The “Magnificent Seven” stocks in the market are a sight to behold. Wall Street unravels their allure, each stock a gem waiting to be uncovered. Among them, Amazon shines with a brilliance that dazzles investors. Let’s delve into what makes Amazon the star of this elite group.

A Glimpse into Amazon’s Stellar Performance

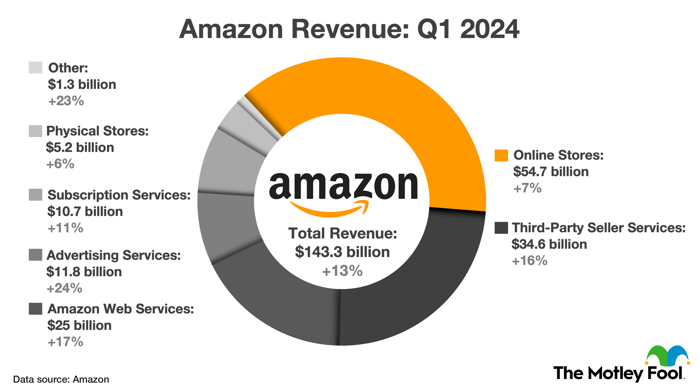

A single glance at Amazon’s first-quarter financial report reveals a story of triumph. The numbers speak of a 13% surge in revenue, soaring like an eagle on the winds of success. The company’s operating margin expanded by a solid 700 basis points, a testament to its strategic prowess. Amidst this financial crescendo, net income tripled, a feat that echoes through the halls of Wall Street.

Amazon’s first-quarter revenue growth across its primary business segments is a symphony of success.

The Triumvirate of Amazon’s Growth Engines

Within Amazon’s realm, the juggernaut of e-commerce, digital advertising, and cloud computing reign supreme. The prophets of Straits Research foretell an 8% annual surge in online retail sales until 2030. Meanwhile, digital advertising and cloud computing stand as pillars of growth, with a compound annual growth rate that promises a golden future.

Amazon’s dominion in e-commerce is unrivaled, holding court as the largest online marketplace in North America and Western Europe. It continues to capture market share, a relentless titan poised to surpass all. Among the gods of commerce, Amazon stands tallest, casting a shadow that even Alibaba finds formidable.

Evolved from its retail roots, Amazon’s digital advertising domain blossoms like a rose in spring. It commands the lion’s share of retail ad spending in the U.S, dwarfing competition with a prowess akin to Goliath in battle. As it expands its territories globally, Amazon’s reign in digital advertising remains unchallenged, a force to be reckoned with.

And then there’s Amazon Web Services (AWS), the behemoth of cloud infrastructure and platform services. Nurtured by the zeal for innovation in an era of artificial intelligence, AWS stands as a colossus. Leading the pack in infrastructure-as-a-service and cloud services, AWS forges ahead into the realm of AI-as-a-service, a trailblazer in a landscape fraught with competition.

While the tides may ebb and flow in the market share game, with Microsoft Azure gaining ground, AWS stands unyielding. Its alliances with AI pioneers like OpenAI and Anthropic propel it to greater heights. At every layer of the technological edifice, AWS invests, innovates, and conquers, a testament to its indomitable spirit.

As CEO Andy Jassy unveils Amazon Q, a conversational copilot that promises a realm of possibilities, it becomes clear – Amazon’s legacy is not just in sales figures. It’s in the art of innovation, the science of adaptation, and the soul of exploration.

Riding the Wave of Amazon’s AI Innovation: A Potential Golden Ticket for Investors

Revolutionizing Assistance and Expanding Horizons

The buzz around Amazon’s latest earnings call is palpable, and for a solid reason. The advent of Q, their AI-powered assistant for software development and data, is not just turning heads – it’s setting a new benchmark for prowess. Q boasts unparalleled success rates in code suggestion and security vulnerability detection, surpassing competitors by a long mile. This innovative stride paves the way for Amazon to regain lost market ground and potentially propel cloud services sales growth to unprecedented heights.

The Lucrative Path Ahead: Investing in Amazon Stock

In coming years, Amazon is poised for substantial growth by simply aligning with e-commerce, digital advertising, and cloud computing market trends. A projection of 11.1% annual sales growth till 2026 and 10.9% growth in the subsequent five years is already on the cards. The current valuation, standing at 3.3 times sales, is fair game, even though it’s a tad above the three-year average of 2.9 times sales. Amazon’s prospects of outperforming the market in the near horizon seem promising, especially if AI catalyzes a surge in cloud services sales. Patient investors eyeing promising returns may find a humble beginning by acquiring a small position in Amazon stocks today.

Unraveling Investment Conundrums: Should You Dive into Amazon?

Before leaping into the Amazon stock fray, ponder on this – the renowned Motley Fool Stock Advisor team has identified the top 10 stocks set to skyrocket, and surprisingly, Amazon is not in the lineup. These selected stocks hold the promise of colossal returns down the line. Reflect on a historical tangent – when Nvidia made a similar roster on April 15, 2005, a $1,000 investment then would snowball to a staggering $553,959. Stock Advisor lays out a straightforward path to success for investors, complete with portfolio building tips, regular analyst updates, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has surpassed the S&P 500 return by over fourfold.

Considering the transformative power of AI and the current financial landscape, one might wonder – is Amazon the golden goose of the investment realm, waiting to be discovered?