Impending Stock Split

Walmart’s (WMT) impending three-to-one stock split set to take effect on Monday, February 26, has piqued the interest of many investors. The current price of $177 per share is expected to decrease to around $59 per share after the split, marking a strategic move by Walmart to enhance trading accessibility and appeal to a broader investor base.

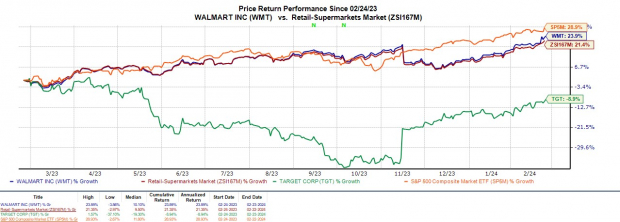

Current Price Performance

Walmart’s stock has demonstrated robust performance, boasting a year-to-date increase of +12%, outstripping the S&P 500’s +6% rise. In comparison to its omnichannel rival Target (TGT), Walmart has outshone with a +7% increase. Over the last year, Walmart’s shares have soared by +24%, surpassing both Target’s -9% and its Zacks Subindustry’s +21% performance while marginally lagging behind the benchmark.

Image Source: Zacks Investment Research

Positive Q4 Results Catalyst

Reporting its fourth-quarter results, Walmart delivered impressive figures that bode well for its standing within the retail industry. The company’s earnings of $1.80 per share surpassed the Zacks Consensus of $1.65 per share by 9%. Fourth-quarter sales of $173.38 billion reflected a 5% increase year over year, outperforming estimates by over 1%, attributed to the success of the busy holiday season.

Image Source: Zacks Investment Research

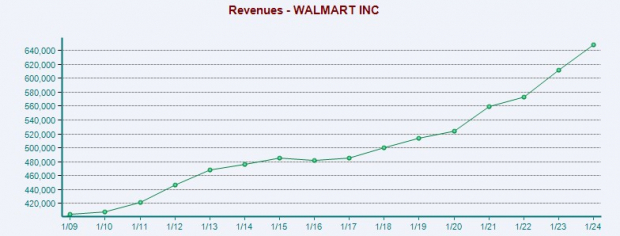

E-commerce Growth and Outlook

Walmart’s robust quarter was bolstered by its expanding e-commerce division, experiencing a notable 23% sales surge during Q4, contributing significantly to over $100 billion in online sales for the year. Overall, Walmart’s total sales for fiscal 2024 climbed 6% to $648.1 billion, with annual earnings increasing by 6% to $6.65 per share.

Image Source: Zacks Investment Research

Earnings Per Share Overview

Anticipated growth projections for Walmart reveal a positive trajectory, with expected 3% top-line growth in the current FY25 and a further 4% surge in FY26 sales to $698.5 billion. The annual earnings forecast predicts a 5% uptick in FY25 to $7.02 per share post-split at $2.34 per share. Additionally, a promising 9% EPS growth is projected for FY26, underscoring Walmart’s strong financial outlook.

Image Source: Zacks Investment Research

Key Takeaways

As Walmart’s stock holds a Zacks Rank #3 (Hold), the company has witnessed a remarkable performance, particularly at the onset of the year. While Walmart’s expanding e-commerce segment and long-term prospects continue to attract investors, the anticipation of better buying opportunities post-split remains prudent, considering historical market trends where stock splits do not always equate to immediate price escalations.