If this heralds a long-awaited market upswing, companies with lower market capitalizations might see the most substantial gains.

Fifteen years since the launch of its blockchain network, Bitcoin has gradually established itself as the digital equivalent of gold. With no physical constraints and a secure self-custody nature, Bitcoin is backed by an extensive computing network that bolsters its digital value.

Underpinning this assertion is the ongoing support that Bitcoin has seen from the monetary system. In the first four months of fiscal year 2024, the Treasury Department reported a deficit gap of $532 billion, soaring 16% from the corresponding period a year earlier. Against the backdrop of an astronomical $34 trillion national debt, Bitcoin’s appeal has continued to grow due to the mismanagement of centralized money. Over the last three months, the value of Bitcoin has surged by 40% to $51.2k. But there’s an intriguing prospect for traditional stock traders to potentially profit even more from the rise of Bitcoin – thanks to companies contributing to the security of the Bitcoin network.

Here are some affordable crypto stocks that have outpaced Bitcoin in terms of performance, with a sole exception.

Iris Energy

Amid the past three months, Australian Bitcoin mining enterprise Iris Energy Ltd (NASDAQ:) has witnessed a remarkable surge of 171%. Benefiting from the Australian government’s commitment to sustainability, Iris has redoubled its efforts to power its data centers with 100% renewable energy.

This involves land allocation, electrical infrastructure, and proprietary data centers harnessing a staggering 760 MW of power. As of the November update, Iris Energy is on course to elevate its Bitcoin mining output from 5.6 EH/s in October to nearly double that figure, at 10 EH/s by Q2 2024. The company boasts an overall operational capacity of 2,160 MW, spanning facilities in Canada and Texas.

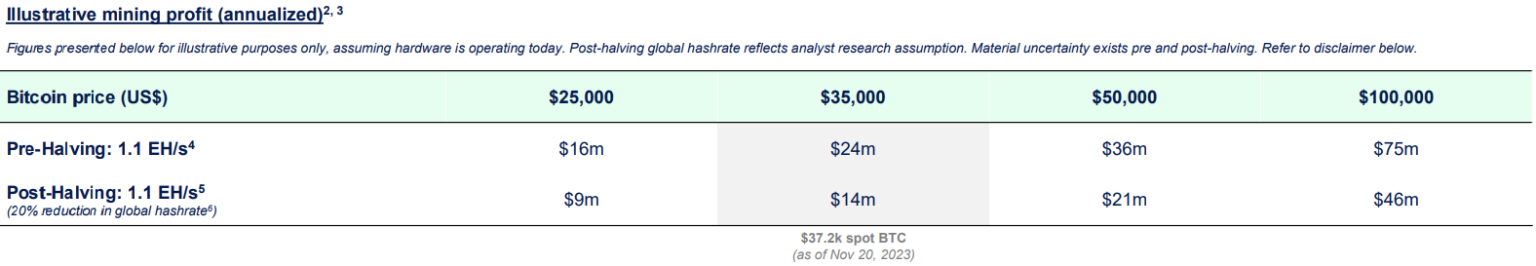

A portion of this energy will be channeled toward generative AI and cloud computing following the acquisition of 248 Nvidia (NASDAQ:) H100 GPUs. Given Bitcoin’s scarcity, Iris Energy is contemplating continued Bitcoin mining profits even after the 4th halving in April.

Compared to the industry average of 1.58 power usage effectiveness (PUE), Iris operates at a remarkably efficient 1.1 PUE. In September, when the price of Bitcoin was in the $26k range, Iris reported mining 390 BTC for a net mining revenue, excluding electricity costs, of $4.9 million.

According to insights from eight analysts compiled by Nasdaq, IREN stock is a “strong buy.” The average price target for IREN is set at $9.79 versus the current price of $8. The highest estimate stands at $10, while the lowest forecast sits at $9.5 per share.

Cipher Mining

Over the past three months, the performance of CIFR stock has been more aligned with the BTC price, outpacing the cryptocurrency by just 6%. Specializing in industrial-scale Bitcoin mining, US-based Cipher Mining Inc (NASDAQ:) mined 371 BTC in January 2024, amassing a total holding of 1,132 BTC after selling off 34 BTC.

The company’s mining capacity stands at 7.2 EH/s, as indicated in the January operational update. Cipher Mining disclosed a 60 MW expansion during that month in conjunction with an additional acquisition of 16,700 A1466 mining rigs from Canaan. These developments would position the company in a similar range as IREN in Q2 2024, at approximately 8.4 EH/s.

Based on insights from seven analysts compiled by Nasdaq, the stance on CIFR stock is a “strong buy.” The average price target for CIFR is $6.33, contrasting with the current price of $4. The high estimate is double that at $8, while the low forecast is above the current level at $5 per share.

Greenidge Generation Holdings

Positioned as a provider of carbon-neutral Bitcoin mining in Dresden, New York, Greenidge Generation Holdings Inc (NASDAQ:) is transitioning to a new business model that incorporates both hosting and mining. Consequently, GREE shares dipped by 8% over the past three months, presenting a compelling opportunity to buy amidst the pullback.

In February, Armistice Capital pledged $6 million to support Greenidge in executing this transformation. For Q4 2023, the company reported its first profitable quarter in the past two years, with operating income ranging from $1.4 to $2.4 million.

Greenidge’s revenue of $19.7 million was divided between data center self-mining ($7.3M) and hosting ($10.7M). The company’s total capacity stands at 3.1 EH/s, with 1.2 EH/s dedicated to cryptocurrency mining. In 2023, Greenidge succeeded in reducing its debt by $85.3 million, leaving it at $68.7 million, with $13.6 million in cash.

According to information from two analysts compiled by Nasdaq, GREE is tagged as a “strong buy.” The average price target for GREE is $20, contrasting with the current price of $4 per share.

***

Disclaimer: Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our

website policy

prior to making financial decisions.

This

article

was originally published on The Tokenist. Check out The Tokenist’s free newsletter,

Five Minute Finance,

for weekly analysis of the biggest trends in finance and technology.