The impending Bitcoin halving has unleashed a storm of speculation within the cryptocurrency realm. As the event draws near, with halving slicing the Bitcoin rewards for miners, its nuances demand investor attention for sagacious fiscal planning and strategic asset management.

Tracing the footprints of past halvings while decoding present market patterns, investors navigate the impending halving with a sharper lens honed for the ever-fluctuating cryptocurrency domain.

Unveiling the Bitcoin Halving

Mined through a process called mining, Bitcoin engages miners in a competitive quest to crack algorithmic puzzles. Solved puzzles add blocks to the blockchain, rewarding the victor with freshly minted Bitcoin units. In Bitcoin’s nascent days (2009), the reward was a generous 50 Bitcoins per block.

The Bitcoin halving dance occurs roughly every four years or after mining 210,000 blocks; not timed but block-triggered, the cycle’s period slightly wavers due to hash rate and mining difficulty vacillations. Come April 20, 2024, this year’s halving will slash rewards from 6.25 to 3.125 Bitcoins per block.

Inbuilt into the Bitcoin network, the halving’s essence lies in curtailing block rewards, tapering the flow of freshly minted Bitcoins. This diminishing supply aims to combat inflation, preserving Bitcoin’s long-term value trajectory. As halvings unfold, the new coin gush will ebb until the 21 millionth Bitcoin circulates.

Impacts on Bitcoin Miners

Bitcoin miners, deeply tethered to the cryptocurrency’s ebb and flow, witness seismic shifts owing to the halving’s timbre.

Termed hash rate and clocking about 10 minutes, the mining process buckles against the surging or ebbing tide of miners, adjusting with hash rate’s varying swell. As the halving looms, hash rates balloon, only to plummet post-ceremony, culling inefficient miners from the fold.

With dubbed “record-high” hash rates, teeming mining giants unleash faster, more efficient rigs while clinging to archaic gear facing obsolescence. In a pre-emptive gambit, Bitcoin stalwart Riot Platforms acquired new miners, paralleled by CleanSpark‘s data center coup.

Implications on Bitcoin Price

Preceding the halving, Bitcoin often scales peaks, yet predictably decoding price trends from a meager three halvings remains an uphill battle.

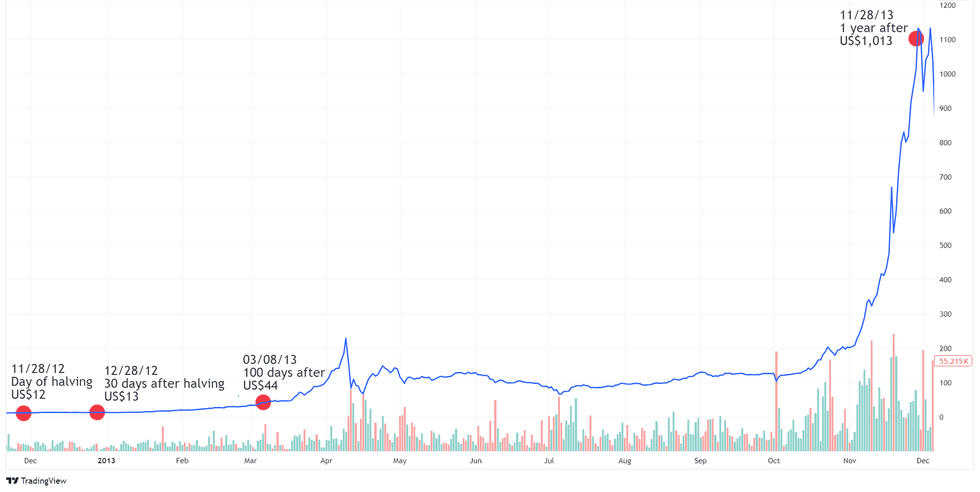

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

The inaugural Bitcoin halving on November 28, 2012, cleaved mining rewards from 50 to 25 Bitcoins. As Bitcoin tiptoed into the limelight, shadowed by economic uncertainties in Europe, its value twirled from a modest $5.50.

