Investing wisely demands patience. Studies universally confirm that longevity in the stock market translates to higher returns.

Let’s delve into two exceptional buy-and-hold prospects and discover why they deserve a spot in the portfolios of long-term investors.

Image source: Getty Images.

Amazon: A Reliable Titans’ Trove

Let’s shine a light on the first no-brainer stock: Amazon (NASDAQ: AMZN). While there are myriad reasons to hold this iconic entity, a few key financial indicators underscore why Amazon shines brightly in the long-term investment universe.

Amazon’s colossal stature is unmistakable. With annual revenue exceeding $600 billion, it trails only Walmart in the hierarchy of American revenue generators.

In addition, Amazon’s impressive growth trajectory is evident through its 10% year-over-year revenue expansion. This expansion signifies an annual influx of approximately $60 billion in new sales at its current magnitude.

Furthermore, Amazon’s avant-garde prowess shines in various cutting-edge technologies, including the flourishing Amazon Web Services (AWS) — clocking a 19% year-over-year growth rate. Notably, Amazon spearheads the robotics domain with over 750,000 robots toiling ceaselessly in its fulfillment centers. Lastly, the company embarks on numerous artificial intelligence (AI) endeavors, leveraging generative AI to streamline its e-commerce operations and its ubiquitous voice-powered echo devices.

In essence, Amazon’s substantial and escalating sales figures bear testament to its continuous innovation to cater to existing patrons and draw in new customers. Over the forthcoming decade, Amazon stands out as a no-brainer stock due to its blend of established enterprises and pioneering ventures.

Meta Platforms: The Fountain of Free Cash Flow

The subsequent no-brainer addition to your investment kitty is Meta Platforms (NASDAQ: META). The primary reason for Meta’s compelling candidacy is its unwavering commitment to bolstering shareholder value.

What sets Meta apart is its astounding ability to churn out copious amounts of free cash flow — the lifeblood of any top-tier stock.

Picture a garden hose. As the valve opens wider, water gushes out at a rapid pace. Conversely, with a tighter valve, the water flow diminishes.

In the corporate realm, the valve signifies operational costs and capital outlays, while the water embodies free cash flow — the residue post deductions of salaries, taxes, capital investments, and sundry expenses.

The standout feature of Meta is its capacity to generate substantial free cash flow that continues its upward trajectory.

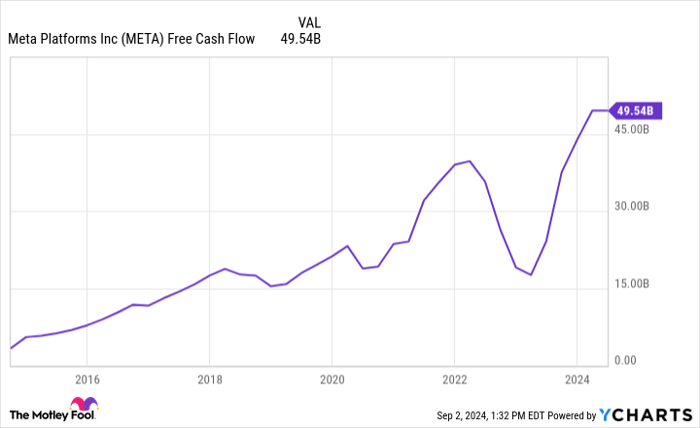

META Free Cash Flow data by YCharts

Over the past decade, Meta has catapulted its free cash flow from around $3 billion to nearly $50 billion — a staggering feat. Consider that many prominent companies fail to amass $50 billion in revenue, let alone free cash flow.

In succinct terms, Meta’s free cash flow positions it as a formidable force in the stock market arena. With ample free cash flow at its disposal, the company can reward shareholders through dividends, stock buybacks, or strategic acquisitions.

In essence, Meta’s management is armed with multiple avenues to uplift its stock price, bringing smiles to investors for years on end.

Should You Buy and Hold These Stocks?

Is Now the Time to Invest $1,000 in Amazon?

Investors eyeing Amazon for potential stock purchases might want to pause and contemplate the latest insights.

Missed the Top 10?

Analysts at the Motley Fool Stock Advisor have unearthed what they deem as the 10 best stocks for investors to consider investing in now. Notably, Amazon is absent from this elite list.

For perspective, consider the case of Nvidia, which featured on such a list back on April 15, 2005. Had you heeded the advice and invested $1,000 at that time, your investment would have burgeoned to an astonishing $630,099!

Guided by the Stock Advisor, investors are provided with a straightforward roadmap to success. The service offers assistance in constructing a solid portfolio, regular analyst updates, and two fresh stock suggestions monthly. Noteworthy is the fact that the Stock Advisor has outperformed the S&P 500 by more than quadruple the return rate since 2002.

Final Food for Thought

Interested investors are encouraged to explore the recommended top 10 stocks by the Stock Advisor. It is always illuminating to peek into stories like that of Nvidia from 2005, offering a glimpse into the potential of foresight and strategic investing.

Remember, the bottom line is not just about the present; it’s about constructing a future-proof investment strategy that stands the test of time, much like the historical anecdotes shared by Stock Advisor.