Before you zealously act on the latest Wall Street tittle-tattle, consider the ramifications carefully. Popular finance culture puts an undue emphasis on brokerage recommendations, pushing lay investors into an obscene maelstrom of bullish enthusiasm. But do these ratings carry any substantial weight?

It’s time to take a peek behind the curtain and see what these esteemed Wall Street apparatchiks have to say about Microsoft (MSFT).

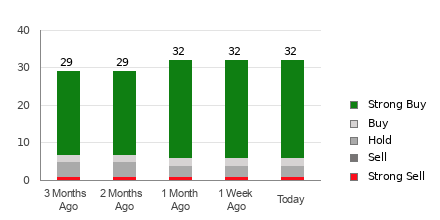

Amidst the cacophony of brokerage recommendations stands Microsoft, sporting an average brokerage recommendation (ABR) of 1.24, buoyed by the earnest musings of 38 brokerage firms. With an ABR of 1.24, the consensus approximates between Strong Buy and Buy. Out of the 38 recommendations that shape this ABR, a staggering 32 are Strong Buy and three are Buy. Consequently, Strong Buy and Buy jointly claim 92.1% of all recommendations.

Breaking Down Brokerage Recommendations for MSFT

However, before you leap aboard the MSFT bandwagon, exercise caution. Statistical research suggests that brokerage recommendations possess no more predictive power than a crystal ball at a psychic fair. Bound by the self-serving interests of their employers, brokerage analysts exhibit a five-to-one bias towards “Strong Buy” over “Strong Sell,” leading to distorted and unreliable ratings.

Instead of naively relying on brokerages, consider cross-referencing their analysis with the Zacks Rank, a tool revered for its rigor and objectivity. The Zacks Rank divides stocks into five categories, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering a reliable forecast of near-term price performance.

Differentiating Between ABR and Zacks Rank

It’s crucial to distinguish between the ABR and Zacks Rank. While both metrics occupy the same 1-5 range, their methodologies are as contrasting as caffeine and decaf. The ABR is a one-dimensional representation, aggregated solely from brokerage recommendations. In contrast, the Zacks Rank is a multidimensional model, powered by earnings estimate revisions, and is grounded in quantitative analysis.

Brokers peddle sunny recommendations to the detriment of investors, while the Zacks Rank thrives on the influence of earnings estimate revisions – a strong indicator of future stock prices, according to empirical evidence.

Furthermore, there lies a gulf in the timeliness of ABR and Zacks Rank. The ABR can grow stale, failing to keep up with the rapid shifts in market sentiment. Conversely, the Zacks Rank provides a real-time snapshot of evolving earnings estimates, ensuring its perennial relevance in predicting stock prices.

Is MSFT a Lucrative Investment?

In the realm of earnings estimate revisions, Microsoft’s Zacks Consensus Estimate has mounted a 0.1% surge over the past month to $11.14 for the current year. This harmonious accord among analysts in ratcheting up EPS estimates presents a compelling case for a meteoric ascent in the stock’s value.

This surge in the consensus estimate has conferred a coveted Zacks Rank #2 (Buy) upon Microsoft, signifying a propitious juncture for potential investors.

Could this Buy-equivalent ABR furnish valuable guidance for discerning investors? Perhaps, but proceed with vigilance.