Two consumer discretionary stocks that have recently secured a spot on the Zacks Rank #1 (Strong Buy) list are none other than the esteemed cruise line operators Norwegian Cruise Line NCLH and Royal Caribbean Cruises RCL.

As we enter the peak travel season for leisure and recreation, both Norwegian and Royal Caribbean are emerging as undervalued gems in the stock market.

The Path to Recovery & Impending Growth

With over three years elapsed since the onset of the COVID-19 pandemic, the resurgence of the broader cruise industry is palpable.

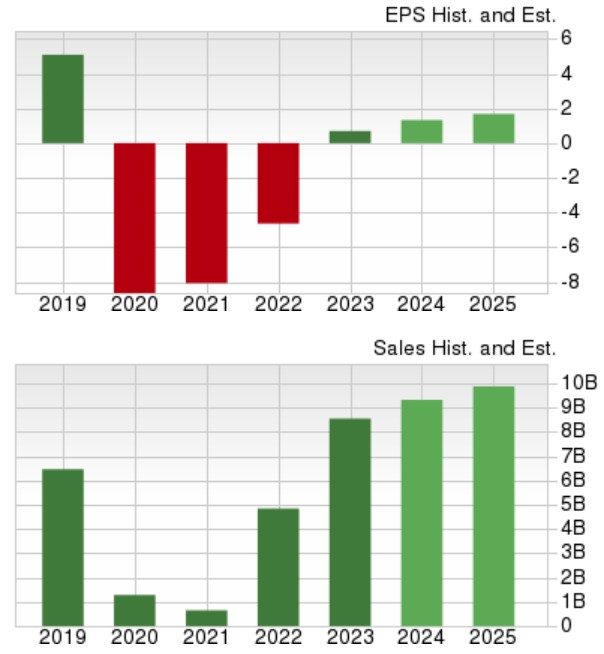

Norwegian’s total sales are forecasted to climb by 9% in fiscal 2024, followed by an additional 6% uptick in FY25 to reach $9.93 billion. In a significant leap, Norwegian’s yearly earnings are predicted to skyrocket by 94% this year to $1.36 per share from $0.70 per share in 2023. Furthermore, FY25 EPS is estimated to leap by 27% to hit $1.73 per share.

Even though Norwegian’s profitability is still below pre-pandemic levels of $5.09 per share in 2019, the company has surpassed its pre-COVID revenue of $6.46 billion from that same year.

Image Source: Zacks Investment Research

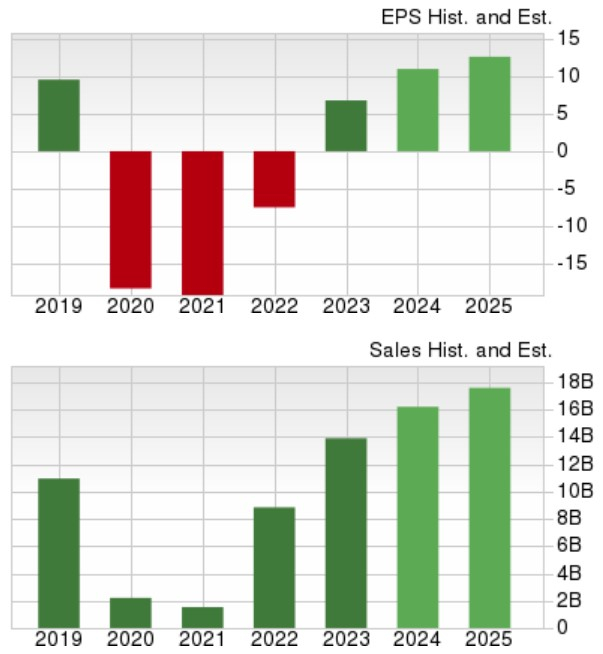

On the other hand, Royal Caribbean is poised for a 16% surge in its top line in FY24, with a further anticipated 9% increase in FY25 to $17.63 billion. Remarkably, Royal Caribbean’s annual earnings are expected to increase by 62% in FY24 to $10.96 per share from $6.77 per share the previous year. Additionally, a 15% growth in EPS is on the horizon for FY25. It is worthy to note that Royal Caribbean is set to surpass its pre-pandemic earnings of $9.54 a share in 2019, having already exceeded pre-COVID sales of $10.95 billion.

Image Source: Zacks Investment Research

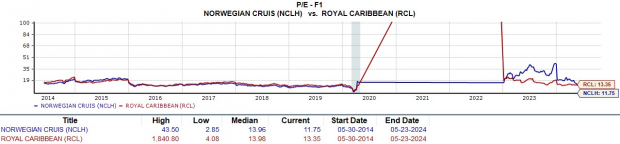

Appealing P/E Ratios

Adding to the allure of Norwegian and Royal Caribbean’s post-pandemic rebound are their attractive P/E valuations. Norwegian’s stock is trading at 11.7 times forward earnings, while Royal Caribbean is at 13.3 times – a substantial discount compared to the Zacks Leisure and Recreation Services Industry average of 18.7 times and the S&P 500’s 22.1 times.

Image Source: Zacks Investment Research

In Conclusion

With the continued uptrend in earnings estimates for Norwegian Cruise Line and Royal Caribbean for FY24 and FY25, the notion that these stocks are undervalued gains further support. This suggests that Norwegian and Royal Caribbean possess untapped potential and are primed for further growth from their current levels.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never witnessed a lower presidential election year. With an energized and engaged voter base, the markets have exhibited an almost unswerving bullish trend regardless of the winning party!

Now is the time to download Zacks’ free Special Report featuring 5 stocks that promise remarkable potential for both Democrats and Republicans…

1. Medical manufacturer has achieved a remarkable growth of +11,000% in the past 15 years.

2. Rental company is dominating its industry with exceptional performance.

3. Energy powerhouse is in line to boost its already substantial dividend by 25%.

4. Aerospace and defense standout has just secured a potential $80 billion contract.

5. Giant Chipmaker is establishing massive facilities in the U.S.