Advanced Micro Devices (NASDAQ: AMD) witnessed a substantial surge in its stock price during Friday’s trading session, with a remarkable 5.3% increase by the closing bell, according to data from S&P Global Market Intelligence.

Despite the absence of any company-specific developments, the momentum in AMD’s share price rode high on the tailwinds of positive indicators for AI demand and growth prospects. Dell released its fourth-quarter report after Thursday’s closing, which acted as a potent fuel injection, igniting optimism in the realm of artificial intelligence (AI) stocks.

The Impetus from Dell’s Strong Q4 Performance

Dell’s fourth-quarter performance has emerged as the latest catalyst for bolstering optimism surrounding AI stocks. The company delivered a stellar non-GAAP (adjusted) earnings of $2.20 per share on revenue of $22.3 billion, surpassing the consensus estimates that forecasted earnings of $1.72 per share on approximately $22.15 billion in revenue. Moreover, Dell indicated robust demand for its AI server offerings, projecting a prosperous outlook through 2025.

Closing the week’s trading activities with a remarkable surge of 31.6%, Dell’s upward trajectory had a cascading effect on the valuations of leading AI players. Noteworthy among them, AMD’s stock witnessed an impressive 37.5% ascent in 2024’s trading thus far and an astounding 158% surge over the past year.

Forecasting the Trajectory of AMD Stock

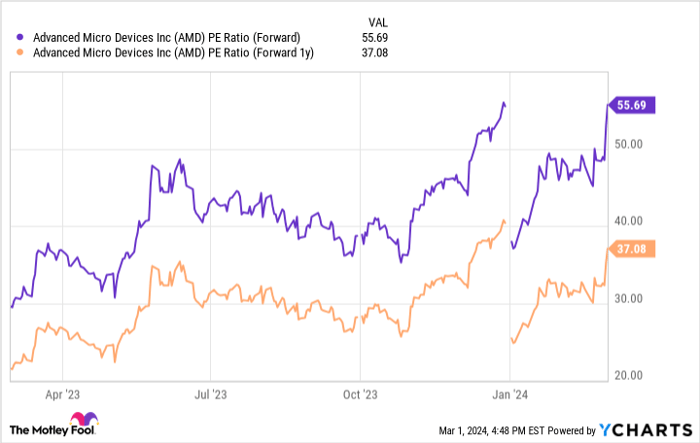

AMD’s stock has undergone an extraordinary rally fueled by enthusiasm surrounding the company’s AI prospects. Presently, the shares are trading at 55.7 times the expected earnings for the current year and 37 times the anticipated profits for the forthcoming year.

Guided by the midpoint estimates, AMD is anticipating revenues of around $5.4 billion in the initial quarter of this year, suggesting a stable performance compared to the same period last year. While the company is yet to witness explosive growth in sales and earnings attributed to AI processor sales, market sentiment remains bullish on the future acceleration of growth.

AMD PE Ratio (Forward) data by YCharts.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now, with Advanced Micro Devices making the list alongside other overlooked opportunities.

*Stock Advisor returns as of February 26, 2024

Keith Noonan has no position in any of the mentioned stocks. The Motley Fool has positions in and recommends Advanced Micro Devices. For detailed disclosure information, refer to this policy.