Earnings season continues to chug along, with various companies reporting quarterly results daily. The period is undoubtedly an exciting time for investors, as companies finally pull the curtain back and unveil what’s transpired throughout the period.

This upcoming week, we have several notable names on the reporting docket, a list that includes several mega-cap tech favorites such as Meta Platforms META, Amazon AMZN, and Apple AAPL.

Apple

Perhaps the most beloved of the bunch, market leader Apple will reveal quarterly results on February 1st after the market’s close. The company has been on a solid earnings streak as of late, exceeding our consensus earnings and revenue expectations in three consecutive quarters.

Shares got a nice boost following its latest set of results, sparking a strong rally.

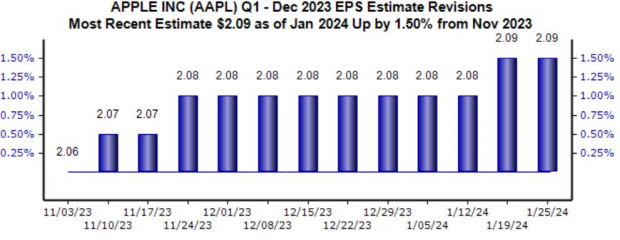

Analysts have been bullish regarding the bottom line, with the $2.09 Zacks Consensus EPS Estimate up a modest 1.5% since November and suggesting growth of roughly 11% year-over-year. Revenue expectations have been slightly more negative, as the $117 billion quarterly sales estimate has been taken 1.4% lower over the same period.

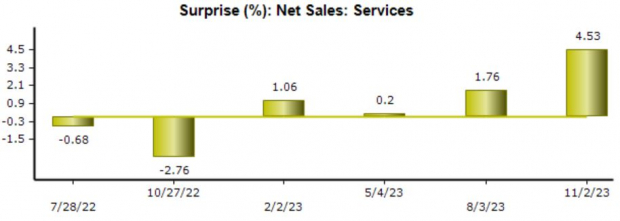

Of course, investors will be focused on the company’s iPhone sales, but Apple’s services portfolio has also been a great source of growth over the last several years. For the quarter, we expect the company to post $23.3 billion in revenue from Services, nicely above the year-ago mark of $20.7 billion.

Amazon

Amazon, the e-commerce and cloud computing titan, will report on February 1st after the market’s close. The company has posted strong quarterly results as of late, exceeding our consensus EPS expectations by an average of 55% over its last four releases.

Like AAPL, Amazon shares moved well higher post-earnings following its latest release, with shares continuing their momentum throughout 2024 so far.

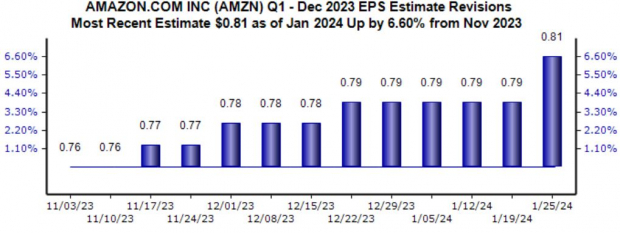

Analysts have been notably bullish for the release, as the $0.81 Zacks Consensus EPS estimate has been taken nearly 7% higher since November and reflects growth of a sizable 280% year-over-year. Top line expectations have primarily remained flat.

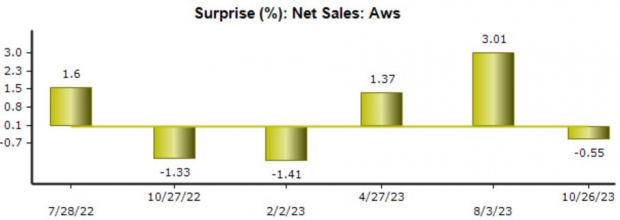

Concerning Amazon, AWS will likely be yet again a big focus among investors. For the release, the Zacks Consensus estimate for AWS sales stands at $24.3 billion, reflecting solid growth from the year-ago mark of $21.4 billion.

Meta Platforms

Like those above, Meta Platforms is scheduled to unveil its quarterly results on February 1st after the market’s close. The company has crushed earnings expectations as of late, exceeding both earnings and revenue estimates in four consecutive releases.

Shares faced modest pressure post-earnings following its latest release before quickly rebounding and melting higher.

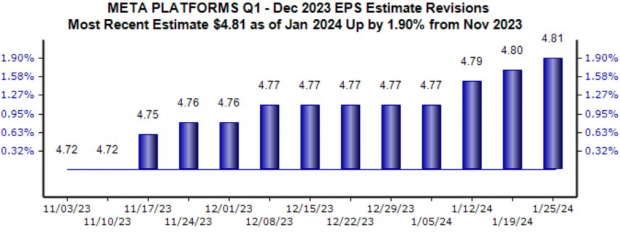

Analysts have been bullish on tech’s outlook, and Meta certainly hasn’t been an exception, with the $4.81 Zacks Consensus EPS Estimate up 2% since last November and indicating growth of 60%. Top line revisions have moved similarly, as the $38.9 billion consensus sales estimate has climbed 1% over the same period.

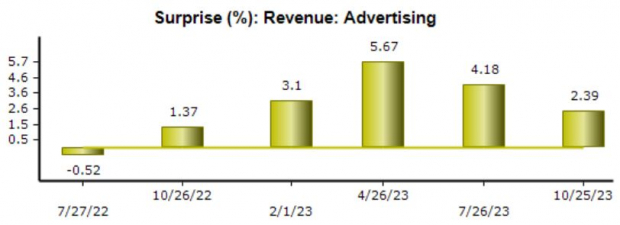

The company generates the bulk of its revenues through advertising, a metric that META has consistently positively surprised on as of late. For the quarter to be reported, the Zacks Consensus estimate for advertising net sales stands at $37.8 billion, showing considerable growth from last year’s $31.3 billion print.

Bottom Line

Earnings season is upon us, with a wide variety of companies unveiling quarterly results daily.

Next week, we’ll hear from several mega-cap tech players, including Amazon AMZN, Apple AAPL, and Meta Platforms META.