Even the second round of “meme stock mania” in GameStop (GME), which took Wall Street by storm last week, can’t hold a candle to the continuous hype train that is semiconductor and market leader Nvidia. Best known for its high-performance semiconductors, Nvidia has been a Wall Street force since going public in January 1999. Founded in 1993 by CEO Jensen Huang, Nvidia personifies one of history’s most unlikely Wall Street stories.

Though the semiconductor industry is one of the most cutthroat industries on Wall Street, Zacks Rank #1 (Strong Buy) stock Nvidia (NVDA) found its niche in the space and has dramatically outperformed well-known competitors such as Advanced Micro Devices (AMD) and Intel (INTC).

Nvidia has recaptured investors’ attention more recently as it benefits from the robust growth of the artificial intelligence (AI) market. Driven by unquenchable growth from mega-cap tech companies like Microsoft (MSFT) and Tesla (TSLA), Nvidia has grown into one of the largest companies in the world by market cap and has seen its stock soar more than 3,000% over the past five years. NVDA is garnering the Street’s attention his week for its 10-for-1 stock split.

Deciphering the Mechanics of a Stock Split

A stock split is a corporate action in which a company increases the number of shares for existing shareholders while decreasing the value of shares.

Understanding the Logistics Behind a Stock Split

To simplify the concept, investors can think of a stock split as swapping two nickels for a dime (representing a 2-for-1 split). In other words, if you have one share of a $100 stock pre-split, post-split you would hold two shares at a $50 value. Investors must understand that the market cap or value of the stock does not change. In Nvidia’s case, shareholders received ten shares for every share they held before the split date – a 10-for-1 split.

Conversely, a reverse split represents the opposite – the share price increases while the number of shares held by the investor decreases. Again, there is no immediate change in the stock’s value due to a stock split.

Unraveling the Rationale Behind Companies Opting for a Stock Split

Companies typically split their stocks to make shares more attractive to investors. For example, retail investors may prefer a lower-priced stock. Conversely, institutional investors may perceive penny stocks as low quality or be mandated not to invest in them.

Evaluating the Implications of Stock Splits

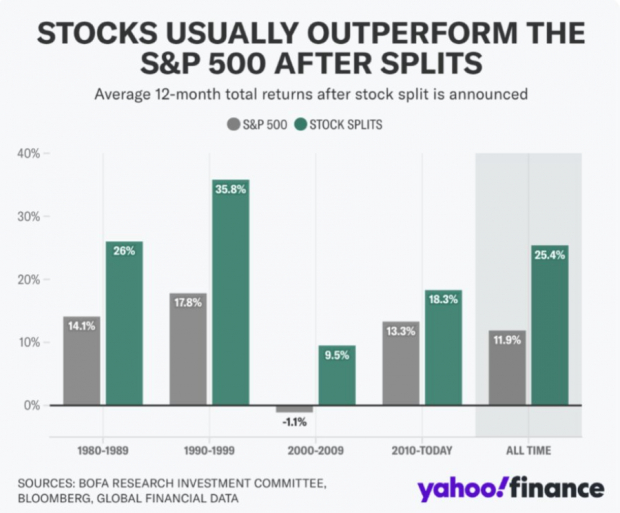

Like many things on Wall Street, stock splits should be weighed on a case-by-case basis by investors. Overall, historical stats indicate that stocks that split tend to outperform the S&P 500 Index over the next 12 months.

Image Source: BofA Research, Bloomberg

The Risk of Overzealous Stock Splits: A Cautionary Tale

Excessive stock splits, or two or more stock splits in a year, may be a red flag for investors. A company that splits its stock too many times may be trying to compensate for deteriorating fundamentals or may simply be getting too greedy. Qualcomm (QCOM), one of the best-performing stocks of the late 1990s, split twice in 1999, with the last split occurring in December. The next month, QCOM stock value topped out, and it would not make fresh highs again for two decades.

Image Source: Zacks Investment Research

Unpacking Stock Split Considerations for Investors

A stock split is just one factor investors need to consider. Investors should consider how far a stock has run pre-split and, as always, avoid chasing the stock if not already long. Fundamentals and future EPS expectations play a crucial role in determining the stock’s outlook. Finally, a stock split can add needed liquidity to an options market if the options became too expensive prior to the split.

Conclusion: Navigating the Aftermath of Stock Splits

Stock splits are making headlines again after Nvidia split its stock on Monday. Investors should consider several factors when weighing the prospects of a recently split stock.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential

Surfing the Financial Wave During Election Year

Stocks Weathering the Political Storm

With voters energized and engaged, the market has been unfailingly bullish regardless of the election results.

Promising Investment Opportunities

Now is the time to explore investment opportunities that span the political spectrum.

Notable Stock Performances

Over the past 15 years, a medical manufacturer has seen an incredible surge of +11,000%, showcasing its resilience in the ever-changing market.

Similarly, a rental company has emerged as a dominant force in its sector, setting a high bar for competitors.

An energy powerhouse is gearing up to boost its substantial dividend by a remarkable 25%, signaling a strong future outlook.

In the aerospace and defense arena, a standout player recently secured a lucrative $80 billion contract, solidifying its position in the industry.

Additionally, a giant chipmaker is making significant investments by establishing vast manufacturing facilities in the U.S., bolstering its presence in the market.