The Resilience of Big Tech

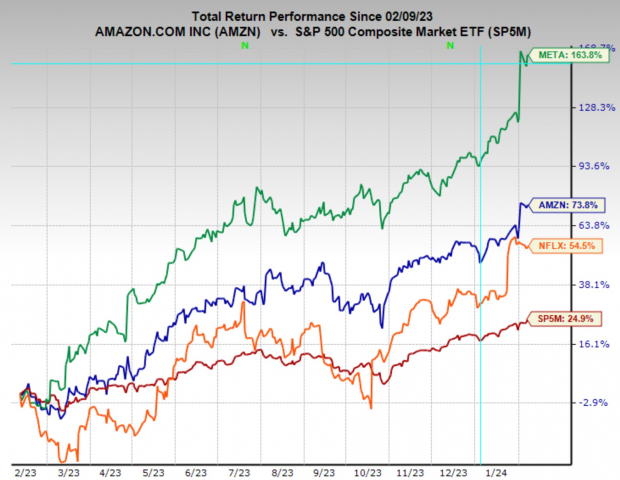

Big tech has astounded the investor community with its remarkable resilience and capacity to generate massive profits in the wake of the latest earnings reports. Companies such as Amazon (AMZN), Meta Platforms (META), and Netflix (NFLX) showcased impressive earnings, leading to significant upward gaps in their stock prices.

While some investors may harbor doubts about investing in large-cap technology stocks after their substantial rallies over the past year, it’s worth noting that a stock’s ascent doesn’t necessarily signify the end of its upward trajectory.

Image Source: Zacks Investment Research

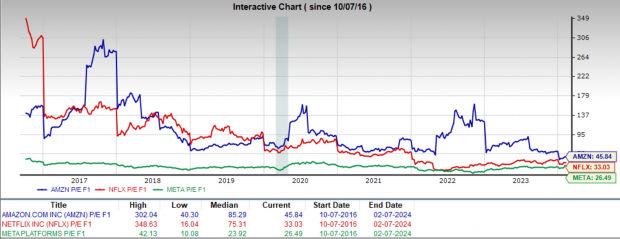

Furthermore, these three stocks are presently trading at historically reasonable relative valuations, dispelling concerns about entering an overvalued market. Following robust growth and profitability in their most recent quarterly reports, coupled with earnings estimate upgrades, their valuations appear even more justified.

Image Source: Zacks Investment Research

The Netflix Phenomenon

Netflix’s recent quarterly earnings surpassed estimates on both the top and bottom lines, showcasing record subscriber growth with 261 million paid subscribers, adding 13 million in Q4 alone. Furthermore, the streaming platform’s management unveiled plans to expand content offerings and sealed a deal with the WWE to stream the Raw wrestling program weekly.

With a Zacks Rank #1 (Strong Buy) rating and an overwhelming consensus among analysts in favor of upward trending earnings revisions, Netflix stock presents a compelling post-earnings gap and bull flag technical setup. The stock’s potential breakout at the $564 level signifies a high-probability trade, bringing optimism to investors.

Image Source: TradingView

The Success Story of Meta Platforms

Similarly, Meta Platforms delivered stellar earnings, surpassing both sales and earnings estimates while witnessing a 25% year-over-year sales surge to $40.1 billion in Q4. The company’s expenses also exhibited an 8% YoY decline, solidifying its financial position.

With a Zacks Rank #1 (Strong Buy) and unanimous agreement among analysts regarding earnings estimate upgrades across various timeframes, Meta Platforms stock has depicted a post-earnings bull flag technical formation, hinting at a potential breakout at the $474 level. This development bodes well for investors seeking growth opportunities in the tech sector.

Image Source: TradingView

The Amazon Advantage

Amazon, the e-commerce and cloud-computing behemoth, continues to impress with another quarter of earnings that outpaced analyst estimates. Its burgeoning advertising business and a Zacks Rank #1 (Strong Buy) rating strengthen the case for considering AMZN stock as a worthy investment.

Following the theme of post-earnings bull flags, Amazon stock’s potential breakout at the $171.50 level signals a promising upward trajectory, presenting an enticing opportunity for astute investors.

Image Source: TradingView

Investment Opportunity in Semiconductor Stocks

Amid the tech sector’s dynamism, semiconductor stocks exemplify tremendous growth potential. With strong earnings growth and an expanding customer base, the global semiconductor industry is poised for remarkable growth, projected to surge from $452 billion in 2021 to $803 billion by 2028, reflecting the sector’s immense potential for investors.