Peloton (NASDAQ:PTON), an interactive fitness platform operator that gained widespread popularity during the pandemic, finds itself at a precarious juncture. Despite hovering near all-time lows following disappointing financial results, the stock does not reflect a bargain by any means. Although some Wall Street analysts are starting to express optimism about Peloton’s potential shift toward a subscription-based business model, I maintain a bearish stance and foresee further challenges on the horizon.

The Mounting Hurdles

In 2021, Peloton’s stock soared to over $170, establishing the company as a leader in at-home fitness solutions amidst the pandemic. However, the ensuing significant decline in financial performance has led to a staggering loss of more than 95% of its market value since the peak.

Peloton continues to grapple with a slew of challenges that have accumulated over the past three years. These challenges stem from both company-specific issues and broader industry headwinds.

Firstly, there has been a notable downturn in hardware sales, particularly the once-popular Bike, directly impacting the company’s bottom line and cash flow. In the second quarter of Fiscal 2024, Peloton recorded a 16% year-over-year decline in connected fitness products revenue, amounting to $319.1 million. During the recent earnings call, CFO Liz Coddington cautioned that the softness in product sales will persist over the next few quarters.

Secondly, Peloton is burdened with a substantial inventory of Tread+ products, which could pose a future challenge if demand fails to materialize as anticipated. CEO Barry McCarthy acknowledged during the Q2 earnings call last week that the company’s lack of experience in selling these products at full price might impede projected sales in the coming quarters. Failure to offload the Tread+ inventory in a timely manner could result in substantial losses for the company.

Thirdly, Peloton has struggled to deliver significant innovation in recent years, being compelled to relaunch existing products such as Tread+ to address safety concerns that arose during this period. This dearth of innovation at a product level may have paved the way for competitors to encroach on Peloton’s market share in the fitness equipment sector.

Furthermore, investors need to closely monitor the persistent failure of Peloton’s management to meet their targets. A prime example is the management’s decision to revise free cash flow targets for Fiscal 2024.

During the Q1 earnings call in November, the company had anticipated substantial improvement in free cash flow in the second half of the year, aiming for near-breakeven free cash flow for the full year. However, in the recent update, the company confessed that positive free cash flows can only be achieved in Q4, falling short of the annual goal.

From a growth standpoint, Peloton is not expected to return to positive revenue growth until the fourth quarter of Fiscal 2024. The company has experienced year-over-year revenue declines in each of the last eight quarters, underscoring the persistent challenges in revitalizing its growth. The company has also issued a caution that achieving growth at scale will remain a hurdle in the foreseeable future.

Assessing Bankruptcy Risk

Peloton holds $1.7 billion in long-term debt against $738 million in cash and short-term investments. The most significant debt maturity on the horizon is $1 billion worth of convertible bonds due in 2026.

In recent quarters, the company has managed to curtail some of the hemorrhaging in operating cash flows, a positive sign. The company’s operating cash outflow decreased to $31.2 million in Q2 from $670.2 million in the March 2022 quarter.

This operational improvement has been driven by strategic cost reductions and a focus on the subscription business. If these advancements persist in the coming period, Peloton should be able to meet short-term debt obligations without diluting existing shareholders.

While Peloton does not appear to be on the brink of bankruptcy in the immediate term, continued tepid revenue growth, challenging industry conditions, and product issues could elevate the bankruptcy risk in the long haul. Consequently, investors must closely monitor these metrics to pinpoint potential inflection points in Peloton’s trajectory.

Evaluating Analyst Views on Peloton Stock

Following the release of Peloton’s Q2 earnings, Citi (NYSE:C) analysts emphasized the improvement in subscriber and engagement metrics, underscoring the company’s ongoing recovery. Citi analysts also noted the narrowing free cash flow loss as another positive development.

JPMorgan (NYSE:JPM) analysts Dough Anmuth and Bryan Smilek are also shifting toward a bullish stance on Peloton, citing the company’s recent success in identifying growth areas to prioritize while discontinuing partnerships and products unlikely to contribute meaningfully to growth.

Gene Munster, Managing Partner at Deepwater Asset Management, posits that Apple (NASDAQ:AAPL) stands to gain from a potential business combination with Peloton, as Apple Fitness lacks a hardware component, a gap that Peloton could fulfill. However, Munster believes that Peloton remains a fundamentally flawed business, thereby serving as a major deterrent to Apple’s potential acquisition.

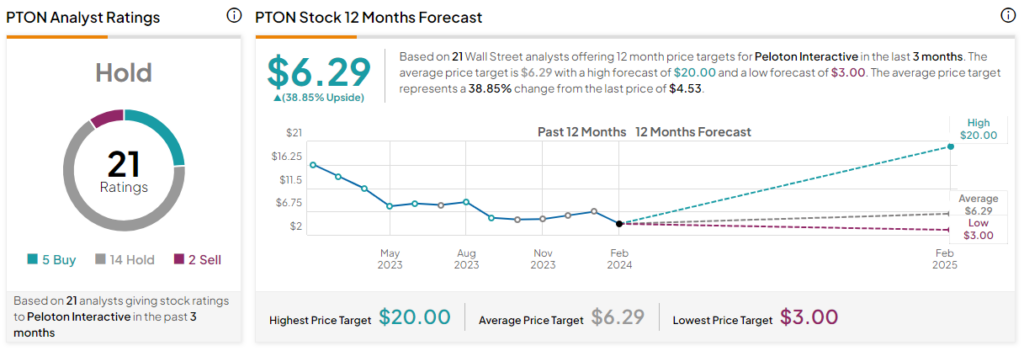

Collectively, based on the assessments of 21 Wall Street analysts, PTON stock is rated as a Hold. The average Peloton stock price target stands at $6.29, implying a 38.9% upside from the current market price.

The Deceptive Illusion of Value

Despite hitting near all-time lows, PTON stock trades at a forward price-to-sales multiple of just 0.6. While this may seem appealing initially, the company is still years away from profitability and has yet to surmount its revenue growth challenges. As such, the seemingly attractive valuation may be misleading.

Conclusion: Peloton’s Uncertain Road to Recovery

Compared to its state in 2021, Peloton now operates as a more streamlined and agile business, benefiting from operational efficiencies. Nevertheless, the company confronts several hurdles that constrain its growth potential. Moreover, profitability appears to be a distant prospect at best. Given these challenges, the apparently modest valuation of the company might be illusory.