As the US stock market experiences internal rotations, shifting from Tech/Growth areas to more cyclical sectors like Energy and Materials, investors find themselves at a crossroads. The market, while exhibiting signs of a manic bull phase, presents high risks that cannot be ignored. This ever-changing landscape necessitates a strategic approach towards sector selection and risk mitigation.

Amidst these fluctuations, the diversification and breadth of the overall market pose both challenges and opportunities for investors. While it may be tempting to take a bearish stance against the broad market, the very nature of its broad composition makes it a formidable opponent, especially in the face of ongoing internal rotations.

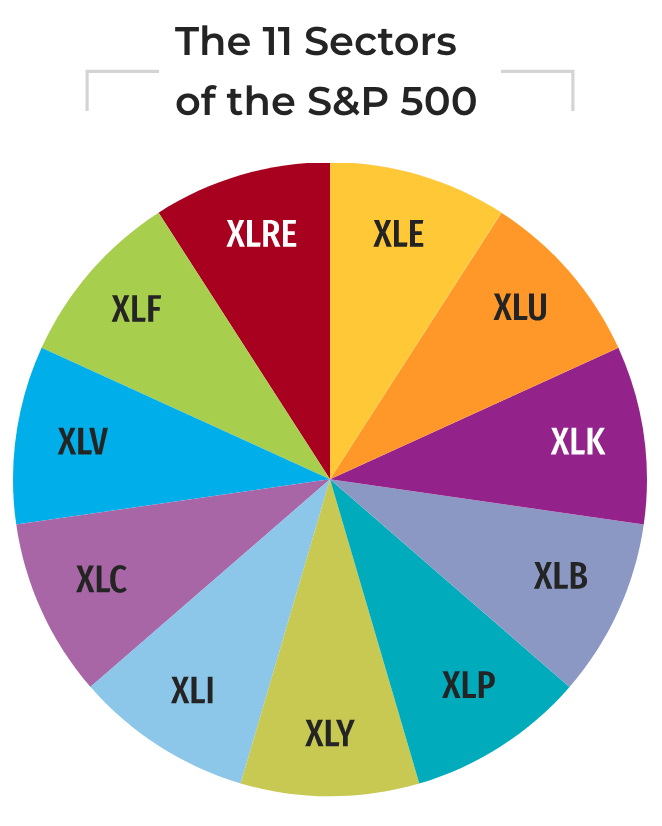

One way to navigate through these uncertain times is by examining the sector breakdown of the S&P 500 using SPDRs, which offer a more nuanced approach to sector analysis compared to a generic, one-size-fits-all strategy.

Examining the performance of these sectors, while intriguing on a micro-level, underscores the importance of a granular approach in aligning one’s investment strategy with prevailing market dynamics.

Engaging in the market’s current dance, I have taken a bearish position on the Technology sector, as shared in yesterday’s NFTRH Trade Log. Simultaneously, I have taken bullish positions in Energy and Materials, recognizing the fluidity and unpredictability of the current market environment.

Amidst this market flux, the role of government policies looms large, particularly in the run-up to the upcoming presidential election. While politics typically plays a minimal part in financial analyses, recent developments warrant a closer look. The nuanced interplay between the Fed’s stance, highlighted by a superficial hawkish tone, and the Biden administration’s strategic moves, including Janet Yellen’s integral role, suggests a coordinated effort to navigate through economic uncertainties.

While sectors like Semiconductors pose a degree of unpredictability, areas such as Energy, Materials, and Industrials hold promise due to their cyclicality and responsiveness to fiscal stimuli and inflationary signals—provided investors can look beyond the shadow of the Federal Reserve’s influence.

Strategic Insights

Anticipating a market correction in the near term, followed by a potential bullish surge leading into Q4 and the election period, requires a keen understanding of shifting sectoral dynamics. Whether the market opts for a correction or continues its rotational journey towards November remains to be seen. For those considering a bearish stance, a thorough evaluation of macroeconomic factors and sectoral trends is imperative to position oneself advantageously.

Disclaimer:

Please note that the opinions expressed are based on personal analysis and should not be construed as investment advice. For detailed terms of service, refer to NFTRH.com and Biiwii.com.