An Insightful Look at Bitcoin’s Halving Events

Bitcoin’s journey has been one akin to a rollercoaster ride, with exhilarating highs and stomach-churning lows that have left investors gasping for breath. The cryptocurrency first made waves when its price surged from a modest US$12 to a staggering US$1,013 within a year after the November 2012 halving event. This meteoric rise hinted at Bitcoin’s potential to be recognized as a viable alternative asset class, tantalizing investors with promises of financial glory.

The Rise and Fall of Bitcoin

However, the thrill was short-lived, as Bitcoin’s price plummeted to under US$300 by mid-2015, leaving early adopters with a bitter aftertaste. The second halving in July 2016 breathed new life into the cryptocurrency, propelling its value to US$648 and ushering in a period of unprecedented growth.

The Maturation of Bitcoin

By June 2017, Bitcoin had eclipsed the US$2,500 mark, sparked by the phenomenon known as FOMO, or fear of missing out, that gripped the investing community. Overjoyed by the potential of blockchain technology, large financial institutions jumped on the bandwagon, fueling Bitcoin’s price to a record high of US$19,783.21 by December 2017.

The Impact of Recent Halving Events

The most recent halving event on May 11, 2020, while deemed anticlimactic, set the stage for a monumental shift in the cryptocurrency landscape. The economic turmoil brought on by the COVID-19 pandemic paved the way for Bitcoin to shine as a potential safe-haven asset, akin to gold, attracting a wave of new investors searching for stability in uncertain times.

As the world delved deeper into decentralized finance (DeFi) in 2020, Bitcoin emerged as the “gold standard” among digital currencies, drawing the attention of mainstream players like PayPal and Square (now part of Block). This newfound recognition culminated in Bitcoin’s monumental climb to over US$68,000 in November 2021, rewriting the record books once again.

A Glimpse into the Future

The upcoming halving event slated for 2024 has set the crypto community abuzz, with the recent approval of spot Bitcoin exchange-traded funds (ETFs) marking a significant milestone. These ETFs provide a gateway for risk-averse investors to partake in Bitcoin’s price movements without the complexities of direct ownership.

The resurgence of the crypto industry in late 2023, fueled by legal victories and the promise of spot Bitcoin ETFs, has reinvigorated market sentiments and reignited faith in the sector. With Bitcoin prices soaring to new heights in 2022 and ETF volumes reaching unprecedented levels, the stage is set for a thrilling chapter in Bitcoin’s ever-evolving narrative.

The Impending Bitcoin Halving and Investment Opportunities

Anticipating Bitcoin’s Future Amidst Halving

As Bitcoin approaches its halving event at the end of February, market analysts are closely monitoring the impact on the digital currency. Previous patterns suggest a pullback in the months leading up to the halving, followed by a significant surge post-halving. In a unique turn, the supply influx from miners is currently being absorbed by exchange-traded funds (ETFs). This absorption may pave the way for remarkable gains later in the year, as historical trends hint at an upside acceleration after the halving event.

Strategies for Investing Pre-Halving

Analyst and Factor CEO Peter Brandt has raised his Bitcoin price target to a staggering US$200,000 by September, citing a potential 66% surge from his earlier estimate of US$120,000. Envisioning forthcoming all-time highs, industry experts anticipate a notable price surge driven by retail FOMO, potentially propelling Bitcoin to remarkable levels.

With price estimates ranging from US$75,000 to US$150,000 within the next 12 to 18 months, optimism prevails in anticipation of hitting all-time highs. Including Bitcoin as part of a standard 60/40 equity bond portfolio can impact its volatility positively. Studies suggest that allocating 3 to 5 percent of a portfolio to Bitcoin can lower overall volatility and boost expected returns, attributing this to the asset’s non-correlation and high volatility.

For investors concerned about volatility, the key lies in managing portfolio allocation rather than the nature of the investment’s volatility. Rebalancing portfolios quarterly and strategically maneuvering between assets can foster enhanced performance and mitigate market risks effectively.