If you’ve been keeping up with the rumblings surrounding Tesla (NASDAQ: TSLA), you’ve been bombarded with a chorus of negativity. From challenges in the electric vehicle (EV) sector to lay-offs and whispers of ditching a much-hyped sub-$25,000 model, Tesla’s journey has been nothing short of turbulent.

Image source: Tesla.

Scrutinizing Tesla’s Potential Value

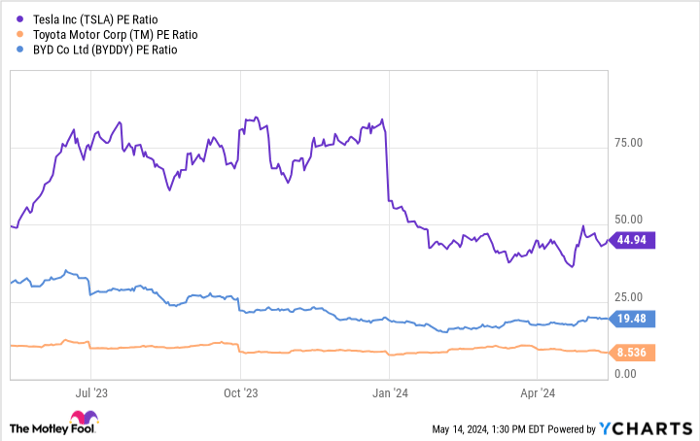

When compared to its automotive counterparts, Tesla’s stock appears steeply priced and possibly overvalued. The evidence can be found by delving into the price-to-earnings (P/E) ratios of companies.

Currently, Tesla boasts a P/E ratio of 42. This valuation is a whopping five times greater than that of Toyota, the second-most valuable automaker, and roughly twice the figure of China’s fellow EV producer, BYD.

TSLA PE Ratio data by YCharts.

Although Tesla’s stock seems unattractive from a pure automotive perspective, glimpses of its future endeavors hint at a discounted trade.

Many view Tesla as a prime investment opportunity to tap into the potential of artificial intelligence (AI), despite the necessity for further evolution before the company fully reaps the rewards.

The Path Ahead: Tesla’s Undervalued Outlook

CEO Elon Musk envisions Tesla as the world’s most valuable entity in the making. This will be driven by enhancing its full self-driving software and elevating the capabilities of its humanoid robot, Optimus.

Musk’s aspiration within the self-driving realm is to inaugurate a robotaxi service. With self-operating vehicles in the mix, Musk plans to craft a unique ride-hailing entity that could revolutionize travel. He perceives it as an “almost limitless” opportunity, a sentiment echoed by many analysts who view it as a potential game-changer.

The true potential of a technology absent anywhere else is challenging to quantify, yet ARK Invest ventured into the realm. Through a Monte Carlo simulation, the investment firm estimated that robotaxis could rake in revenue up to $440 billion, approximately four times the total revenue of 2023.

While Optimus may not dazzle to the extent of robotaxis, its potential remains substantial. Analysts at Morgan Stanley suggest that Optimus could disrupt up to 30% of the global labor market by performing repetitive and hazardous tasks currently executed by humans. Musk envisions Optimus outstripping vehicle manufacturing revenue eventually.

Presently, Optimus is operational at Tesla plants, handling rudimentary tasks. Nevertheless, Musk anticipates its role expansion by year-end and plans to release it to consumers and markets by 2025.

The Current Investment Landscape

From a pure EV vantage point, justifying a Tesla investment might pose a challenge. However, while the EV production capacity surges and global EV adoption blossoms, Tesla’s genuine potential lies in its AI initiatives.

For risk-averse investors weathering Tesla’s near-term storms, caution might be prudent. Nevertheless, for individuals with a long investment horizon and a taste for risk, Tesla stands tall among the few superior choices.

Amidst Tesla’s fundamentals, the wisdom of a renowned guru, Warren Buffett, springs to mind: “Be greedy when others are fearful, and fearful when others are greedy.” Scouring the web, trepidation swirling around Tesla’s investment echoes strong.

Although negative headlines alone do not beckon investments, reflecting on Tesla’s track record of success, the strides in AI product development it has made, and the transformative potential these technologies offer society, Tesla emerges as a sturdy long-term growth option for savvy investors.

Investing Wisdom: Where to Allocate $1,000 Now

Listening when our analyst crew proclaims a stock tip often pays off. After all, their two-decade-old newsletter, Motley Fool Stock Advisor, has outperformed the market by threefold.*

They’ve unveiled the 10 best stocks for immediate acquisition… featuring Tesla on the list alongside 9 other potentially overlooked stocks.

*Stock Advisor returns as of May 13, 2024.