profitable trends, and effective cash flow management. Its dedication to AI research and development, alongside strategic partnerships, further cements its stability and growth.

Palo Alto Networks: Safeguarding with AI

- 2024 Year-To-Date: +15.7%

- Market Cap: $110.5 Billion

Palo Alto Networks, trading at $341.20, boasts a 15.7% year-to-date increase as businesses prioritize cybersecurity. Integrating AI into its offerings, the California-based company utilizes Cortex XDR to fortify digital defenses against evolving threats. The AI-centric strategy equips organizations to proactively combat sophisticated cyber-attacks, positioning Palo Alto Networks as a key player in the cybersecurity realm.

Scoring 4.0 for Financial Health, Palo Alto Networks reflects robust profitability and a promising growth trajectory, fueled by consistent innovation and a growing customer base.

CrowdStrike: AI-Powered Cybersecurity Titan

- 2024 Year-To-Date: +51.6%

- Market Cap: $94.2 Billion

With a stock surge of 52% this year, CrowdStrike stands out as a leader in cloud-based cybersecurity, leveraging AI in its Falcon platform. Through continuous AI and machine learning analysis, CrowdStrike offers real-time threat detection, essential in the current climate of rising cyber threats. The company’s AI-driven cybersecurity approach appeals to businesses seeking proactive protection against a dynamic threat landscape.

CrowdStrike’s resilience and growth trajectory, backed by AI innovation, make it a compelling choice in the cybersecurity sector.

The Rise of Software Stocks in AI: Unleashing Profitability Potential

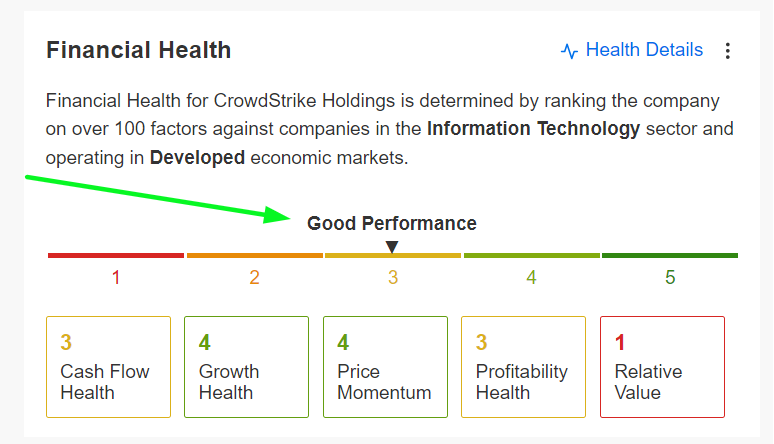

An above-average Financial Health Score, gauged by InvestingPro’s AI-based models, signifies a prosperous future for the software giant. This score reflects its promising profitability outlook, strong sales potential, robust cash flow growth, and expanding market reach.

Source: InvestingPro

The endpoint security leader’s solid fundamentals and long-term growth forecasts highlight its adeptness in seizing the escalating demand for advanced cybersecurity solutions.

Innovative Software Leaders in the AI Realm

Palantir, Palo Alto Networks, and CrowdStrike stand out as three software stocks uniquely positioned to capitalize on the AI frenzy. Their strides in AI technology and unwavering focus on innovation catapult them as pioneers in their respective domains.

Furthermore, each enterprise boasts a commendable Financial Health Score, emphasizing their robust growth trajectory and profitability patterns.

For investors eyeing a slice of the AI-propelled expansion, these three stocks present alluring prospects. Employing tools such as InvestingPro’s AI-driven models can aid in detecting such high-potential investments, enabling well-informed decisions amidst the swiftly evolving tech sphere.

Navigating Investment Terrain with a Sharp Eye for Opportunity

Whether you’re an amateur investor or a seasoned trader, engaging with InvestingPro could unlock a realm of investment possibilities while mitigating risks amid the backdrop of soaring inflation, elevated interest rates, and escalating geopolitical tensions.

- ProPicks: Curated stock winners selected by AI with a proven track record.

- Fair Value: Instantly determine if a stock is undervalued or overvalued.

- Stock Screener: Explore top stock picks based on a myriad of filters and criteria.

- Top Ideas: Peek into stock selections of investing tycoons like Warren Buffett, Michael Burry, George Soros, and Ray Dalio.

Disclosure:

At the time of writing, long on the S&P 500 via the SPDR S&P 500 ETF (SPY) and the Invesco QQQ Trust ETF (QQQ).

Also holding a position in the Technology Select Sector SPDR ETF (NYSE:).

Regular portfolio rebalancing of individual stocks and ETFs is based on continuous risk evaluation of both the macroeconomic landscape and companies’ financial standings.

The opinions presented in this piece solely reflect the author’s viewpoint and should not be construed as investment counsel.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for further stock market insights and analysis.