A Pleasant Surprise

Diving into the Q4 earnings cycle, company after company reports quarterly results, including many delightful surprises. Throughout this period, several companies experienced significant margin expansion, brightening the financial landscape.

Three standout companies – Netflix NFLX, Procter & Gamble PG, and Meta Platforms META – demonstrated an impressive uptick in profitability, delivering results that pleased investors. Let’s take a closer look at each to understand and appreciate their success.

Netflix: A Picture of Success

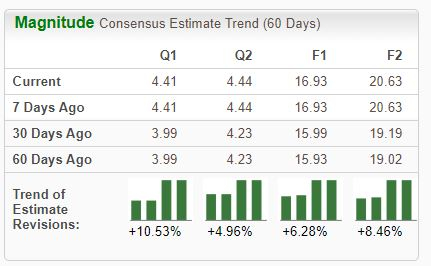

Streaming giant Netflix enjoyed upward earnings estimate revisions across the board, leading to its Zacks Rank #1 (Strong Buy) status.

Image Source: Zacks Investment Research

Its profitability picture transformed significantly during the latest period, with operating income soaring to $1.5 billion from the previous $0.5 billion, and the operating margin leaping to 17% from 7% a year ago.

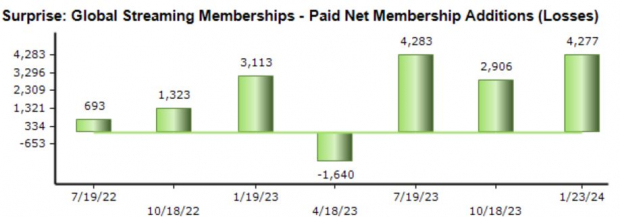

Subscriber additions during this period reached 13.1 million, dwarfing the consensus estimate of 8.8 million. Netflix has consistently exceeded expectations in adding subscribers, as evidenced by the chart below.

Image Source: Zacks Investment Research

Meta Platforms: The Trend Continues

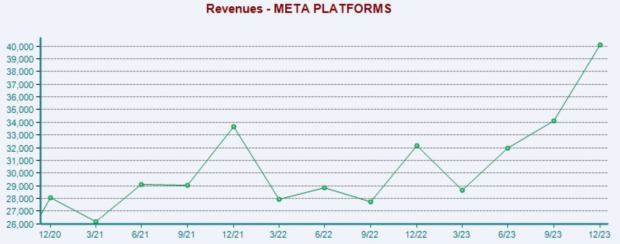

Meta has been consistently delivering robust earnings results, exceeding our consensus EPS expectations by an average of 20% over the last four releases. Remarkably, the company’s operating margin stood at 41%, a remarkable improvement over the year-ago figure of 20%.

Its latest report showed a 25% year-over-year revenue increase and a 77% EPS surge. The 25% revenue gain marks the highest year-over-year growth in eight quarters.

Image Source: Zacks Investment Research

To top off the strong results, the company announced its first-ever dividend, payable on March 26th to stockholders of record as of the close of business on February 22nd.

Procter & Gamble: A Clean Win

Procter & Gamble delivered an 8% beat relative to the Zacks Consensus EPS estimate and posted revenue slightly below expectations, with both figures surpassing the year-ago results. The company’s gross margin reached 52.7%, significantly above the year-ago figure of 47.5%.

Following the release, the company raised its FY24 core net EPS growth to a range of 8% – 9%, compared to the previous range of 6% – 9%. The stock has seen bullish activity following the publication of the results, injecting positive sentiment.

Image Source: Zacks Investment Research

The Bottom Line

A favorable operating environment has led to increased profitability for numerous companies, resulting in post-earnings stock surges throughout the 2023 Q4 cycle thus far. For those seeking companies enjoying margin expansion, Netflix NFLX, Procter & Gamble PG, and Meta Platforms META have all seen significant improvements in their profitability.