Following the Trail of Smart Money

On Wall Street, a cacophony of distractions competes for attention – financial TV pundits, scrolling news updates, and the ever-volatile emotions of individual investors. To navigate this chaos, one must forge a clear path, seize opportunities, and tune out the noise. Nonetheless, reinventing the wheel is hardly necessary. Insights gleaned from seasoned insiders and elite traders can be invaluable. Here are two methods to track the “smart money.”

Unveiling 13F Reports

A 13F filing, a quarterly disclosure mandated for institutional money managers with over $100 million in assets, offers a window into the minds of financial giants. While retail investors may not mirror these moves precisely, they can unravel the rationale behind such transactions and gauge the level of faith by assessing the trade’s weight in the portfolio.

Divining Insider Purchases

Monitoring insider buying can offer a competitive edge. Notably, insider purchases carry more weight than sales, signaling a firm belief in upside potential. Unlike preplanned sales, insider buying suggests a singular conviction – that the stock is poised to soar.

Stanley Druckenmiller’s Strategic Foresight

Renowned for his uncanny forecasting abilities, Stanley Druckenmiller, a protégé of George Soros, boasts a three-decade streak of never posting an annual loss. Leveraging his exceptional acumen across asset classes, Druckenmiller recently scored big with Nvidia, showcasing his prowess.

Druckenmiller’s Bold Argentina Venture

Druckenmiller’s foray into Argentina was inspired by President Javier Milei’s pro-free-market vision, sparking a flurry of investment activities. Leveraging artificial intelligence, Druckenmiller pinpointed the top five Argentine ADRs, expressing confidence in the country’s potential rebound after years of socialist policies.

ARGT ETF: Riding Druckenmiller’s Confidence

The ARGT ETF offers U.S. investors access to a diversified basket of Argentine stocks, aligning with Druckenmiller’s bullish stance. Noteworthy is the ETF’s remarkable outperformance, boasting a 23% increase in the year-to-date period.

Small Caps’ Return to Form?

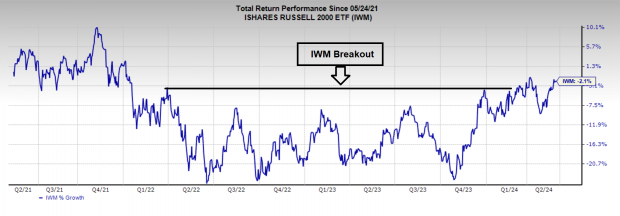

With a hefty stake in call options within the Russell 2000 ETF (IWM), Druckenmiller appears optimistic about small caps. The prospects of lower interest rates have fueled speculation on small caps reverting to the mean, supported by technical indicators hinting at a breakthrough for IWM.

The possible interest rate cut in late 2024, in light of subdued inflation figures, may catalyze small caps’ resurgence. The chart underscores this sentiment, echoing the timeless Wall Street axiom, “The longer the base, the higher in space.”

Image Source: Zacks Investment Research

Navigating the Bitcoin ETF Wave

The approval of several spot Bitcoin ETFs earlier this year ignited hope for institutional adoption of the premier cryptocurrency. The subsequent 13F disclosures unveiled over 600 institutions securing positions in Bitcoin ETFs like IBIT, setting the stage for a potential institutional crypto rally.

Insights from Michael Burry and David Tepper

Visionaries like Michael Burry and David Tepper bring a blend of boldness and precision to the market, often charting unconventional yet successful paths.

Insightful Investor Bets: Why China Holds Promise for Burry and Tepper

Investment Mavericks and Their Legendary Bets

Michael Burry and David Tepper are renowned for their contrarian investment strategies, often backed up by uncanny foresight. Burry gained widespread recognition after accurately predicting and betting against the market before and during the 2008 Global Financial Crisis. His story was immortalized on the big screen with Christian Bale portraying him in “The Big Short.” On the other hand, Tepper made bold moves during the aftermath of the GFC, placing significant investments in major banks like Bank of America (BAC) on the belief that they would be considered “too big to fail” by the government – a prediction that ultimately proved to be correct, leading to substantial profit gains and enabling Tepper to acquire the Carolina Panthers.

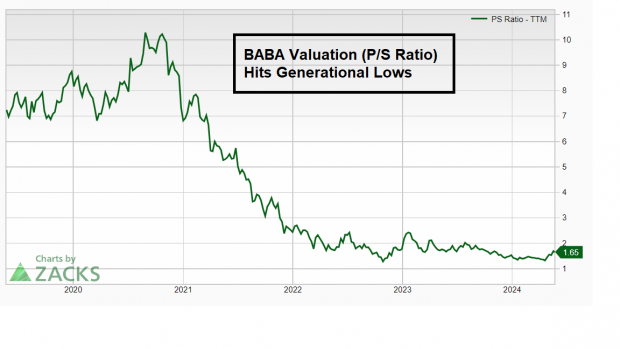

A Bold Contrarian Move: China and Alibaba (BABA)

Both Burry and Tepper are now setting their sights on a potential resurgence in China, particularly in the e-commerce sector. Burry’s investment portfolio includes a substantial position in JD.com (JD) as well as a significant stake in Alibaba (BABA). Tepper, on the other hand, has a major holding in Alibaba (BABA). Of particular interest is Alibaba (BABA), where key insiders such as Founder and CEO Jack Ma have recently purchased over $100 million worth of company stock. Moreover, Alibaba (BABA) presents an intriguing opportunity due to its current undervaluation.

Image Source: Zacks Investment Research

Strategic Insights: The Verdict on Market Trends

This quarter’s 13Fs and notable insider transactions provide invaluable insights into the investment inclinations of seasoned market players. Keep a keen eye on emerging trends in areas such as Argentina, small-cap stocks, Bitcoin, and the promising landscape of Chinese markets to stay ahead of the curve.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little over 9 months.

To read this article on Zacks.com click here.