Before we delve into the heart of discussion about the reliability of brokerage recommendations and how to leverage them to your advantage, let’s take a peek at what the big players on Wall Street think about Deere (DE).

With an average brokerage recommendation (ABR) of 1.79 (approximating between Strong Buy and Buy), Deere is currently under the scope of 21 brokerage firms. Among these, 12 strongly recommend buying and one suggests a buy, constituting 57.1% and 4.8% of all the recommendations, respectively.

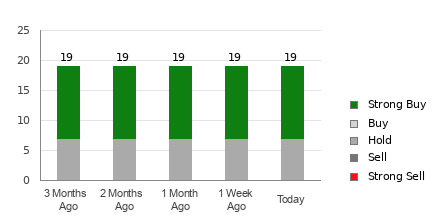

Brokerage Recommendation Trends for DE

The ABR hints at buying Deere, yet evidence shows that relying solely on this information for investment decisions may not be wise. Research reveals a strong positive bias in analysts’ ratings due to the vested interest of brokerage firms in the stocks they cover. Analysts issue five “Strong Buy” recommendations for every “Strong Sell” recommendation, skewing their ratings and misguiding investors more often than providing genuine insight on a stock’s future price movement.

While brokerage recommendations might not be the ideal guide, the Zacks Rank, a leading stock rating tool, breaks down stocks into five categories, providing an efficient indicator of a stock’s likely price performance in the near future.

ABR Should Not Be Confused With Zacks Rank

It is important to note that while both ABR and Zacks Rank use a scale of 1-5, they are distinct. ABR is solely based on brokerage recommendations in decimals, whereas Zacks Rank, displayed in whole numbers, is a quantitative model relying on earnings estimate revisions.

Arguably, the Zacks Rank is more reliable because it is backed by earnings estimate revisions, which are closely linked to stock price movements in the short term.

Another critical divergence between the ABR and Zacks Rank is the freshness of the data. Unlike ABR, the Zacks Rank is always timely in predicting future stock prices, given that analysts constantly revise their earnings estimates, promptly reflected in the Zacks Rank.

Should You Invest in DE?

Regarding earnings estimate revisions for Deere, the Zacks Consensus Estimate has remained constant at $28.46 for the current year over the past month. While consistent analyst views suggest stability in the company’s earnings prospects, this has resulted in a Zacks Rank #3 (Hold) for Deere.

Given these dynamics, it might be prudent to approach Deere’s ABR with caution.